BitGo Holdings’ IPO, the first institutional digital asset custodian to enter the NYSE in 2026, experienced a chaotic start. After a euphoric 36% rally on the first day, the stock crashed 22% the next day, plunging below its $18 IPO price. This extreme volatility illustrates the challenges crypto companies face in public markets amid a sector-wide downturn.

A Promising Introduction That Turned Sour

BitGo Holdings completed its IPO on January 22, 2026, on the New York Stock Exchange under ticker BTGO. The company priced its shares at $18, exceeding the initial range of $15 to $17, a signal generally interpreted as strong institutional demand.

The offering raised $212.8 million through the sale of 11.8 million Class A common shares, valuing the company at approximately $2.08 billion. Goldman Sachs and Citigroup acted as lead underwriters, joined by Deutsche Bank Securities, Mizuho, and Wells Fargo Securities.

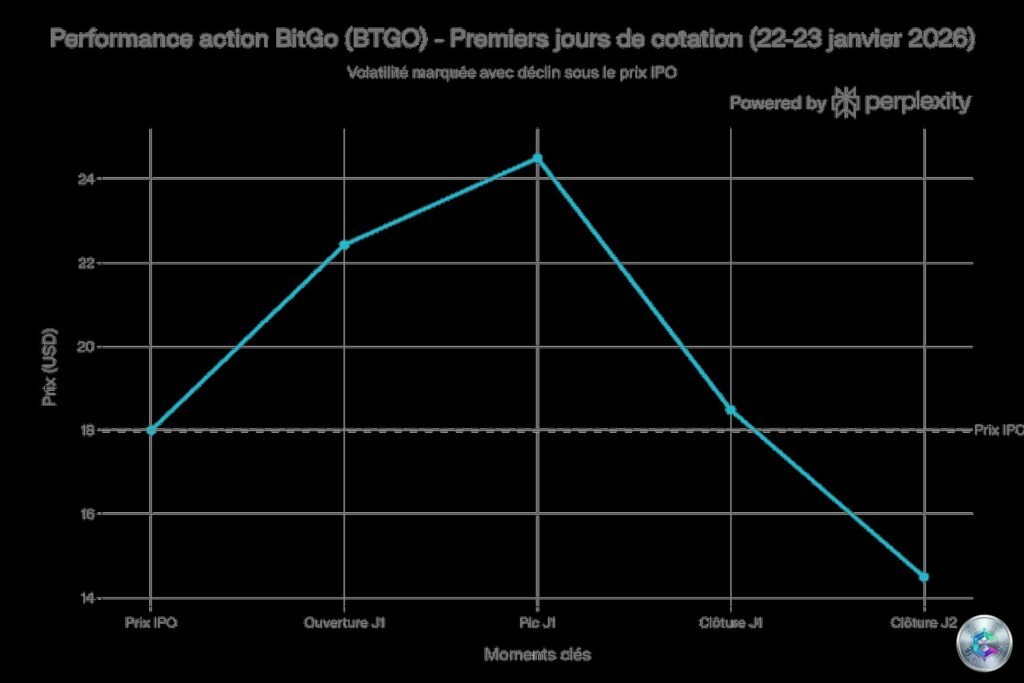

The first day started with a bang. The stock opened at $22.43, a 24.6% increase, before reaching an intraday peak of $24.50 (+36%). But this euphoria lasted only a few hours. At closing, BTGO had surrendered almost all its gains to finish at $18.49, a modest 2.7% gain.

The second trading day confirmed fears. The stock collapsed 21.58%, closing at $14.50, or 19.4% below the IPO price. Data reveals that at certain points during the session, the stock was down 13.4% from the IPO price, illustrating extreme volatility.

An Institutional Custody Giant With a Unique Model

Founded in 2013 by Mike Belshe and Ben Davenport, two Silicon Valley veterans who previously worked at Google and Facebook respectively, BitGo has established itself as one of the pioneers of multi-signature security for Bitcoin. Mike Belshe, current CEO, is notably co-inventor of the SPDY protocol and principal author of HTTP/2.

Unlike exchange platforms dependent on trading volumes, BitGo has built its business model on institutional custody and staking services, representing over 80% of its revenues. This positioning aims to generate recurring and more stable cash flows.

As of September 30, 2025, the platform secured $104 billion in digital assets, a 96% year-over-year increase. The company supports more than 1,550 different assets and serves approximately 4,900 institutional clients across 100 countries.

Impressive Numbers But Concerning Margins

For the first nine months of 2025, BitGo recorded approximately $10 billion in total revenues, compared to $1.9 billion in the same period of 2024. The company projects annual revenue between $16.02 and $16.09 billion, a five-fold increase.

However, these figures mask a more nuanced economic reality. BitGo’s net margin remains extremely thin: less than 0.35% of total revenues. For every dollar of sales, the company generates only one cent of net profit. Net income for the first nine months of 2025 was only $35.3 million, down from $156.6 million for all of 2024.

A Federal Banking License as Strategic Asset

In December 2025, the Office of the Comptroller of the Currency (OCC) approved BitGo Trust Company’s conversion into a national bank under the name BitGo Bank & Trust, National Association. This approval places BitGo under unique federal supervision, eliminating the need to obtain state-by-state licenses.

This regulatory status allows the company to provide its digital asset custody and settlement services across the entire U.S. territory without duplicating regulatory obligations. Assets held in qualified custody benefit from insurance coverage of up to $250 million.

