On December 31, 2025, the American monetary « plumbing » emitted a signal that crypto markets are monitoring with increasing attention: a record use of the Standing Repo Facility (SRF) of approximately $74.6 billion. While this spike may appear to be just a classic year-end stress, it fits into a sequence of Fed decisions that reinforces an increasingly debated thesis: in the post-ETF regime, Bitcoin now responds more to liquidity cycles than to the traditional halving calendar.

A Revealing Year-End Stress

The Federal Reserve’s H.4.1 balance sheet shows $74.6 billion in « repurchase agreements » on Wednesday, December 31, 2025. This figure corresponds to massive recourse to the Fed’s repo tool, typical of a moment when private financing becomes scarce, with banks and dealers reducing their risk-taking around reporting dates.

Reuters also reports this record usage while emphasizing the « year-end » reading: liquidity management and balance sheet constraints, rather than a systemic emergency signal. On the same day, the ON RRP (overnight reverse repo) stood at $105.993 billion.

The Real Pivot: QT Halt and T-bill Purchases

Beyond the seasonal spike, the most important signal for crypto markets is technical in nature. The Fed announced the halt of runoff (end of Quantitative Tightening) on December 1, 2025, and the start of Treasury bill purchases via « reserve management purchases » of approximately $40 billion starting December 12.

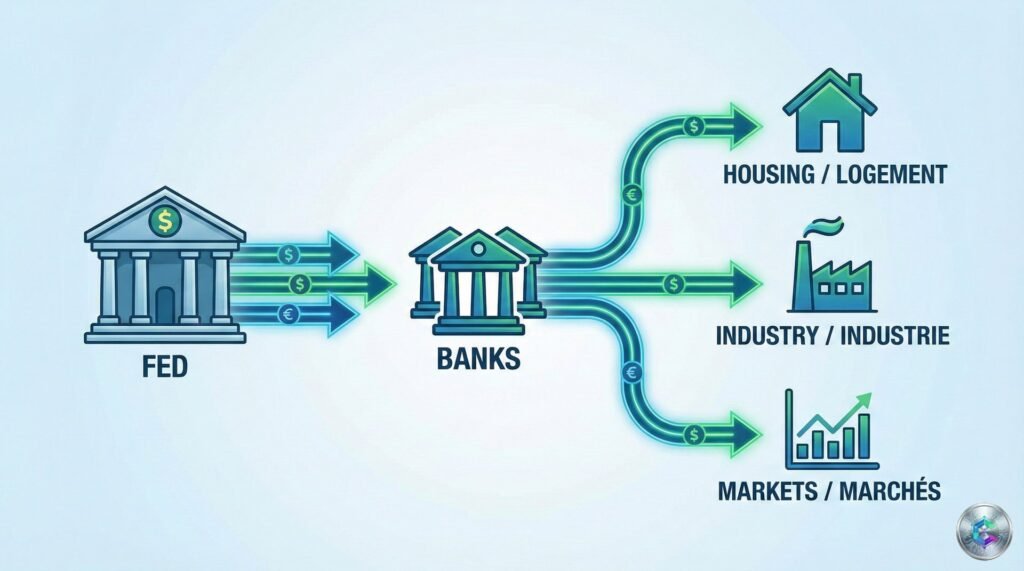

According to the New York Fed, the FOMC requested an increase in SOMA holdings via secondary market Treasury bill purchases to maintain « ample » reserves. Even though the Fed insists on the « technical » nature of these operations, these purchases reverse the marginal liquidity flow compared to pure QT.

Bitcoin: Now « Plugged Into » Liquidity Flows

The fundamental argument is structural: Bitcoin has entered more deeply into macro flow circuits. CryptoSlate documents that the total AUM of U.S. spot BTC ETFs fell from a peak of $169.54 billion (October 6, 2025) to $120.68 billion (December 4, 2025).

In this context, anything that improves market depth and reduces balance sheet constraints can mechanically decrease the violence of corrections and facilitate the return of a more regular institutional « bid. »

The End of the 4-Year Cycle?

Grayscale explicitly embraces the idea that 2026 could mark the end of the 4-year cycle theory, with a probability of new highs in the first half of 2026. Their reasoning: regulatory integration and ETPs bring more stable flows, less « parabolic » than in 2017 or 2021.

Standard Chartered’s research follows the same direction: the bank no longer considers halving as the main driver, but rather ETF flows as the long-term price engine. Bitcoin is increasingly behaving like a macro flow asset, no longer just as an internal crypto narrative.

What to Watch in Q1 2026

For crypto investors, here’s an actionable checklist for the first quarter of 2026:

- SRF Normalization: If repo falls rapidly after the new year, the « seasonal » diagnosis is reinforced. If elevated levels persist, it suggests a system that remains constrained.

- ON RRP Trajectory: A sustained decline signals that players are putting cash back to work (more risk-on). A persistently high ON RRP may signal the opposite.

- T-bill Purchases: The Fed indicates a pace « elevated for a few months. » The question for markets: Q1 only, or an extended program?

- Financial Conditions (NFCI): The index is already in « loose » territory at year-end (negative). Maintaining negative + T-bill purchases = a historically favorable mix for risky assets.

- Stablecoins: Total capitalization ($265.6 billion) serves as a simple proxy. When it accelerates, the market often has more « ammunition » to take on risk.

- Daily ETF Flows: Data becomes an essential « tape » reading to monitor the return (or not) of regular demand.

Three Scenarios for Bitcoin in 2026

Scenario 1 — Base Case: De-stress + Technical Support

Repo and ON RRP normalize post year-end, reserve purchases remain « elevated for a few months, » and financial conditions remain accommodative. Bitcoin benefits from a less hostile environment with less violent corrections and better support levels.

Scenario 2 — Bullish: Liquidity + Demand

Clear and persistent recovery in ETF flows combined with dynamic stablecoin growth. This is the combination most conducive to a strong directional move, as it marries capacity (liquidity) and demand (flows).

Scenario 3 — Risk-Off: Noisy Plumbing

If funding tensions repeat beyond seasonal patterns or if a macro shock tightens conditions, Bitcoin returns to its « beta »: faster liquidations, wider spreads, increased volatility. The year-end spike would then be a warning, not an epiphenomenon.

Conclusion

The December 31 repo spike is not, in itself, a « magic signal » bullish for Bitcoin. However, it acts as a revealer: the Fed doesn’t want reserve liquidity to become too scarce and is already authorizing « technical » balance sheet tools to stabilize the system.

In a Bitcoin market now structured by ETFs and institutional flows, this plumbing matters more than before. The most robust reading for Q1 2026 therefore consists of following a simple and factual checklist: repo/ON RRP, reserves, NFCI, stablecoins, and ETF flows. These indicators, more than ever, will determine Bitcoin’s trajectory in the coming months.