On January 26, 2026, gold broke through a new historic milestone, surpassing $5,075 per ounce, marking a spectacular rise of over 60% in 2025. This unprecedented surge of the yellow metal raises a crucial question for crypto investors: is Bitcoin, often presented as « digital gold, » threatened by this overwhelming dominance of its millennia-old competitor?

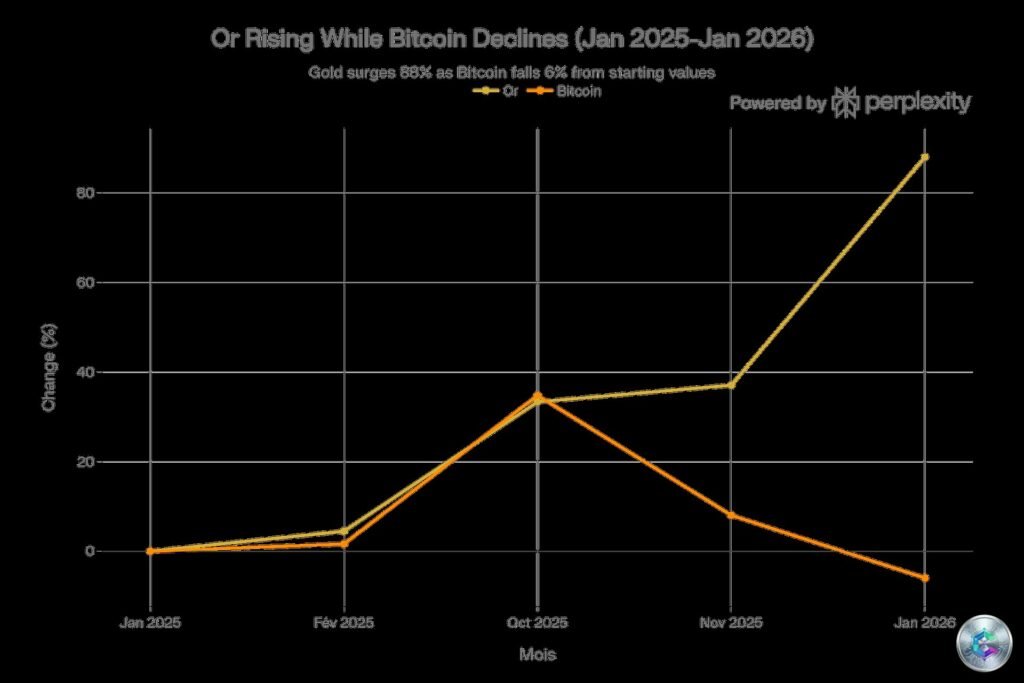

2025 Performance: A Historic Gap Between Gold and Bitcoin

The year 2025 will be remembered as one of brutal divergence between the two most closely watched safe-haven assets in the world. While gold multiplied records with a 60 to 65% increase, Bitcoin ended the year with a negative performance of -1.2%, despite reaching a historic peak of $126,000 in October 2025.

This BTC underperformance occurs in a paradoxical context: the year following the April 2024 halving, a traditionally bullish period for cryptocurrency, should have propelled Bitcoin to new heights. Instead, the king of crypto currently trades around $87,900, a drop of nearly 30% from its October ATH.

Opposite Trajectories: Gold Climbs, Bitcoin Falls

While gold continued its methodical ascent — rising from $2,700 in January 2025 to over $5,075 in January 2026 — Bitcoin experienced extreme volatility. After reaching $126,000 in October 2025, BTC plunged below $90,000 at the end of 2025, before continuing its descent to $87,900 in early 2026.

This volatility reminds us that Bitcoin has not yet acquired the stable safe-haven status that gold has possessed for millennia.

Drivers Behind Gold’s Surge

Massive Central Bank Purchases

The main catalyst for gold’s rise remains structural purchases by central banks. Goldman Sachs anticipates average acquisitions of 60 tons per month in 2026, in a context of progressive de-dollarization of global reserves.

Poland perfectly illustrates this trend: the Polish National Bank now holds 550 tons of gold — more than the ECB (506.5 tons) — and is targeting 700 tons. This strategy is part of a broader movement where central banks seek to reduce their exposure to U.S. Treasury bonds and diversify their reserves.

In August 2025, a symbolic threshold was crossed: central banks held more gold by value than U.S. debt for the first time in 30 years.

Dollar Weakening and Geopolitical Tensions

Gold also benefits from several favorable macroeconomic tailwinds:

- Anticipated interest rate cuts: The Fed is expected to implement two rate cuts in 2026, totaling 50 basis points, which reduces the opportunity cost of holding a non-yielding asset like gold

- Dollar depreciation: Goldman Sachs economists anticipate a weaker dollar by 2026, making gold more affordable for foreign investors

- Geopolitical uncertainties: Trade tensions related to Trump’s tariffs, the specter of a U.S. government shutdown, and international conflicts fuel demand for the precious metal

Bitcoin Facing Its Demons

Growing Correlation With Risk Assets

One of Bitcoin’s major problems in 2025-2026 is its growing correlation with risky assets, particularly technology stocks. The average correlation between BTC and the S&P 500 reached 0.5 over one year, compared to only 0.2 to 0.3 in previous years.

