The digital asset market is entering a period of unprecedented structural reconfiguration in Q1 2026. Bitcoin, following a correction of more than 45% from its all-time highs in late 2025, is navigating a zone of extreme tension where fear dominates — yet beneath the surface, reversal signals are quietly accumulating. This multi-timeframe analysis combines technical data, market microstructure, and macroeconomic variables to define the key levels to watch in the coming weeks.

Macroeconomic Context: The Fed, Inflation and the Labor Market

« Sticky » Inflation Blocking the Monetary Pivot

Bitcoin’s behavior in February 2026 cannot be divorced from the health of the US economy. Core CPI came in at 2.6% in December 2025 — its lowest since March 2021 — but remains above the Fed’s 2% target. This « sticky inflation » limits the central bank’s ability to ease monetary policy.

| Economic Indicator | Value (Dec. 2025) | Forecast (Jan. 2026) |

|---|---|---|

| CPI Headline (Annual) | 2.7% | 2.7% |

| Core CPI (Annual) | 2.6% | 2.5% |

| PCE Headline (Annual) | 2.8% (Nov.) | 2.41% (Est.) |

| Unemployment Rate | 4.4% | 4.4% |

The appointment of Kevin Warsh as the new Federal Reserve Chairman has hardened market expectations. Perceived as more « hawkish » than his predecessors, Warsh appears to prioritize absolute monetary stability. Markets have consequently pushed back expectations for significant easing to the second half of 2026, at best in June. For Bitcoin, this translates into a high opportunity cost relative to Treasury bonds, curbing capital rotation into the crypto sector.

A Slowing Labor Market

The year 2025 recorded the weakest job growth for a non-recession year since 2003. Non-Farm Payrolls forecasts for January 2026 stand around 68,000 — a modest figure signaling economic fatigue. This slowdown is fueling short-term recession fears, pushing institutional investors into a « risk-off » posture at the expense of risk assets like Bitcoin.

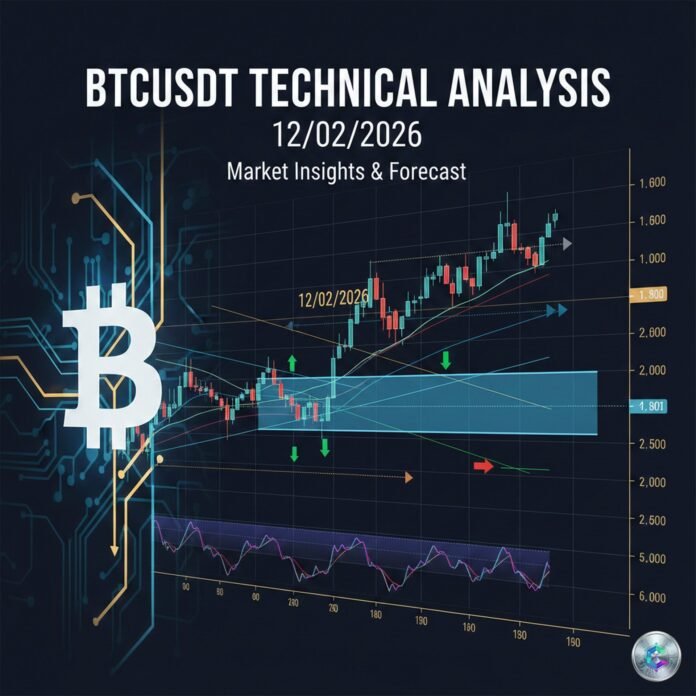

Multi-Timeframe Technical Analysis: BTC/USDT

Daily Structure (1D): Historic Oversold Conditions

On the daily timeframe, Bitcoin bears the scars of a massive correction. Price is trading well below both its 50-day Moving Average (MA50) and its 200-day Moving Average (MA200), technically confirming a bearish structure. This dual moving average pressure means any bounce will initially be interpreted as a mere technical rebound within an overarching downtrend.

Notably, the daily RSI reached an extreme level of 15 in early February — a degree of overselling not seen since the 2018 crash. The CryptoQuant Price Z-Score at -1.6 confirms Bitcoin is trading well below its statistical average price, a signal that historically precedes prolonged base-building phases before any reversal.

4-Hour Dynamics (4H): The Battle for the Pivot

The 4-hour chart illustrates the fierce battle around the weekly pivot. Every attempt to break through this threshold has been met with substantial institutional selling pressure. Key levels to monitor on this timeframe:

- Weekly Pivot: A critical zone coinciding with a massive liquidity pool. A sustained close above this level would shift the local structure from « bearish » to « neutral. »

- Local Resistance: The zone that acted as a technical ceiling during the February 10–11 rebound attempts.

- Intermediate Support: The level currently maintaining the structure above the danger zone.

