The tokenization of financial assets reaches a new historic milestone in January 2026. BNY Mellon, one of America’s oldest and most prestigious financial institutions with $55 trillion in assets under management, has just launched tokenized bank deposits for its institutional clients. This initiative marks a decisive step in integrating blockchain technology into the heart of traditional finance.

A Revolution in Bank Deposits

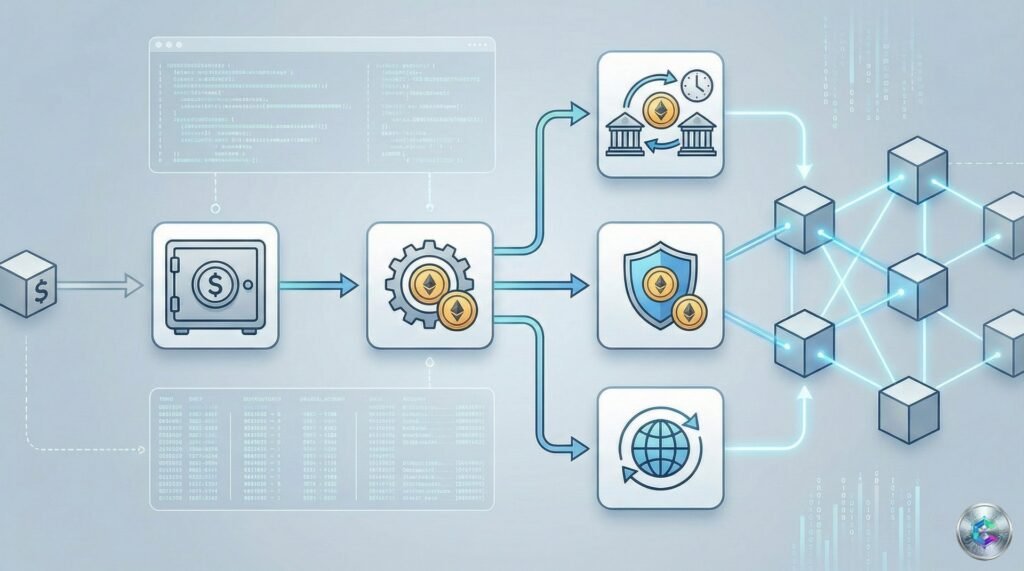

BNY’s tokenized deposits represent on-chain cash balances or depositor claims against the bank, issued on a private permissioned blockchain network developed in-house. This initiative doesn’t create new currency but offers a 1:1 digital representation of clients’ existing deposits, maintained in traditional banking systems for regulatory compliance.

The initial service aims to support collateral and margin requirements, with additional functionalities planned for the future. According to BNY, this approach enables near-real-time fund transfers, eliminating dependence on traditional cut-off times and batch processes. Participating institutions can move tokenized balances across the network within seconds to meet margin calls.

A Widespread Movement Among Major Banks

BNY isn’t alone in this blockchain race. JPMorgan is deploying its JPM Coin (symbol JPMD) on the Canton network in 2026, after launching an initial phase on Base in November 2025. This multi-chain expansion demonstrates a deliberate strategy aimed at adapting the bank deposit token to different institutional use cases.

The Canton network, a public blockchain designed for institutional financial markets with privacy-preserving features, attracts major players such as BNP Paribas, Goldman Sachs, Deutsche Börse, and HSBC. Lloyds Bank completed the first British transaction using tokenized sterling deposits on Canton, purchasing a tokenized Government bond (Gilt) from Archax, thus demonstrating interoperability between blockchain and traditional banking systems.

Goldman Sachs and BNY also launched a collaborative tokenized money market funds solution in July 2025, allowing investors to subscribe via BNY’s LiquidityDirect platform, with mirror tokens created on Goldman Sachs’ GS DAP platform. This initiative marks a first in the United States for fund managers.

Citibank is not far behind. After announcing its Citi Token Services in September 2023, the bank confirmed in October 2024 that its tokenized treasury service had moved from pilot to live production, processing multi-million dollar transactions for institutional clients.

