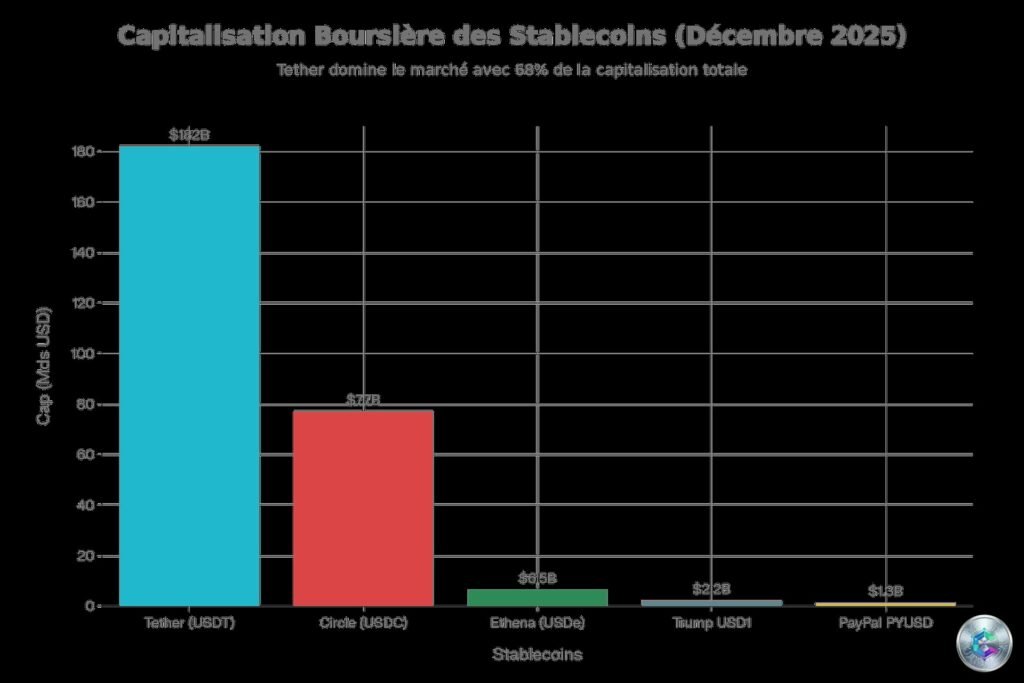

The stablecoin market has reached a historic milestone in 2025, achieving a total market capitalization of $314 billion, representing a spectacular increase of $100 billion in one year. But behind these impressive figures lies a more nuanced reality: market capitalization only tells part of the story.

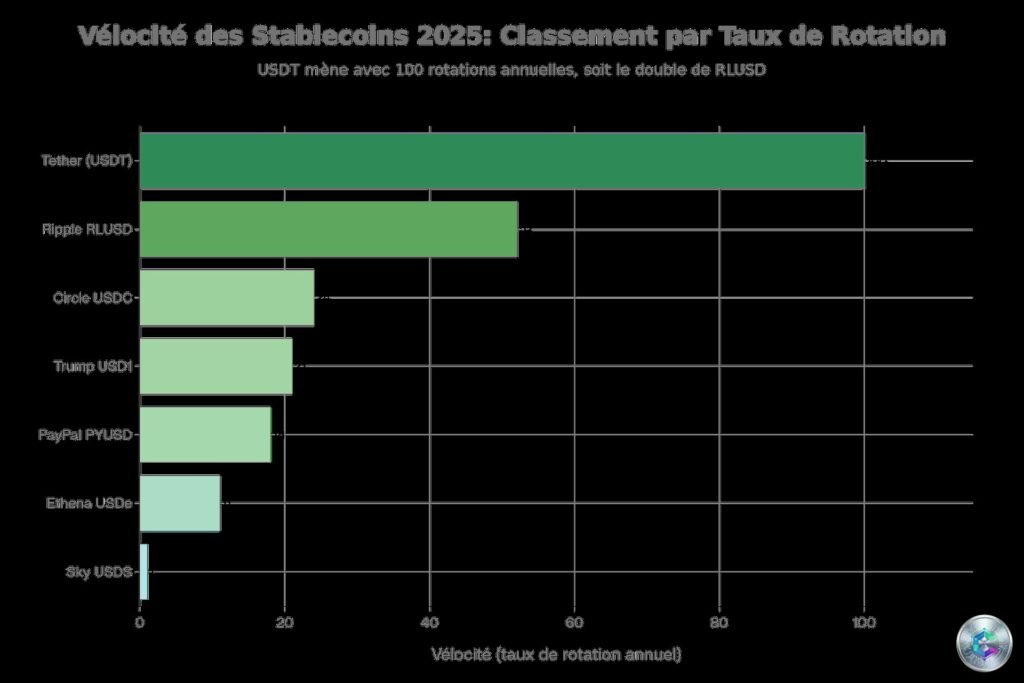

To understand which stablecoins truly dominate the crypto ecosystem, we must examine their velocity – a key indicator that measures how frequently a token changes hands and reveals its actual usage in the market.

