Eric Adams, the former New York City mayor known as the « Bitcoin Mayor, » has just plunged into a major controversy that’s shaking the crypto community. On January 11, 2026, he launched the NYC Token with great fanfare in Times Square, a cryptocurrency that experienced a meteoric rise before collapsing in less than 30 minutes, raising serious allegations of manipulation and a « rug pull. »

A Spectacular Launch Turns Into Disaster

At a press conference held in the heart of Times Square on a Monday afternoon, Adams unveiled his NYC Token project, an initiative he presented as a noble way to fund the fight against antisemitism and « anti-Americanism. » Dressed in a Fendi scarf under a long blue coat and wearing a baseball cap reading « NYC, » the former mayor promised that the revenues generated would be used to educate children about blockchain and fund scholarships for New York students from disadvantaged communities.

« There is a wave of anti-Americanism sweeping not only our Ivy League university campuses, but also our downtown areas, » Adams said during his Fox Business appearance. « The money raised will go to nonprofit organizations like Combat Antisemitism, university funds, including historically black universities (HBCUs), so it’s money that, without raising taxes, can be used to fight the social problems of our city. »

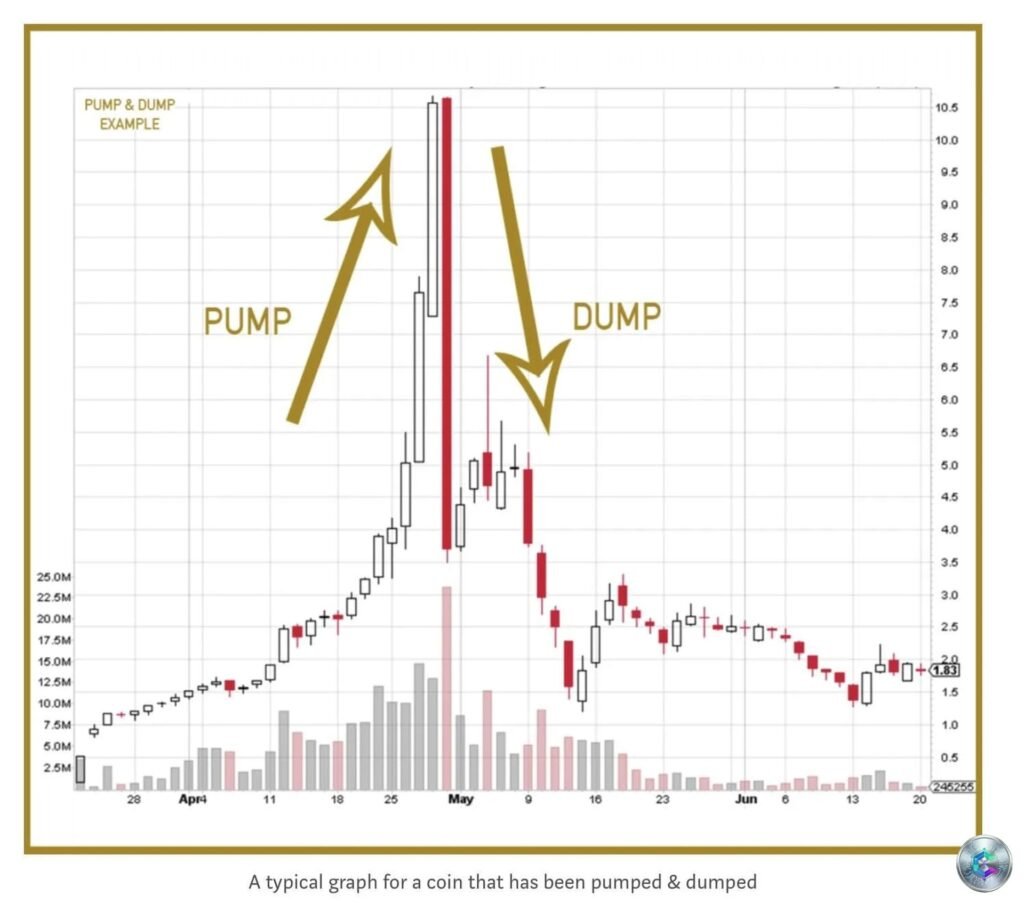

A Devastating Pump and Dump

The NYC Token, launched on the Solana blockchain with a total supply of one billion tokens, experienced a trajectory as spectacular as it was alarming. Immediately after launch, the token exploded, reaching a market cap of approximately $580 to $600 million, with a price peaking at around $0.58.