Regulators Pave the Way for 24/7 Markets

This banking rush toward tokenization occurs within a favorable regulatory context. In September 2025, the SEC and CFTC published a joint statement proposing a shift to financial markets operating 24 hours a day, 7 days a week. This initiative aims to align American markets with the reality of an « always-on » global economy.

The CFTC also launched a pilot program for digital assets in August 2025, authorizing the use of tokenized collateral, including bitcoin, ether, and real assets such as U.S. Treasury bonds and money market funds. This regulatory framework clarifies the use of tokenized assets in futures and swaps trading, enabling faster settlement times and 24/7 operations.

Nasdaq also filed an application with the SEC in September 2025 to allow trading of tokenized securities starting in 2026, making them fungible with their traditional equivalents on the same order book.

Europe Joins the Movement

Across the Atlantic, ten European banks, including BNP Paribas, ING, UniCredit, CaixaBank, and Danske Bank, have created Qivalis, a consortium aiming to launch a euro-backed stablecoin in the second half of 2026. This initiative, compliant with MiCAR regulation, seeks to offer a European alternative to the dollar-backed stablecoin market, which currently represents 99% of the market.

The strategic objective is clear: strengthen Europe’s monetary autonomy in the digital era and develop fast, secure, and less expensive on-chain payment solutions for European businesses and consumers.

Real-World Tokenized Assets in Full Expansion

Beyond bank deposits, the tokenization of real-world assets (RWA) is experiencing explosive growth. BlackRock’s BUIDL fund surpassed $2.3 billion in assets under management in early 2026, distributing over $100 million in cumulative dividends. This tokenized money market fund, backed by U.S. Treasury bonds, cash, and repurchase agreements, represents approximately 39% market share in the tokenized Treasury securities sector.

The forecasts are ambitious. According to the Boston Consulting Group and ADDX, asset tokenization could represent a $16.1 trillion business opportunity by 2030. The non-stablecoin tokenized real assets market is expected to exceed $30 billion in 2026, while Citigroup estimates that tokenized bank deposits could support between $100 and $140 trillion in annual flows by 2030.

Benefits for Financial Institutions

The benefits of tokenization are multiple for financial institutions. It enables transformed liquidity by unlocking capital from traditionally illiquid assets such as real estate and private credit. Instant settlement reduces counterparty risk and improves operational efficiency by eliminating manual reconciliation processes.

Increased transparency through distributed ledger technology provides permanent transaction recording, facilitating compliance and trust. Global accessibility creates 24/7 markets without geographical barriers, significantly expanding the investor pool.

Smart contracts enable automation of transactions, payment processes, and collateral management, reducing friction and transaction costs. For businesses, tokenization offers the ability to transfer and exchange assets with unprecedented speed, transparency, and flexibility.

Toward a Hybrid Financial System

The Regulated Liability Network (RLN) test conducted by several major U.S. banks (BNY Mellon, Citibank, HSBC, PNC Bank, TD Bank, Truist Bank, U.S. Bank, Wells Fargo), in collaboration with Mastercard, Swift, and the Federal Reserve Bank of New York, demonstrates the viability of a payment system using commercial bank deposit tokens and tokenized records of central bank deposit liabilities on a single ledger.

This pilot project tested domestic payments between commercial banks and cross-border payments in U.S. dollars, confirming that the RLN is a viable payment system design, particularly for improving the experience of global U.S. dollar users.

The objective is not to replace the existing financial system but to improve it by allowing dollars to circulate 24 hours a day, 7 days a week, at any time and in any amount, while maintaining full compliance with KYC, AML regulations, and sanctions.

An Ongoing Structural Transformation

The launch of tokenized deposits by BNY and the massive adoption of blockchain by global financial institutions marks a historic turning point. The convergence between traditional finance and blockchain infrastructure is no longer an experiment but an operational reality transforming global capital markets.

This evolution is accelerating thanks to a favorable regulatory environment, concrete institutional use cases, and growing demand for permanently operating financial systems. Banks that rapidly adopt tokenization are positioning themselves to capture a share of the future digital monetary system, estimated at several tens of trillions of dollars by 2030.

The question is no longer whether tokenization will transform finance, but at what speed this transformation will occur and which players will dominate this new digital financial infrastructure.