Between Christmas and New Year 2025, a viral screenshot circulated massively on social media, claiming that a systemically important US bank had been liquidated urgently after failing to meet a $2.3 billion margin call on silver futures contracts. The Federal Reserve allegedly injected $34 billion to suppress the crisis. A story worthy of a financial thriller.

However, reality is both more mundane and more concerning. There is no reliable evidence of a bank failure. What is real is a margin increase system publicly announced by the CME (Chicago Mercantile Exchange), an extremely volatile market, and a $675 million collateral shock that forced the systematic deleveraging of hundreds of leveraged traders.

Why This Rumor Works

The viral success of this rumor is explained by three powerful psychological factors. First, the real history of precious metals market manipulation by major banks. JPMorgan paid $920 million in 2020 for a settlement in a systematic manipulation case spanning from 2008 to 2016. This real story creates fertile ground: the public knows that banks manipulate metals markets.

Next, the activation of the financial panic narrative. The « Crash JP Morgan, Buy Silver » meme dates back to the 2010s and has never really disappeared. When silver surges, margins increase, and prices collapse violently, investors’ brains automatically fill in the blanks with recognizable stories.

Finally, the context of Fed repo operations. The Federal Reserve actually operates a Standing Repo Facility (SRF), and banks actually use it. At the end of December 2025, SRF usage reached $25.95 billion on December 29 — a high but routine level for year-end.

The Paper Trail: No Proof of Failure

If a systemically important large bank had actually failed a margin call and been liquidated urgently, the system was designed for this to manifest, even in an opaque manner. When searching for the usual primary confirmations, none exist:

- No CME member default notice published in December 2025

- No statements from regulators (CFTC, Fed, FDIC)

- No coverage from major news agencies (Bloomberg, Reuters, WSJ)

- No public naming of the supposedly « vaporized » bank

What Really Happened: The CME Margin Shock

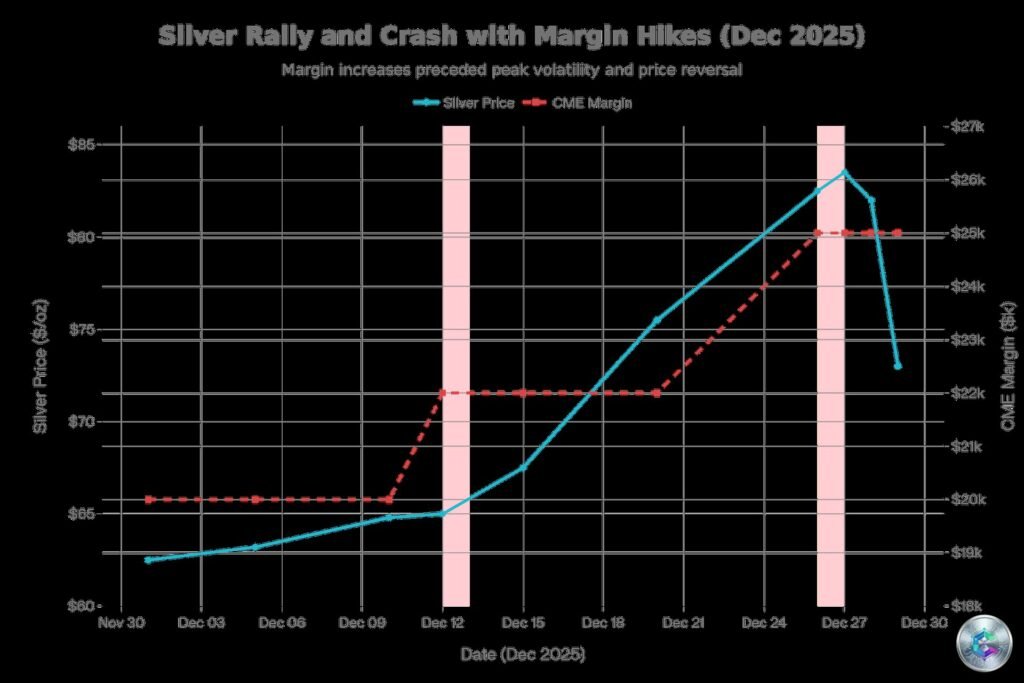

On December 26, 2024, the CME publicly announced an advisory (Advisory No. 25-393) taking effect on December 29. For COMEX silver contracts expiring in 2026, the required initial margin was increased by approximately $3,000 per contract, rising from $22,000 to about $25,000 — an increase of 13 to 14%.

