January 20, 2026, will be remembered as a major turning point for global financial markets. In just a few hours, U.S. President Donald Trump’s geopolitical ambitions concerning Greenland triggered a massive wave of sell-offs worldwide, exposing the fragility of a financial system built on expectations of stability.

A Perfect Storm: Diplomatic Tensions Meet Market Pressure

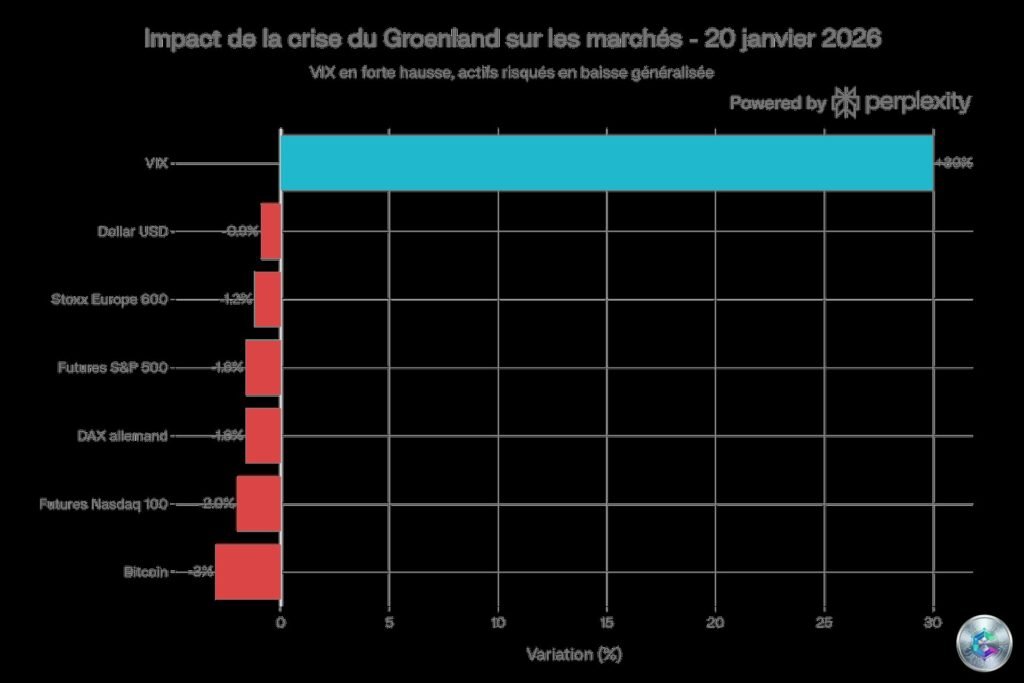

Trump’s stated desire to seize this autonomous Danish territory, accompanied by unprecedented tariff threats against eight European countries, transformed a simple geopolitical tension into a catalyst for systemic stress in the markets. The numbers speak for themselves: the traditional safe-haven dollar lost 0.9% against a basket of currencies, S&P 500 futures fell 1.6%, and Nasdaq 100 futures plunged 2%. In Europe, the Stoxx 600 declined 1.2%, and the German DAX dropped 1.6%.

A Calculated and Methodical Escalation

The American offensive is not improvised. The previous weekend, Trump announced the imposition of 10% tariffs starting February 1st on products from Denmark, Norway, Sweden, France, Germany, the Netherlands, Finland, and the United Kingdom. These tariffs could reach 25% by June 1st if no agreement is reached on the « complete and total purchase of Greenland. »

The presidential message leaves no room for ambiguity: « There can be no turning back » on Greenland, described as « imperative for national and global security. » The U.S. administration explicitly links this commercial escalation to its strategic objectives in the Arctic, invoking the need to counter Russian and Chinese advances.

On January 20, Trump added another layer of pressure by threatening to impose 200% tariffs on French wines and champagnes, directly targeting an emblematic sector and illustrating Washington’s willingness to use trade as a weapon to obtain political concessions.

The Dollar Loses Its Safe-Haven Status

The most revealing movement of this crisis is undoubtedly the fall of the dollar. Traditionally, during periods of geopolitical stress, the greenback plays the role of safe haven. On January 20, this mechanism completely reversed: the dollar fell 0.9% against a basket of currencies, while the euro strengthened to around $1.16.

This reversal reflects a loss of confidence in the stability of U.S. policy. According to ING, « the dollar is no longer playing its safe-haven role » because « investors have reassessed their exposure to U.S. assets. » Deutsche Bank summarizes the situation bluntly: « The dollar has lost its exceptionalism. »

Volatility Explosion: A Market Caught Off Guard

The market’s fear gauge, the VIX index, jumped to its highest level of the year, breaking through the 20-point mark with a 30% increase in 24 hours. This brutal movement is explained by investors’ extremely optimistic positioning before the crisis. According to Bank of America’s January survey, 48% of global fund managers had no hedging against a sharp drop in equities, the lowest level since January 2018.

