The year 2025 will go down in history as the one that saw prediction markets transition from a niche experiment to institutional financial infrastructure. With $44 billion in trading volume and capital at stake quadrupling to reach $13 billion, the sector experienced a spectacular transformation, dominated by the Kalshi-Polymarket duopoly controlling 99% of the market.

Explosive Growth Driven by Two Giants

This explosion occurred in a context where prediction markets became much more than simple betting platforms. They established themselves as reliable economic forecasting tools, regularly outperforming traditional polls and institutional forecasting models. The weekly peak of $2.3 billion recorded during the week of October 20, 2025, demonstrates this growing maturity.

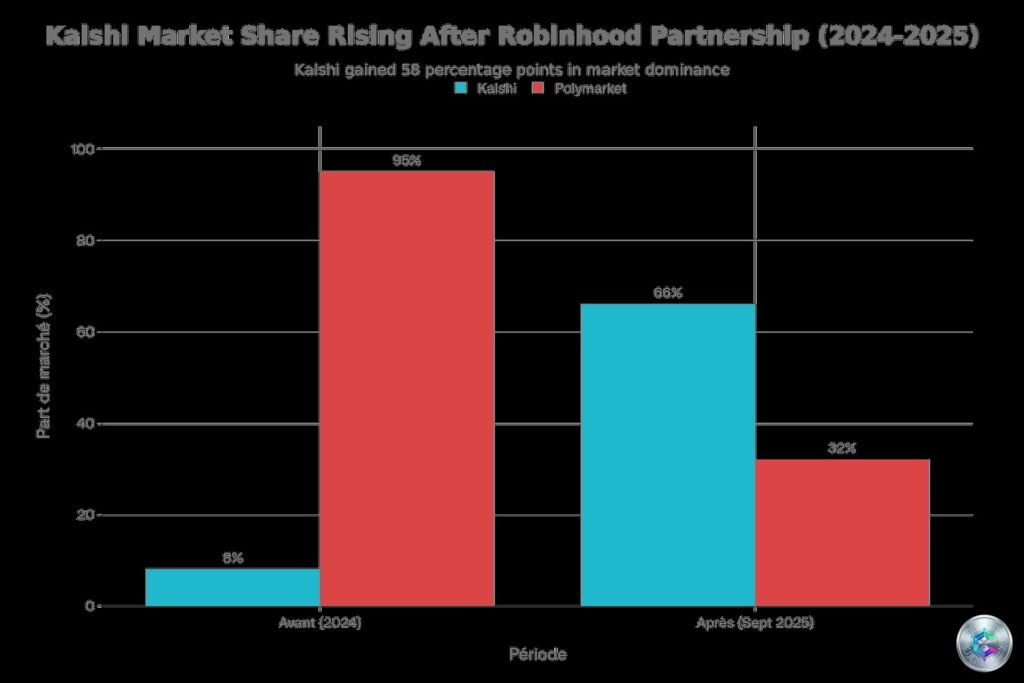

The Great Reversal: How Kalshi Dethroned Polymarket

The most striking story of 2025 remains the complete reversal of the market hierarchy. In early 2024, Polymarket reigned supreme with 95% market share, relegating Kalshi to a modest 8% position. This dominance seemed unshakeable, built on the powerful network effects of the crypto ecosystem.

Everything changed with a masterful strategic move: the partnership between Kalshi and Robinhood announced in March 2025. This alliance transformed Kalshi’s regulatory advantage – a federal CFTC license valid in all 50 U.S. states – into a weapon of massive disruption. Within months, positions reversed: Kalshi surged to 66% market share while Polymarket plummeted to 32%.

The numbers illustrate the magnitude of the earthquake. Kalshi’s annualized volume exploded from $300 million to $40-50 billion, a 200-fold increase. Its daily active users multiplied by 20 to reach 75,000, while Polymarket’s collapsed by 50% to 24,000.

Two Radically Different Philosophies

Despite their shared dominance, Kalshi and Polymarket embody two opposing philosophies shaping the sector’s future.

Kalshi: Regulated Disruption

Kalshi positioned itself as the regulated disruptor of the traditional sports betting sector. Its model rests on two strategic pillars: regulatory arbitrage and superior capital efficiency. Unlike sports betting platforms like DraftKings or FanDuel, limited to about 30 states, Kalshi operates under a federal CFTC license, granting it national coverage including massive markets like California and Texas.

Financial results confirm the explosive trajectory: from $1.8 million in revenue in 2023, Kalshi jumped to $24 million in 2024 (1,220% growth), then exceeded $200 million in the first half of 2025, reaching an annualized rate of $600-700 million by November 2025. Sports now dominate 75% of its activity.

