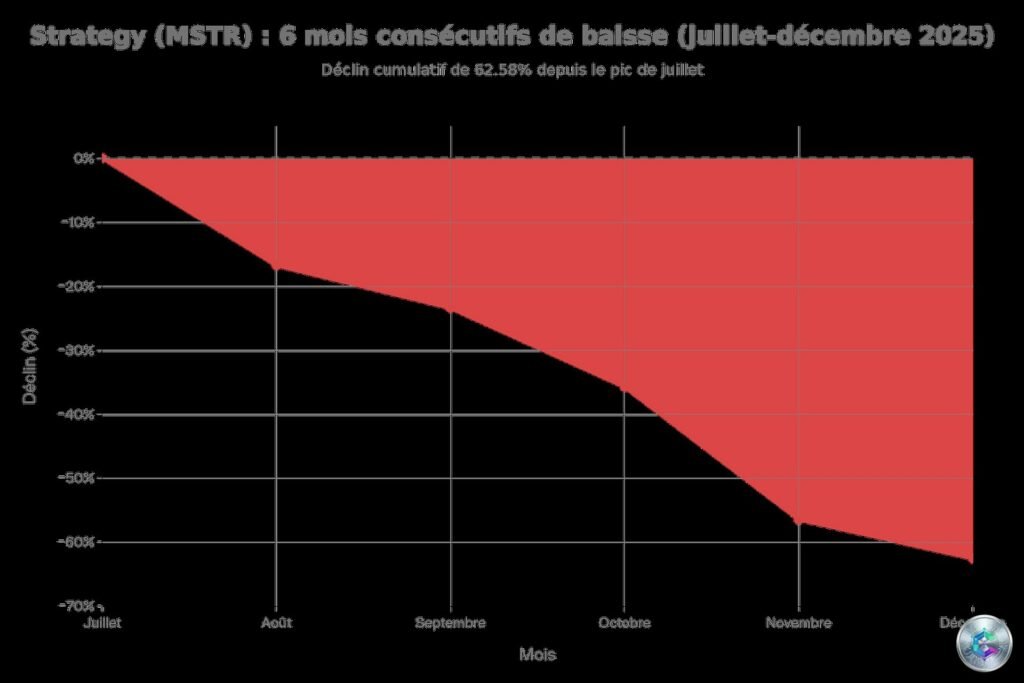

The year 2025 will be etched in Strategy’s (formerly MicroStrategy) stock market history as a major turning point. For the first time since the bold adoption of Bitcoin as a treasury asset in August 2020, the stock of the company led by Michael Saylor has recorded six consecutive months of decline, an unprecedented sequence that disrupts market perception of this now-iconic accumulation model.

An Unprecedented Collapse

Between July and December 2025, Strategy posted relentless losses: -16.78% in August, -16.36% in October, -34.26% in November, and -14.24% in December. In total, the stock lost nearly 59% over six months and posted a decline of 46% to 49% for the full year.

This bearish sequence contrasts radically with previous corrections. During the 2022 bear market, Strategy had suffered a brutal -74% drop, but it was followed by spectacular rebounds exceeding 40% in just a few months. In 2025, no relief rally interrupted the downtrend. The market appears to have conducted a gradual and methodical revaluation rather than a one-time capitulation.

Total Disconnect from Bitcoin and Nasdaq

The paradox is striking: while Strategy lost nearly half its value in 2025, Bitcoin limited its annual decline to around -9.65%. Even more surprising, the Nasdaq 100 — the index to which Strategy has belonged since December 2024 — gained more than +20% over the same period.

This underperformance raises a fundamental question: if Strategy is supposed to be a leveraged Bitcoin stock market « proxy, » why is it disconnecting so violently from its underlying asset? The answer lies in a combination of structural factors that have gradually eroded investor confidence.

The mNAV Ratio Collapse: End of a Historic Premium

At the heart of the Strategy model is the concept of mNAV (market Net Asset Value), the ratio between market capitalization and the net value of Bitcoin assets held. Historically, Strategy traded at a substantial premium of 2x to 3x, reflecting the attractiveness of Bitcoin exposure via a regulated listed vehicle.

In November 2024, this premium briefly exceeded 65% during the issuance of $3 billion in convertible bonds. In Q2 2025, it still oscillated between 40% and 55%.

Then came the collapse. By mid-2025, the mNAV had fallen to 1.32. In November 2025, it crossed the critical threshold of 1, briefly reaching 0.97, meaning market capitalization was lower than the value of bitcoins held. By late December, the ratio stagnated around 1.05, representing an effective discount.

Continued Accumulation but Massive Dilution

Paradoxically, this stock weakness occurs in a context of uninterrupted accumulation. As of December 28, 2025, Strategy held 672,497 bitcoins, acquired for a total cost of $50.44 billion, or an average price of $74,997 per BTC.

But this accumulation frenzy confronts an unavoidable reality: dilution. Outstanding shares increased 20% in 2025. To finance its purchases, Strategy continuously issues new shares via its ATM (At-The-Market) program, mechanically diluting existing shareholder participation.