Explosive Growth Driven by Institutional Adoption

In 2025, the stablecoin industry recorded over $4 trillion in on-chain transactions between January and July, representing an 83% increase year-over-year. This explosive growth is explained by several key factors:

- Accelerated institutional adoption

- The passage of the GENIUS Act in the United States, clarifying the regulatory framework

- Expansion of use cases beyond simple crypto trading into cross-border payments, corporate treasury, and decentralized finance

Understanding Velocity: The Key Indicator of Real Usage

A stablecoin’s velocity measures the ratio between total transaction volume and average market capitalization over a given period. High velocity indicates that the token actively circulates in the economy, serving as a medium of exchange for payments, trading, and DeFi operations. Conversely, low velocity suggests that the token is primarily held as a store of value.

To put this in perspective, Tether (USDT) displays a velocity exceeding 100 in 2025, meaning each dollar of USDT in circulation changes hands more than 100 times per year. This performance far exceeds that of the US dollar M1, which hovers around 6.2. This difference is explained by the intensive use of stablecoins in 24/7 crypto trading, arbitrage between exchanges, and automated DeFi transactions.

Top 7 Most Dynamic Stablecoins of 2025

1. Tether (USDT): The Undisputed Hegemon

Velocity: >100 | Market Cap: $182 billion

Tether maintains its dominant position with a 68% market share and a velocity that crushes all competition. USDT’s daily transaction volume regularly exceeds $140 billion, surpassing even Bitcoin and Ethereum most days.

The numbers speak for themselves: in the first half of 2025, more than $8.9 trillion of USDT was settled on-chain, with average monthly net flows of $400 million and an annual growth rate of 24.8%. In October 2025 alone, over 65 million transactions involved USDT.

The Tron network alone hosts approximately $20 billion in daily USDT transfers, with more than 8.3 million transactions per day. The Tron-Ethereum combination represents 77% of all USDT transactions in the third quarter of 2025.

2. Ripple RLUSD: The Newcomer’s Explosive Entry

Velocity: 52 | Market Cap: New (launched December 2024)

The launch of Ripple’s RLUSD on December 17, 2024 immediately shook the stablecoin market. With a velocity of 52, RLUSD positions itself directly as Tether’s most serious challenger, displaying a rotation rate that far exceeds USDC’s (24).

RLUSD’s approval by the New York Department of Financial Services (NYDFS) on December 10, 2024 gave the stablecoin immediate institutional legitimacy. The NYDFS is widely considered one of the strictest financial regulators in the world, and this approval signals Ripple’s full compliance with American standards.

3. Circle USDC: The Champion of Institutional Compliance

Velocity: 24 | Market Cap: $77 billion

Circle experienced an exceptional 2025, with its USDC capitalization rising from $44 billion to $77 billion, representing 75% growth. This expansion is accompanied by on-chain transaction volumes exceeding $50 trillion over the year.

Circle’s IPO in 2025 marked a turning point for the stablecoin industry. The stock surged 160% on its first day of trading, valuing the company between $21 and $42 billion depending on sources.

4. Trump USD1: The Political Stablecoin’s Meteoric Rise

Velocity: 21 | Market Cap: $2.2 billion

The launch of USD1 by World Liberty Financial in March 2025 was one of the most controversial and spectacular events in the stablecoin market. With an initial offering of only $3.5 million, USD1 exploded to reach a capitalization of $2.2 billion in just two months, representing a dizzying 1,540% increase.

This growth is inseparable from the political support the project enjoys. In January 2025, President Donald Trump signed an executive order titled « Strengthening American Leadership in Digital Financial Technology, » creating a favorable environment for stablecoin development in the United States.

5. PayPal PYUSD: Fintech Integration with Yield

Velocity: 18 | Market Cap: $1.3 billion

PYUSD’s capitalization experienced an impressive trajectory in 2025. Starting from $498 million at the beginning of the year, the stablecoin surpassed the billion-dollar mark in June, then continued to climb to reach nearly $3.8 billion in December.