A standard COMEX silver contract represents 5,000 troy ounces. With silver at around $75 per ounce, that represents approximately $375,000 of notional exposure. With a margin of $25,000, the leverage is about 15x. A movement of a few percent can eat through considerable collateral.

As of December 16, silver COMEX open interest stood at around 224,867 contracts according to CFTC reports. Applying the $3,000 margin increase per contract yields a gross additional collateral demand of approximately $675 million.

The Cascade Liquidation

On December 29, when the new margin requirements took effect, the market reacted violently. According to analyst Shanaka Anslem, approximately $4 billion in long silver positions were liquidated in approximately one hour. This is one of the fastest liquidations ever observed.

This is not a story of bank collapse. This is a story of forced deleveraging, and forced deleveraging looks like panic on a chart. Liquidity completely disappeared, prices plunged straight down as bids evaporated.

Historical Precedents

This mechanism is not new. In 1980, the Hunt brothers attempted to « corner » the silver market, accumulating more than 100 million ounces. When the CME adopted Silver Rule 7 on January 7, 1980, increasing margins from 4% to 10%, the price collapsed. On March 27, 1980 — the famous « Silver Thursday » — the price plunged from $21.62 to $10.80 in 4 days.

In 2011, a similar scenario occurred. Silver had climbed from $8.50 to $49. The CME raised margins five times in nine days, increasing margins from 4% to 10% of notional. The price fell from $49 to $26 in a few weeks.

The pattern is clear: when leverage accumulates and silver rises too fast, the CME increases margins. This forces traders to post more collateral or sell. Most sell, creating a downward spiral.

The Real Systemic Problem: The Physical Crisis

Beyond the margin shock, a deeper structural problem emerges. The silver market is experiencing its fifth consecutive year of supply deficit. The cumulative shortage since 2021 approaches 800 million ounces — equivalent to an entire year of global production.

COMEX registered stocks decreased by 70% compared to 2020 peaks, falling from 346 million ounces to only 82 million at the end of 2023. At the end of November 2025, outstanding COMEX silver futures contracts represented approximately 234 million ounces in paper claims, but available physical stocks were only 113 million ounces. A deficit of 121 million ounces.

Physical silver price in Shanghai trades at a $5 to $8 premium per ounce compared to COMEX contracts — a massive arbitrage signaling that paper is disconnected from physical.

In December 2025, more than 60% of registered physical silver available for delivery was requested in just four trading days. This is the real systemic problem: the silver futures market is now severely decoupled from physical reality.

Indicators to Monitor

To distinguish signal from noise in the coming weeks, follow these metrics:

- CME Silver CVOL: The volatility gauge was at 81.71 on December 28. If it cools down, pressure decreases.

- Additional CME margin notices: Further increases would signal that volatility remains uncontrolled.

- CFTC Commitments of Traders reports: Check if silver open interest contracts sharply.

- Paper-to-physical ratios: Watch if the gap between COMEX physical stocks and open interest continues to widen.

- LME stocks: If physical exchange stocks continue to fall, it’s confirmation that physical scarcity is real.

Lessons for Crypto Traders

For cryptocurrency traders and investors, the persistent question: can what happens in silver happen in crypto? The silver story in December 2025 is a case study in leverage risk management.

Much of the observed market stress is mechanical. It comes from collateral requirements, volatility spikes, and the speed at which leverage unwinds. This stress can seem « systemic » — and it does threaten the system — even when no institution has failed individually.

The social layer adds on top, converting real volatility into viral mythology. Rumors work because they resonate with recognized fears. Learn from this case before crypto margins become the next viral screenshot.

Sources: CryptoSlate, Reuters, CFTC, CME Group, Yahoo Finance