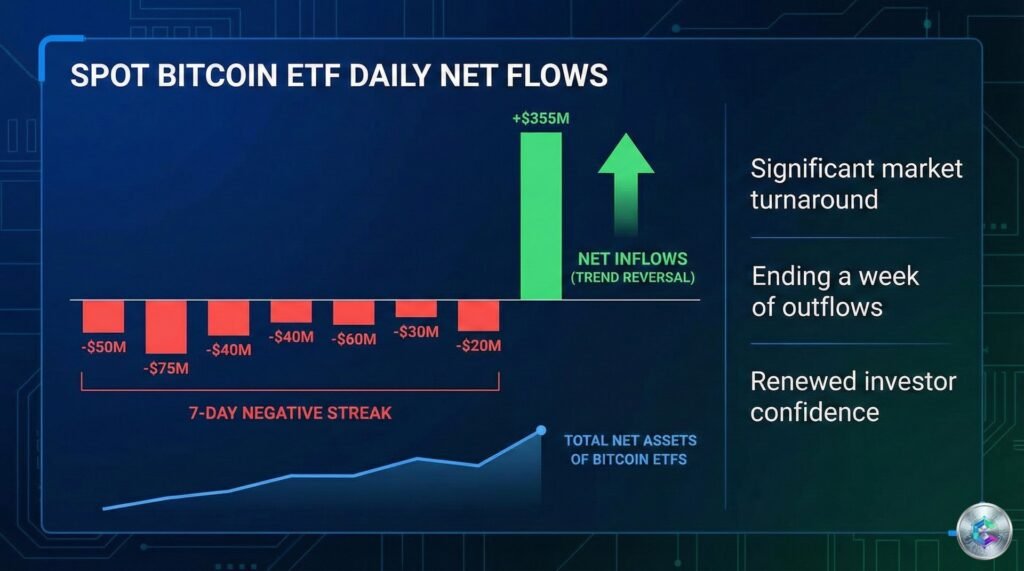

In a dramatic reversal that caught markets by surprise, U.S. spot Bitcoin ETFs recorded $355 million in net inflows on December 30, 2024, ending a seven-day consecutive outflow streak. This sharp turnaround marks a potential shift in institutional sentiment toward Bitcoin, following a year-end marked by significant profit-taking.

Massive Inflows Led by BlackRock

According to data from SoSoValue, BlackRock’s IBIT ETF dominated with $144 million in inflows, once again confirming its status as the flagship vehicle for institutional Bitcoin exposure. Ark Invest and 21Shares’ ARKB ETF followed with approximately $110 million, demonstrating that demand extends across the entire spot Bitcoin ETF segment.

These flows represent long-term institutional capital, distinctly different from the speculative movements observed in derivatives markets. Each dollar invested in these ETFs translates into the acquisition of physically-backed BTC, mechanically reducing the circulating supply on exchange platforms.

After the Storm: From $782 Million Outflows to Lightning Reversal

The week of December 22-26 had been particularly challenging for Bitcoin ETFs, with $782 million in net outflows. This phenomenon, largely attributed to « window dressing » and year-end portfolio rebalancing, had fueled fears of waning institutional demand.

On certain December sessions, outflows exceeded $400 to $500 million, temporarily bringing BTC ETF assets under management close to their early-year levels. Analysts were then discussing a « normal correction » after the euphoria of the initial launch months.

$114 Billion in Assets Under Management

The entire universe of U.S. spot Bitcoin ETFs now represents just over $114 billion in assets under management, approximately 6.5% of Bitcoin’s total market capitalization. Since their launch in January 2024, these products have attracted roughly $57 billion in cumulative net flows, according to Farside Investors data.

BlackRock alone has accumulated over $62 billion in cumulative inflows since launching its IBIT, making it the world’s largest Bitcoin ETF and one of the most successful ETF launches in history.

Implications for Bitcoin Price

This massive capital return comes in a particular context. Several analysts note that this inflow session coincides with a marked rebound in crypto prices at year-end, suggesting institutional investors potentially perceive the end of December’s corrective phase.

Historically, periods when daily inflows exceed several hundred million dollars have often coincided with Bitcoin price expansion phases. The reduction in available supply on the spot market, combined with sustained institutional demand, creates favorable dynamics for BTC.

Outlook for 2025

The question now is whether this rebound marks the beginning of a new phase of institutional accumulation or is merely a temporary adjustment before new outflows.

The coming weeks will be crucial in determining the trend. If flows remain positive in January 2025, Bitcoin ETFs could once again become a central driver of upward momentum, as they were during the first half of 2024.

Conversely, a rapid return to negative territory could suggest this rebound was merely a « rebalancing blip » before new waves of profit-taking.

The Key Role of the BlackRock Effect

The continued involvement of BlackRock and other asset management giants acts as a seal of trust for traditional investors. For many institutional investors still hesitant, the presence of these major players facilitates the decision to enter or strengthen their Bitcoin exposure through regulated products.

As Coinfomania highlights, « BlackRock and ETFs trigger a fresh wave of Bitcoin accumulation, » illustrating the decisive influence of these players in market dynamics.

Conclusion

The $355 million influx in a single session reminds us that Bitcoin ETFs remain an essential barometer of institutional sentiment. A single day of flows can suffice to radically change the perception of a market previously judged to be deflating.

For investors and crypto market observers, this signal sends a clear message: despite year-end turbulence, institutional appetite for Bitcoin remains structurally solid, and spot ETFs continue to play a central role in the adoption of digital assets by traditional capital.

Sources: The Block, Farside Investors, SoSoValue, Coinfomania