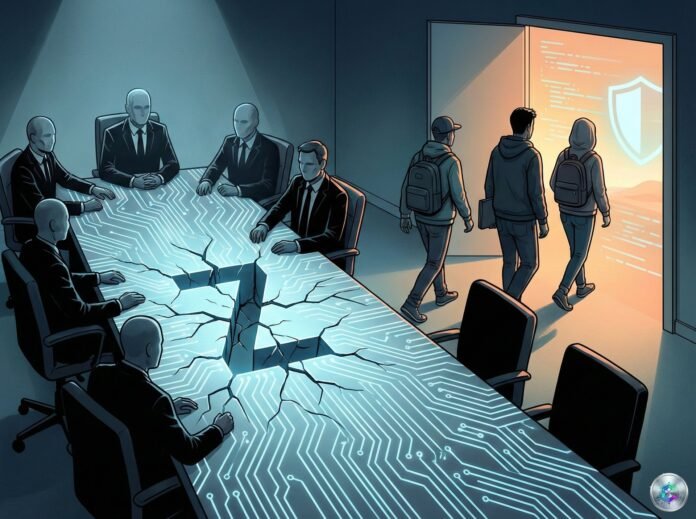

January 7, 2026 will be etched in Zcash history as a day of major rupture. The entire team at Electric Coin Company (ECC), the historic organization behind the development of this privacy-focused cryptocurrency, resigned collectively following a governance conflict with Bootstrap Project’s board of directors. This unprecedented crisis paradoxically occurs at the moment when Zcash is experiencing its strongest institutional momentum since its 2016 launch.

A Disguised Dismissal That Triggers the Exodus

Josh Swihart, CEO of Electric Coin Company since December 2023, published a scathing announcement on X (formerly Twitter). According to him, the majority members of Bootstrap’s board unilaterally modified the team’s employment conditions, making it impossible to perform their duties with integrity. « In summary, the terms of our employment were modified in a way that made it impossible to accomplish our tasks effectively and with integrity, » Swihart stated.

The Bootstrap board members pointed out are Zaki Manian (co-founder of Sommelier and iqlusion), Christina Garman (assistant professor of computer science at Purdue University), Alan Fairless, and Michelle Lai. Swihart claims these directors have « clearly misaligned themselves from Zcash’s mission, » creating an impasse that pushed the entire technical team to leave.

Immediate Market Reaction

The announcement triggered significant volatility in ZEC’s price. The cryptocurrency initially dropped about 7% to reach $461, before plunging 18-20% according to some sources. Trading volume surged by over 30%, reflecting investor nervousness in the face of this institutional crisis.

This correction follows an exceptional rally that propelled the token from $30 in August 2025 to a peak of $750 in early 2026 — a 20-fold increase in just a few months. This extraordinary performance made Zcash one of 2025’s best-performing cryptocurrencies, with annual gains exceeding 1,900%.

A New Company in the Making

Faced with this impasse, the ECC team is not remaining idle. Swihart confirmed that his entire team is founding a new company while maintaining the same mission: « building unstoppable private money. » The name of this new entity has not yet been revealed, but this decision reflects a desire to continue developing Zcash’s privacy technologies under a different organizational structure.

Crucial fact: the Zcash protocol itself remains fully functional and unaffected by this crisis. As an open-source project, Zcash doesn’t belong to any single entity, and the network continues to operate normally despite organizational turbulence.

Zooko Wilcox’s Nuanced Position

Zooko Wilcox, founder of Zcash and former ECC CEO until December 2023, adopted a measured stance. While defending the integrity of Bootstrap board members, he emphasized that the Zcash network remains « permissionless, secure, and safe to use. » Wilcox continues to sit on Bootstrap Project’s board as a director.

Notably, Wilcox himself had left the ECC CEO position in December 2023 to join Shielded Labs — an independent Swiss-based organization — as Head of Product. This transition suggests he may have already anticipated some governance tensions.

A Paradoxical Institutional Momentum

This crisis occurs at the precise moment when Zcash is experiencing its strongest institutional momentum. On November 25-26, 2025, Grayscale filed an S-3 with the SEC to convert its Zcash Trust into a spot ETF. This product, trading under the ticker ZCSH, currently manages between $151 and $196 million in assets.

If approved (a decision is expected in the second half of 2026), it would be the first Zcash spot ETF in the United States. « We consider ZEC as a key contributor to a well-balanced digital asset portfolio, » Grayscale stated.

Cypherpunk Technologies’ Aggressive Accumulation

Cypherpunk Technologies continues an aggressive ZEC accumulation strategy. As of December 30, 2025, the company held 290,062.67 ZEC, representing 1.76% of the total circulating supply. The company, backed by the Winklevoss twins through a $58.88 million private placement, aims to accumulate 5% of the Zcash network.

Interesting detail: Josh Swihart joined Cypherpunk as a strategic advisor in December 2025, just weeks before the collective resignation — timing that raises questions about potential coordination of this transition.

The Privacy-by-Default Turning Point

Beyond price volatility, Zcash is experiencing a fundamental transformation in its usage. In 2025, approximately 23% of the total ZEC supply is now held in the shielded pool (confidential transactions), and 30% of transactions use privacy features — some sources even mention 70%.

This evolution is largely attributable to the launch of ECC’s Zashi mobile wallet, which makes confidential transactions the default. The wallet also integrated innovative features like Zashi Swaps and CrossPay, generating nearly $800 million in swaps and payments via NEAR Intents over the past 30 days.

Technical Developments Continue

Despite organizational turbulence, the Zcash ecosystem continues several ambitious technical initiatives. Shielded Labs is developing Crosslink — a hybrid protocol combining Proof of Work and Proof of Stake that ensures once a block is confirmed, it cannot be reversed.

Meanwhile, Sean Bowe leads Project Tachyon, an initiative aimed at scaling confidential transaction throughput to thousands of transactions per second. « The goal is to make Zcash the world’s fastest private money, » Bowe explains.

Zcash vs Monero: Two Opposing Philosophies

The comparison with Monero is inevitable. Monero enforces privacy on all transactions by default, while Zcash makes it optional. This distinction has profound implications for regulatory compliance.

Unlike Monero, which faces repeated delistings, Zcash benefits from a compliance advantage thanks to its transparent transactions that allow institutions to audit funds when necessary. In 2025, Zcash even surpassed Monero in market capitalization, becoming the largest privacy-focused cryptocurrency.

Conclusion: A Crisis That Could Strengthen Decentralization

The ECC team’s collective resignation raises crucial questions about Zcash’s organizational future. However, this crisis could paradoxically strengthen the project by accelerating its real decentralization. The Zcash protocol itself — the open-source code that runs the network — remains completely unchanged by this crisis.

The Zcash ecosystem now has several independent development centers: the new company founded by the former ECC team, Shielded Labs, the Zcash Foundation, and community grants. This plurality reduces the risk of a single point of failure and could stimulate innovation.

As Zooko Wilcox emphasized: « Zcash’s role in human history is, and will be, much larger than any individual. » The coming months will be decisive in determining whether this crisis was a bump in the road or a turning point toward more authentic decentralization.