However, this euphoria was very short-lived. In less than 30 minutes, the NYC Token price collapsed by more than 80%, dropping from $0.47 to around $0.10. The market cap plummeted from $600 million to approximately $110 million, leaving thousands of investors with catastrophic losses.

Damning Evidence of Manipulation

On-chain analyses conducted by Bubblemaps platform and other blockchain experts revealed extremely suspicious fund movements pointing to a classic « rug pull. » According to these analyses, a wallet linked to the NYC Token creator (identified as wallet 9Ty4M) allegedly withdrew approximately $2.43 million in USDC from the liquidity pool near the token’s market cap peak.

More specifically, the wallet transferred 80 million tokens to an account that used these tokens to create liquidity on the Meteora decentralized exchange. This account then withdrew $2.43 million in USDC before reinvesting only $1.5 million after the price had already dropped by 60%. According to estimates, approximately $932,000 in USDC liquidity never returned to the pool.

« There was no explanation regarding these liquidity maneuvers, » Bubblemaps reported on X. « It is unfortunately similar to the $LIBRA launch, where liquidity was significantly manipulated. »

From « Bitcoin Mayor » to Crypto Scandal

This case represents a brutal turning point for a politician who had positioned himself as an ardent defender of cryptocurrencies. In 2022, Adams made a splash by converting his first three paychecks as mayor into Bitcoin and Ethereum via Coinbase, earning the nickname « Bitcoin Mayor. »

During his mayoral term from 2022 to 2025, Adams multiplied pro-crypto initiatives: creating the Office of Digital Assets and Blockchain Technology, organizing the first NYC Crypto Summit, and publishing a 61-page blockchain plan aimed at making New York « the world capital of crypto. »

However, his reputation began to tarnish as early as 2023 when he failed to declare his crypto assets in the city’s mandatory financial reports. In September 2024, Adams became the first sitting New York mayor to be indicted by federal authorities, facing charges of conspiracy, fraud, solicitation of foreign contributions, and corruption.

A Disturbing Trend of Political Memecoins

The launch of the NYC Token is part of a concerning trend of tokens launched by political figures. This phenomenon was amplified by the launch of memecoins by Donald Trump and First Lady Melania Trump in early 2025.

More recently, the LIBRA token, promoted by Argentine President Javier Milei, has been subject to fraud and racketeering allegations, leading to class action lawsuits. Only 14% of LIBRA investors made a profit, while 86% suffered losses totaling $251 million.

Court documents have identified Benjamin Chow, co-founder of Meteora, as the architect behind at least 15 token launches following an « identical model, » including the MELANIA and LIBRA tokens. The lawsuit claims that these personalities used their fame as « props to legitimize what prosecutors call coordinated liquidity traps. »

Solana: An Ecosystem Conducive to Scams

The choice to launch the NYC Token on the Solana blockchain is not insignificant. A recent study by Solidus Labs reveals alarming figures: approximately 98.7% of tokens on Pump.fun and 93% of liquidity pools on Raydium, two major Solana DeFi platforms, show characteristics of pump-and-dump schemes or rug pulls.

Solana’s extremely low transaction fees and fast transaction finality (less than one second) make it a particularly attractive platform for scammers looking to quickly deploy and execute fraudulent schemes.

Community Reactions and Legal Implications

The crypto community reacted virulently to this case. On Reddit, many users accused Adams of deliberate « rug pull » and raised the possibility of money laundering. « This is undoubtedly a case of money laundering, » one user commented.

New York’s new mayor, Zohran Mamdani, clearly indicated he would not buy the token. On his first day in office on January 1, 2026, Mamdani canceled several of Adams’ executive orders.

Investors who lost money in the NYC Token could potentially sue Adams, as LIBRA token investors have done. A class action lawsuit filed with the SEC in April seeks to classify stake-based memecoins as securities.

Conclusion: A Warning for Investors

The NYC Token case is a stark warning for cryptocurrency investors. Tokens launched by political figures or celebrities, even those claiming to serve noble causes, can prove to be dangerous traps. The prestige and fame of these public figures lend false legitimacy to projects that are often opaque and poorly structured.

Red flags were numerous from the launch: no identified partners, undisclosed funding mechanisms, terminological confusion (Adams called blockchain « block change technology » in an interview), and most importantly, suspicious liquidity movements from the first hours.

With 86% of LIBRA token investors having lost money and hundreds of millions of dollars evaporated in these politico-crypto schemes, it is clear that the intersection between politics and cryptocurrencies requires heightened vigilance and stricter regulation.