Polymarket: From B2C to B2B

Facing Kalshi’s rise in the American retail market, Polymarket orchestrated a masterful strategic pivot: transforming from a loss-making B2C model into a B2B data-as-a-service platform. The clearest signal? The $2 billion investment from Intercontinental Exchange (ICE), owner of the New York Stock Exchange, valuing Polymarket at $9 billion in October 2025.

This contribution isn’t limited to capital: ICE becomes the global distributor of Polymarket’s event data, transforming users’ speculative activity into quantifiable and monetizable institutional assets.

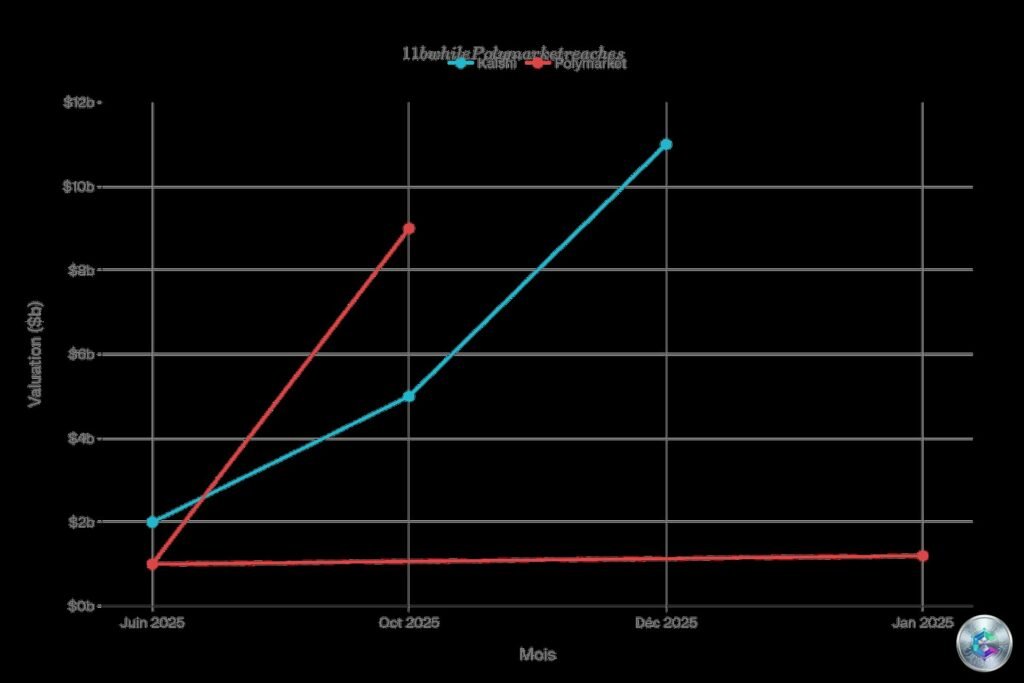

Stratospheric Valuations

Investor confidence in prediction markets’ future is measured by the dizzying valuations reached in 2025. Kalshi saw its valuation jump from $2 billion in June 2025 to $11 billion in December, during a funding round led by Sequoia and CapitalG.

Polymarket’s ascent was equally stunning, with remarkable strategic timing. ICE’s investment propelled Shayne Coplan, the 27-year-old founder who was coding from his bathroom in 2020, to the rank of youngest self-made billionaire in the world according to Bloomberg. Holding approximately 11% of Polymarket, his personal fortune exceeds $1 billion.

Polymarket’s Return to the USA

The year 2025 also marks a decisive regulatory turning point. In July 2025, Polymarket crossed the regulatory Rubicon by acquiring QCEX, a CFTC-licensed derivatives exchange and clearinghouse, for $112 million. This transaction grants Polymarket legal access to American markets, with CFTC approval received in December 2025, marking the end of a three-year exile.

The Expanding Ecosystem

The duopoly’s success triggered a gold rush, attracting traditional finance players and new entrants. Robinhood’s prediction markets hub launch in March 2025 became the platform’s fastest-growing product, generating $100 million in annualized revenue with a projection of $300 million by the end of 2025.

Coinbase also unveiled its ambitious strategy in December 2025, via a partnership with Kalshi, integrating into a comprehensive vision including stock trading and perpetual contracts. The FanDuel x CME Group partnership perhaps represents the most significant validation of prediction markets’ institutionalization.

Institutional Adoption

According to the November 2025 Acuiti report, 45% of global prop trading firms now evaluate prediction markets. In the United States, this figure jumps to 75%, with 10% already actively trading. Institutions integrate prediction markets into their workflows for enterprise risk management and portfolio diversification.