The problem is simple: if the stock trades below its net asset value, each new issuance becomes dilutive rather than accretive. New shareholders get more Bitcoin per share than existing ones, eroding value for the latter.

Convertible Debt: An $8.2 Billion Sword of Damocles

Strategy has massively relied on convertible bonds to finance its expansion. At the end of 2025, the company carried $8.2 billion in convertible debt, with an average maturity of 5.1 years and an average interest rate of only 0.421%.

In February 2025, Strategy issued $2 billion in convertible bonds at 0% interest, maturing in 2030, with a conversion price of $433.43 per share. At $151.95 at the end of December 2025, the stock trades far below this conversion threshold.

These bonds have a dangerous feature: holders have an early put option in March 2028, allowing them to demand redemption at $1,000 per bond if the stock remains below the conversion price. If Bitcoin and Strategy don’t recover by then, the company will have to disburse up to $2 billion in cash, potentially forcing it to sell some of its bitcoins or refinance under degraded conditions.

January 15, 2026: The MSCI Verdict

An institutional sword of Damocles hangs over Strategy: potential exclusion from the MSCI index, with a decision expected on January 15, 2026.

Index provider MSCI has proposed excluding companies where more than 50% of assets are cryptocurrencies, considering them investment funds rather than operating companies. Strategy, with over 85% of its enterprise value in Bitcoin, is directly targeted.

JPMorgan estimates that MSCI index exclusion would trigger capital outflows of $2.8 billion for Strategy alone. If other major indices follow suit, outflows could reach $8.8 billion.

Increased Competition: Over 100 Imitators

Another factor explaining Strategy’s premium erosion: the multiplication of competitors. In 2020, Strategy was virtually alone in the « digital asset treasury companies » (DAT) segment. By 2025, the landscape has radically changed.

More than 100 to 200 listed companies have adopted a Bitcoin treasury strategy. In 2025 alone, 117 new companies added Bitcoin to their balance sheets. Notable new entrants include:

- Metaplanet (Japan): 30,823 BTC, Bitcoin Yield of 568% in 2025

- Marathon Digital Holdings: 53,250 BTC

- Twenty One Capital: 43,514 BTC

- BitMine Immersion Technologies: 3.8 million ETH ($12 billion)

This proliferation creates competitive pressure. The market increasingly treats Strategy as one option among many rather than a unique asset, with significant structural costs.

Bitcoin ETFs: A Simpler Alternative

The approval of spot Bitcoin ETFs in the United States in January 2024 also changed the game. These ETFs offer direct Bitcoin exposure with annual management fees between 0.20% and 1%, without dilution or debt.

BlackRock’s IBIT, the largest Bitcoin ETF, holds nearly $100 billion in assets. For investors simply seeking Bitcoin exposure, an ETF presents undeniable advantages: near-perfect correlation with Bitcoin, transparent fees, no operational management risk.

Strategy offers amplified exposure (beta of 3.41 to 3.71) with historical volatility of 113% versus 55% for Bitcoin. In 2024, Strategy surged 358%, crushing Bitcoin’s +121%. But in 2025, the model showed its limits: -46% for Strategy versus -9.65% for Bitcoin.

Catastrophe Scenario: What If Bitcoin Fell to $74,000?

If Bitcoin fell to $74,000 — close to Strategy’s average acquisition price — holdings value would drop to approximately $49.8 billion. With a market capitalization of $48.3 billion at the end of December, Strategy would display an mNAV ratio close to 1, or even lower.

Some analysts estimate that a Bitcoin drop below $13,000 could trigger insolvency risk. The main risk is a self-fulfilling downward spiral: if Strategy were forced to sell part of its 672,497 BTC (representing 3.2% of total circulating supply), this sale could crash Bitcoin’s price, worsening the situation.

Toward a New Paradigm for 2026

For 2026, Strategy’s challenge will be twofold: proving its model can attract investors beyond mere Bitcoin accumulation, and navigating an increasingly restrictive regulatory environment.

The January 15 MSCI decision will be a crucial first test. Michael Saylor has outlined a pivot: when the stock trades above Bitcoin asset value, Strategy issues shares; otherwise, it suspends issuances. But this wait-and-see strategy could limit future accumulation capacity.

Other observers anticipate sector diversification, with companies integrating Ethereum, Solana, and other digital assets to reduce Bitcoin concentration.

Conclusion: A Model at a Crossroads

Strategy’s six consecutive months of decline mark a historic turning point for the corporate Bitcoin treasury model. What worked in 2020-2024 — aggressive accumulation, premium share issuance, leverage via zero-rate convertible debt — no longer works as well in 2025-2026.

For investors, the lesson is clear: Strategy is no longer a simple « Bitcoin proxy. » It’s a sophisticated financial structure with specific risks — debt, dilution, regulatory risks, capital market dependence — requiring in-depth analysis.

Without a significant Bitcoin recovery above $100,000 and a return of investor confidence, 2026 could prove as difficult, or more so, than the second half of 2025. The January 15 verdict will provide an initial indicator of the direction this disruptive but controversial model will take.