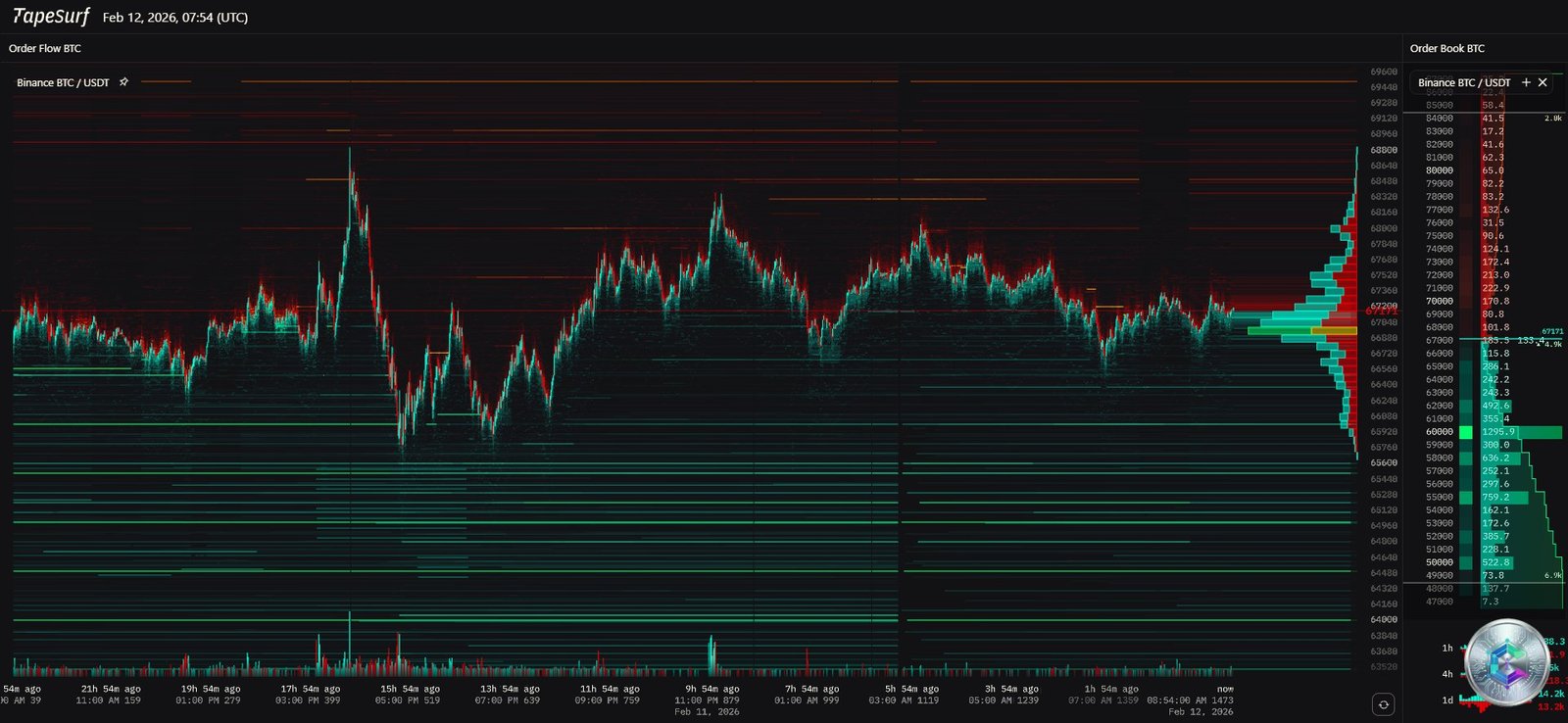

Intraday Microstructure (15M): The Algorithmic War

On the 15-minute chart, high-frequency algorithmic trading strategies dominate price action. The Taker Buy/Sell ratio on Binance has remained below 1 over the past 24 hours, confirming that aggressive sellers are using bounces to exit positions or open new short trades. Volatility remains elevated, with every micro-news item on inflation or regulation triggering rapid price dislocations due to an order book thinned by 25–30% compared to 2025 levels.

Market Microstructure: Liquidation Heatmap

The liquidation mapping reveals a glaring asymmetry in order distribution. The heatmap (TapeSurf / Coinglass) identifies a colossal « short wall » estimated at $5.45 billion extending above current levels, against only $2.4 billion in long positions below the critical support.

| Price Zone | Liquidation Type | Estimated Volume |

|---|---|---|

| Pivot to upper resistance zone | Shorts (sell positions) | $5.45 billion |

| Critical support | Longs (buy positions) | $2.4 billion |

Historically, Bitcoin tends to move toward the densest liquidity zones to « clean up » the market. This imbalance suggests a short squeeze (forced liquidation of sellers) is statistically more likely than an immediate drop — provided the critical support holds. However, these bounces are often bull traps, fueled by forced position closures rather than new sustainable spot buying.

Over the past 24 hours, total liquidations reached $533.88 million, with $401.12 million on the long side — evidence of a massive purge of over-leveraged buyers. However, hourly data shows a resurgence in short liquidations ($5.85M vs $1.39M in longs), which could be a precursor signal for a short-term technical bounce.