Portfolio cash holdings sit at a historically low level of 3.2%, proving that the consensus remained massively bullish. This positioning mechanically amplifies correction movements, fueled by rapid risk adjustments rather than fundamental analysis.

Rush to Gold and Bitcoin’s Collapse

Faced with uncertainty, investors rushed toward traditional assets. Gold broke through the symbolic $4,700 per ounce mark, setting a new all-time high. Silver followed suit, reaching $84.58 per ounce, also an unprecedented peak.

Paradoxically, Bitcoin, often presented as « digital gold, » collapsed 3%, falling from around $95,000 to $92,000, erasing most of its gains from early 2026. Cryptocurrency markets recorded $875 million in liquidations within 24 hours, 90% of which were long positions.

This divergence between physical gold and Bitcoin confirms that during acute geopolitical stress, investors favor assets with a thousand-year history of resilience over digital innovations.

Sectors Under Pressure: Luxury, Automotive, and Tech

Major European luxury houses were among the hardest hit. LVMH fell 3.7%, Hermès declined 2.4%, and Kering dropped 2.9%. The specific threat of 200% tariffs on French wines and champagnes adds a symbolic dimension to this correction.

The German automotive sector also took the full brunt of the announcement. BMW lost 4.5%, Volkswagen fell 4.3%, Mercedes declined 4.6%, and Porsche dropped more than 3%. In Paris, Stellantis gave up 2.5%.

European technology stocks participated in the movement. ASML Holding declined 2.0%, Infineon Technologies lost 2.5%, and Siemens dropped 3.1%, reflecting generalized risk aversion.

Greenland: A Major Strategic Asset

Trump’s interest in Greenland is not a whim. This two million km² island, sparsely populated, harbors considerable natural resources: probably one of the world’s largest uranium reserves, significant rare earth reserves essential for advanced technologies, and hydrocarbon resources whose accessibility increases with melting ice.

Beyond resources, Greenland occupies a crucial strategic position. The island hosts Thule Air Base, established by the United States in 1951, which houses early warning systems against ballistic missiles. With climate change, the Arctic is becoming an increasingly accessible maritime passage zone, opening new trade routes between Asia and Europe.

Economic Impact: Beyond Political Noise

Despite the magnitude of the geopolitical shock, the economic importance of the tariff threat deserves nuance. According to Neil Shearing, chief economist at Capital Economics, even if Trump carried out his threat, it would reduce European growth by about 0.1 to 0.5 points. « A 10% increase would certainly be bad news, but it certainly wouldn’t cause a recession in Europe. »

Total EU gross exports to the United States represent just under 3% of the Old Continent’s GDP. Even a significant trade shock would not, by itself, plunge Europe into recession.

The Risk of Escalation and Retaliation

Faced with this offensive, Europe is adopting a firmer tone. French Economy Minister Roland Lescure stated: « We must be ready to fully use EU tools. Would this have an impact on the European economy? Obviously. But we may be led to make decisions that don’t benefit anyone. »

The European arsenal includes several options: increased tariffs on American products, use of anti-coercion instruments allowing taxation of digital companies, and restriction of American companies’ access to the internal market. The EU is reportedly considering retaliatory tariffs on €93 billion worth of American goods.

A New Normal for Markets

The Greenland crisis marks a turning point. Investment strategies must now integrate permanent and structural geopolitical risk. According to Nigel Green, analyst at deVere Group, « markets no longer view escalation as a one-off event. They approach it as a structural feature of the environment. »

Citi strategists have downgraded their weighting of European equities to « neutral, » believing that the prospect of additional tariffs compromises the scenario of a fragile recovery. Edmond de Rothschild AM warns that this difficult geopolitical sequence risks generating a « non-negligible » economic cost, in the range of 0.2% to 0.5% of growth.

Conclusion: The End of an Era

The crisis of January 20, 2026, will remain a pivotal moment in the history of transatlantic relations and financial markets. Beyond immediate variations, the entire architecture of international relations is wavering. Europe must rethink its security and strategic autonomy model, while markets integrate geopolitical risk as a structural component of their asset valuation.

As Sebastian Paris Horvitz of LBP AM summarizes: « The outcome of this new U.S.-provoked crisis remains difficult to determine at this stage. Nevertheless, it clearly appears to be generating strong uncertainty and hampering economic expansion on both sides of the Atlantic. » In this new world, the ability to navigate uncertainty becomes the most valuable asset for investors and policymakers.