BitGo isn’t alone in reaching this milestone. Circle (USDC issuer) and Ripple also received similar approvals from the OCC in December 2025, signaling maturation of the crypto industry.

The Central Role of Wrapped Bitcoin (WBTC)

Beyond custody services, BitGo plays a central role in the DeFi ecosystem through Wrapped Bitcoin (WBTC), an ERC-20 token co-launched in January 2019. This token represents Bitcoin on the Ethereum blockchain, allowing BTC holders to access DeFi applications.

BitGo acts as exclusive custodian of WBTC, holding Bitcoins in a 1:1 ratio. WBTC’s market capitalization reached a peak close to $15 billion in October 2025, before retreating to about $11 billion in January 2026.

In early January 2026, BitGo expanded WBTC’s footprint by launching it on Base, Coinbase’s Ethereum Layer 2 solution, as part of an omnichain deployment strategy in partnership with LayerZero.

A Hostile Market Context for Crypto IPOs

The IPO timing proved particularly difficult. Bitcoin is going through a marked weakness phase, having fallen 29% from its October peak. At the time of the IPO, BTC was trading around $89,000, down 7% over a week. 2025 ended with an annual decline of 5.7% and a catastrophic fourth quarter showing a 23.7% drop.

Contrasting Performance of Recent Crypto IPOs

2025’s public offerings paint a contrasting picture that explains BitGo’s fall. Circle Internet Group stands as a notable exception. Listed in June 2025 at $31 per share, the stock opened at $69 and currently trades around $82, showing a 165% gain.

This performance is explained by a resilient business model: Circle generates revenue from interest on Treasury reserves backing USDC, a cash flow that persists regardless of Bitcoin fluctuations.

In contrast, exchange platforms suffered devastating losses. Gemini collapsed 70%, falling from $37 to about $11. Bullish lost 52%, dropping from $90 to $43. eToro plunged 49%, falling from $70 to about $36.

Reasons for the Brutal Fall

Several converging factors explain BitGo’s 22% collapse during its second session:

- Profit-taking after excessive rally: After climbing 36% on the first day, the stock naturally attracted quick profit-taking from short-term investors.

- Limited float and reduced liquidity: The low free float in the early days mechanically amplifies volatility. Modest sales volumes can trigger disproportionate price movements.

- Correlation with Bitcoin’s fall: Between IPO day and the second session, Bitcoin fell 12%, dropping from $95,000 to below $90,000, directly weighing on investor sentiment.

- Disappointment with ultra-thin margins: With net profit below 0.35% of revenue, BitGo has very little room to absorb rising costs or declining activity.

- Disappointing sector precedents: Recent crypto IPOs also raised their price above the initial range but now trade well below their IPO price.

Analyst Perspectives and Price Targets

Despite the chaotic start, some analysts maintain positive outlooks. Matthew Sigel of VanEck considers BitGo « a rare pure custody play with strong growth in weak crypto conditions. » VanEck establishes a fair value above $3 billion if Bitcoin returns above $120,000 in the next 12 months, corresponding to a price target near $26.50 per share – an 83% potential upside.

Lukas Muehlbauer of IPOX notes that « BitGo’s IPO is the first major indicator of market appetite for crypto listings in 2026. » He acknowledges that BitGo’s positioning as a regulated infrastructure company reduces exposure to daily Bitcoin movements.

An Ambitious But Risky 2026 Crypto IPO Pipeline

BitGo paves the way for several major players preparing their own IPOs. Kraken filed its S-1 form confidentially in November 2025 and aims for a first-half 2026 listing. The company raised $800 million at a $20 billion valuation.

Ledger, the French hardware wallet manufacturer, is also considering an NYSE IPO that could value the company at over $4 billion. Consensys, known for MetaMask and Infura, would be working with JPMorgan and Goldman Sachs for a mid-2026 IPO.

Other potential candidates include Grayscale, Chainalysis, FalconX, Bitpanda, Anchorage Digital, and Fireblocks. However, the context remains perilous. Saxo Bank analysts observe that « the IPO window has considerably narrowed. »

Strategic Support and Bitcoin Holdings

A notable element lies in the strategic investment announced by YZi Labs, the investment fund affiliated with Changpeng Zhao, former Binance CEO. Ella Zhang, head of YZi Labs, justified this investment by highlighting « BitGo’s impeccable security reputation. »

Additionally, BitGo holds 2,369 Bitcoins on its balance sheet. If BTC were to return to $120,000 – a scenario envisioned by several analysts for 2026 – this position would add about $72 million in market value, or $0.62 per share.

What to Take Away From This Chaotic Start?

BitGo’s collapse below its IPO price after just two days sends a clear signal: blind enthusiasm for crypto IPOs is a thing of the past. Public investors now demand solid fundamentals, comfortable margins, and resilient business models.

The contrast between Circle (+165%) and Gemini (-70%) reveals growing selectivity. The market rewards companies whose revenues are decoupled from daily speculation and punishes those dependent on trading volumes.

BitGo positions itself in an interesting middle ground. Its institutional custody model offers more stability than an exchange platform, but remains exposed to progressive digital asset adoption. Its federal banking license constitutes a major strategic differentiator.

BitGo’s future will depend on its ability to prove three elements: that the 96% growth in assets under custody is sustainable, that the company can expand its margins, and that its regulated bank status translates into accelerated institutional client acquisition.

For companies preparing their IPOs, the message is unequivocal: public markets no longer forgive fragile models. As one analyst noted, « the market will only support crypto companies that can survive a prolonged bear market – not those dependent on a perpetual bull market. »