In April 2025, PayPal announced it would offer an annual yield of 3.7% on PYUSD balances held by American users, with yields accumulated daily and paid monthly. This yield strategy positions PYUSD not only as a payment tool but as a competitive savings instrument.

6. Ethena USDe: The Synthetic Bet on DeFi Yield

Velocity: 11 | Market Cap: $6.5 billion

Ethena’s USDe represents a radically different approach from traditional stablecoins. Instead of being backed by fiat dollars or tangible reserves, USDe uses a delta-neutral strategy involving staked Ethereum and hedged positions on perpetual futures contracts.

USDe experienced a roller-coaster trajectory in 2025. Its capitalization rose from $5.8 billion in January to an impressive peak of $14.7 billion on October 9. However, the October « 1011 crash » (« Black Saturday ») hit USDe hard, with a drop of nearly 50% in two months.

7. Sky USDS: Decentralized Stability by Design

Velocity: 1 | Market Cap: Variable

Sky Protocol’s USDS (formerly MakerDAO) occupies a unique position in this ranking with a velocity of only 1 – and this is entirely intentional. Unlike other stablecoins on this list that optimize for rapid circulation, USDS is designed to be held long-term, functioning more as a decentralized savings instrument than as a medium of exchange.

The GENIUS Act: A Game-Changing Regulatory Framework

The adoption of the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins Act) in July 2025 marked a historic turning point for the stablecoin industry in the United States. It is the first US federal legislation on digital assets, establishing a comprehensive regulatory framework for payment stablecoins.

The bill was introduced by Republican Senator Bill Hagerty on May 21, 2025 and benefited from bipartisan support. The Senate adopted the bill on June 17, 2025 by a vote of 68-30, and President Donald Trump signed it the following day.

This rare bipartisan support testifies to the growing recognition of the central role that stablecoins will play in the future of digital finance and American leadership in this domain.

Growth Projections: Towards $2 Trillion by 2028?

Analysts are unanimous: the stablecoin market will continue to grow exponentially in the coming years, although projections vary considerably:

- Standard Chartered: The investment bank predicts that total stablecoin supply will rise from $230 billion currently to $2 trillion by the end of 2028.

- Tracy Jin (MEXC): Suggests the market could reach $2 trillion as early as 2026, two years earlier.

- Coinbase: The exchange projects the market will reach $1.2 trillion by 2028.

- Citigroup: The bank predicts the market will cross the $4 trillion mark by 2030.

- JPMorgan: Estimates more conservatively that stablecoin supply could reach $500 to $600 billion by 2028.

Use Cases in 2025: Beyond Crypto Trading

The most significant evolution of the stablecoin market in 2025 is not their growth in capitalization, but their transition to real use cases in the traditional economy:

Cross-Border Payments: Stablecoins have revolutionized cross-border payments, reducing average remittance fees from 5% (traditional banks) to just 2.5%. In some cases, platforms using stablecoins display costs below 1%.

Corporate Treasury: Stablecoin usage by companies increased by approximately 25% in 2025, particularly for cross-border payments and supply chain settlements.

E-Commerce: Over 25,000 merchants worldwide now accept stablecoins for online transactions. E-commerce giants like Shopify and WooCommerce enable merchants to accept stablecoins via crypto payment plugins.

DeFi: Stablecoins remain the backbone of decentralized finance. Stablecoin reserves on centralized exchanges reached $50 billion, and the value of yield-generating staked stablecoins reached $6.9 billion.

Conclusion: A Market in Full Transformation

The year 2025 will go down in history as the one when stablecoins moved from the shadows of crypto trading into the light of mainstream finance. With a total capitalization reaching $314 billion and transaction volumes exceeding $4 trillion, these digital assets have become essential financial infrastructure.

Velocity analysis reveals an industry far more nuanced than simple market cap rankings suggest. Tether (USDT) still dominates with a velocity exceeding 100, serving as essential lubricant for the global crypto ecosystem. But new players like Ripple RLUSD (velocity 52) and innovations like PayPal PYUSD’s 3.7% yield demonstrate that innovation is thriving.

The GENIUS Act has created a clear regulatory framework that encourages institutional adoption while protecting consumers. Major traditional banks are now exploring stablecoin issuance, and companies like Circle have successfully completed their IPO, validating the business model with Wall Street.

For investors, developers and businesses, understanding the differences between these seven leading stablecoins – from Tether’s maximum liquidity to Sky USDS’s decentralization and USDC’s institutional compliance – will be essential to navigating this rapidly evolving landscape and seizing the opportunities it offers.