This evolution transforms Bitcoin into a « risk-on » asset rather than a safe haven. When traditional markets panic, Bitcoin now falls with them, thus losing its fantasized status as uncorrelated « digital gold. »

Massive Bitcoin ETF Outflows

Contrary to expectations, U.S. Bitcoin ETFs — which had generated considerable enthusiasm upon their launch in January 2024 — experienced record net outflows in late 2025. In November 2025, ETFs recorded $3.5 billion in withdrawals, followed by an additional $1.1 billion in December.

On November 19, 2025, BlackRock’s flagship ETF (IBIT) suffered its largest single-day outflow with $523 million in withdrawals. This trend continued in early 2026, with fluctuating outflows despite some occasional rebounds.

Persistent Volatility

Bitcoin’s volatility remains a major obstacle to its adoption as a store of value:

- 30% drop between January and April 2025 following Trump’s tariff announcements

- Flash crash on October 10, 2025 with a 15% decline in one session, causing the largest liquidations in crypto history

- 30% correction between October and January (from $126,000 to $87,900)

These brutal fluctuations contrast with gold’s steady progression, which has chained records without significant correction.

Divergent Forecasts for 2026

Gold: Bullish Consensus

Analysts agree on a bullish scenario for gold in 2026:

- Base scenario (50% probability): $4,000 to $4,500 per ounce

- Bullish scenario (30% probability): $4,500 to $5,000, or beyond

- Bearish scenario (20% probability): return to $3,500, considered unlikely

Goldman Sachs recently raised its forecast to $5,400 for the end of 2026, up from $4,900 previously. UBS, ANZ Group, and Bank of America also anticipate levels between $4,000 and $5,000.

Bitcoin: Between Hope and Caution

Bitcoin faces a more uncertain future, with extremely divergent forecasts:

Optimistic scenario:

- Tom Lee (Fundstrat): $200,000 to $250,000 in 2026

- Citigroup: $143,000

- JPMorgan: $170,000 within 6-12 months

Pessimistic scenario:

- Some analysts suggest a return to between $25,000 and $30,000 by the end of 2026

- Bloomberg Intelligence even suggests a $10,000 scenario in an extreme hypothesis

Reality likely lies between these extremes. The consensus is moving toward a range of $100,000 to $150,000, with gradual stabilization as institutional adoption continues.

Complementarity Rather Than Competition

Gold and Bitcoin do not target the same investor profiles. Gold attracts conservative investors seeking stability and central banks diversifying their reserves. Bitcoin appeals to investors accepting high volatility for asymmetric return potential and blockchain technology enthusiasts.

Over a 10-year perspective, Bitcoin still largely crushes gold despite its recent underperformance. Since 2015, BTC has grown by over 1000%, while gold has gained about 180%.

Institutional Adoption Continues

Despite recent setbacks, Bitcoin institutionalization continues:

- 10% of bitcoins in circulation are now held by institutional operators via ETFs

- Strategy (formerly MicroStrategy) holds nearly 600,000 BTC

- Publicly traded companies collectively hold over 965,000 BTC (about 5% of total supply)

- 60% of institutional investors allocate between 1 and 5% of their portfolios to crypto assets

Donald Trump’s announcement in March 2025 of creating a strategic Bitcoin reserve constitutes a major event. This reserve, capitalized with approximately 200,000 BTC already held by the U.S. government through judicial seizures, transforms Bitcoin into a national reserve asset.

The Verdict: Danger or Opportunity?

Gold’s rise to $5,000 does not represent an existential threat to Bitcoin, but rather a salutary reminder of their fundamental differences.

Why gold doesn’t « kill » Bitcoin:

- Distinct markets: Gold represents about $14 trillion, compared to $1.5 trillion for Bitcoin. Both can coexist and grow simultaneously.

- Low correlation: With a historical correlation between 0.1 and 0.3, gold and Bitcoin largely evolve independently.

- Different market phases: Bitcoin is going through a cyclical consolidation phase after its 2024 halving, while gold benefits from an exceptional geopolitical context.

- Technological adoption: Bitcoin benefits from structural trends (digitization, blockchain, DeFi) independent of gold’s performance.

The Winning Strategy: Diversification

Experts’ conclusion is unanimous: the best approach is to hold both assets in a diversified portfolio.

Recommended allocation by profile:

- Conservative profile: 5-10% Gold, 1-3% Bitcoin

- Balanced profile: 3-7% Gold, 3-5% Bitcoin

- Aggressive profile: 0-5% Gold, 5-10% Bitcoin

Gold brings stability and protection against systemic crises. Bitcoin offers growth potential and exposure to the digital economy. Together, they form a complementary combination to preserve and grow wealth.

Conclusion: Bitcoin Survives and Must Reinvent Itself

Gold at $5,000 doesn’t signal Bitcoin’s death, but requires the cryptocurrency to prove its value in a new environment. For crypto investors, the message is clear: don’t neglect gold in your diversification strategy. The yellow metal proved in 2025 that it remains the ultimate safe haven when markets struggle.

But don’t abandon Bitcoin either: its long-term growth potential remains intact, driven by institutional adoption, national strategic reserves, and the ongoing technological revolution.

The real question isn’t « gold or Bitcoin? » but rather « what proportion of each asset corresponds to my risk profile and investment horizon? »

In 2026, the intelligent answer lies in a balanced allocation between millennial stability and disruptive innovation. Gold shines brightly today, but history reminds us that cycles always turn. Bitcoin has already survived several 80% crashes — it will also survive gold’s temporary dominance.

Disclaimer: This article is provided for informational purposes only and does not constitute investment advice. Cryptocurrencies are volatile assets with risk of capital loss. Do your own research and consult a financial advisor before investing.