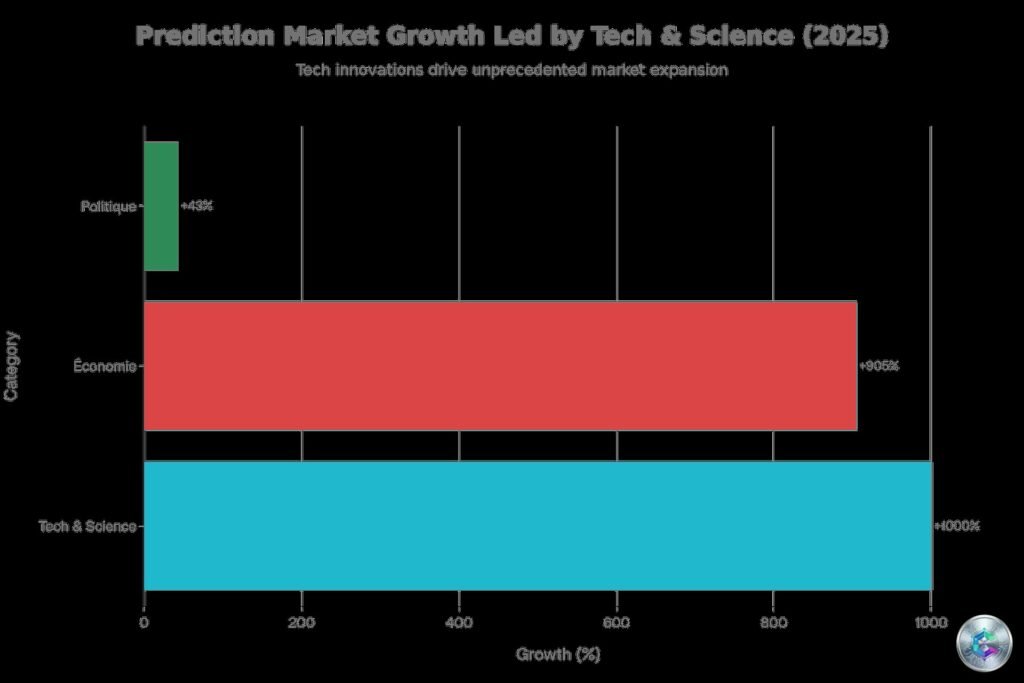

Sports: The Dominant But Controversial Engine

If one category propelled the explosion of volumes in 2025, it’s undeniably sports. 70% of trading volume comes from sports betting, transforming what were supposed to be economic and political event platforms into direct competitors of DraftKings and FanDuel.

This sports dominance fuels the fundamental debate: is it a « new asset class » or a gambling platform disguised as a financial exchange? Preliminary decisions in New Jersey and Nevada sided with Kalshi, but the debate remains fierce.

Superior Accuracy and Reliability

2025 data massively validates the hypothesis that prediction markets generate more accurate forecasts than traditional alternatives. A comparative study of the 2024-25 NBA season showed that Polymarket achieved 67% accuracy in predicting winners, compared to 66% for professional bookmakers.

In macro forecasting, prediction markets demonstrated superior reactivity and precision. Kalshi’s inflation market synthesized dispersed information faster than the Cleveland Fed’s Nowcast model. For the 2024 presidential election, Polymarket predicted Trump as the winner with accuracy superior to national polls.

2026 Projections and Beyond

Analysts converge on a trajectory of exponential growth. Citizens Financial Group projects a five-fold increase in revenue by 2030, exceeding $10 billion. Sporting Crypto’s report estimates a Total Addressable Market that will explode to $95 billion by 2035.

The most disruptive predictions concern AI. According to the December 2025 CGV Research report, prediction markets are transitioning: human predictions are becoming « training data » rather than trading subjects. By 2026, markets will prioritize AI model optimization, with human betting serving more as signal input.

Conclusion

The year 2025 marks the inflection point where prediction markets ceased being technological curiosities to become critical infrastructure for information aggregation and risk management. The Kalshi-Polymarket duopoly proved that financially incentivized collective intelligence can surpass traditional forecasting models.

Three structural dynamics underpin this transformation: progressive regulatory clarity, massive adoption by mainstream distribution channels (Robinhood, Coinbase, FanDuel), and emerging AI integration redefining the very function of markets.

Prediction markets no longer just surface the probability of future events. They create a new infrastructure where truth is weighted by capital, information is monetized in real-time, and uncertainty becomes tradable. 2025 will be remembered as the year this vision moved from utopia to mainstream.