Institutional Flows: ETFs and Miner Capitulation

Massive Outflows but Early Signs of Return

January 2026 was catastrophic for US Bitcoin Spot ETFs, with net outflows exceeding $3 billion. Institutional investors appear to be liquidating their crypto positions to reallocate toward better-performing sectors in 2026, such as infrastructure energy or prediction markets.

A notable resilience nevertheless emerged on February 10, 2026, with a net inflow of $167 million across all Bitcoin ETFs:

- Ark Invest / 21Shares (ARKB): $68.53 million in inflows in a single day.

- Fidelity (FBTC): $56.92 million in inflows, pushing its all-time total past $11 billion.

- BlackRock (IBIT): Confidence base maintained by rumors of a 1% allocation from Asian sovereign wealth funds.

Production Cost: A Fundamental Floor?

According to JP Morgan, the average cost to produce one Bitcoin (electricity + hardware renewal) has fallen to approximately $62,000 in early 2026. With the market price below this threshold, miners are currently operating at a loss. This situation is unsustainable: it leads to miner capitulation, reducing the supply of new BTC hitting the market. Historically, price eventually converges toward the production cost or triggers a rally through supply scarcity — one of the most powerful asymmetric opportunity signals in Bitcoin’s history.

Regulatory Pressure: DOJ and SEC in Ambush

On February 12, 2026, the Department of Justice (DOJ) imposed a $4 million fine on Paxful for serious anti-money laundering failings. While the amount is relatively small, the timing reinforces the perception of a coordinated regulatory crackdown aimed at cleaning up the industry before any new growth phase.

Meanwhile, the SEC continues to push for a strict classification of exchanges as securities brokers, fueling concerns about altcoin and Bitcoin liquidity on US territory. The lack of legislative clarity in Congress — despite 2025 promises — weighs heavily on institutional investor sentiment.

Innovation: The Rise of Agentic Wallets

A ray of technological hope comes from Coinbase, which launched its « Agentic Wallets » today — a protocol enabling AI agents to hold funds, execute trades, and generate yield autonomously for the first time. This innovation could radically increase on-chain transaction volume and create new utility for Bitcoin and stablecoins, independent of human investor sentiment.

Synthesis: Key Levels and Strategic Scenarios

Key Levels to Watch

| Level Type | Price Zone | Technical Significance |

|---|---|---|

| Major Resistance | MA200 | Return to bull market. Long-term target. |

| Pivot Resistance | MA50 | First technical target in case of recovery. |

| Immediate Resistance | $5.45B shorts zone | Psychological tipping point. Potential short squeeze. |

| Short-Term Pivot | Intraday resistance | Tested repeatedly on Feb. 10–11. |

| Base Support | Intermediate level | Maintaining current structure. |

| Critical Support | ~$60,000 | Annual psychological support. Break = panic. |

| Capitulation Support | $42K – $57K | Fibonacci 0.618 — Potential bear market bottom. |

Three Scenarios Going Forward

🟢 Scenario 1 — Short Squeeze (Probability: 40%)

If Bitcoin holds above intermediate support and Coinbase’s earnings tonight beat expectations, a violent acceleration toward the upper resistance zone could be triggered to liquidate the $5.45 billion in short positions identified on the heatmap. This move would nevertheless be considered a bull trap without confirmed ETF buy volume returning.

🟡 Scenario 2 — Sideways Consolidation (Probability: 45%)

Price oscillates between critical support and the pivot resistance for several months, waiting for global liquidity to improve and for US inflation to show clearer signs of retreat heading into summer 2026. This is the most probable short-term scenario.

🔴 Scenario 3 — Final Capitulation (Probability: 15%)

A brutal break of the critical support, triggered by a major macro-economic shock (confirmed recession or regulatory bombshell), would push Bitcoin toward the $42K–$57K zone, completing the 365-day bear market cycle observed historically.

Conclusion: Patience as the Primary Strategy

Bitcoin on February 12, 2026, is an asset in the midst of an identity crisis — torn between its role as a « digital store of value » and its current function as a « tech liquidity proxy. » The technical analysis shows a deeply oversold market, suggesting that much of the bad news is already priced in. However, the absence of an immediate bullish catalyst — beyond the Agentic Wallets innovation or a hypothetical Fed pivot — suggests that patience will be the primary virtue for investors in 2026.

The fact that Bitcoin is trading below its production cost remains the most powerful signal of an asymmetric opportunity for those capable of withstanding short-term volatility. A cautious approach, favoring spot accumulation at critical support levels rather than high-leverage trading, appears best suited to this « extreme fear » environment.

⚠️ Disclaimer: This article is published for educational and informational purposes only. It does not constitute investment advice, nor a recommendation to buy or sell any financial or crypto asset. Cryptocurrency markets are highly volatile and carry significant risk of capital loss. Please consult a professional financial advisor before making any investment decisions. Cryptoinfo.ch disclaims all liability for decisions made based on the information contained in this article.