The crypto sphere has just experienced a chaotic weekend with Bitcoin plummeting below $92,000 on January 19, 2026, erasing the previous week’s hard-earned gains. This sudden correction follows an unprecedented escalation in the trade war between the United States and the European Union, triggered by explosive tariff threats from President Donald Trump linked to his ambition to acquire Greenland.

Trump Strikes Hard: 10% Tariffs on Eight European Countries

On January 18, 2026, Donald Trump announced the imposition of additional 10% tariffs on imports from eight European countries: Denmark, Norway, Sweden, France, Germany, the United Kingdom, the Netherlands, and Finland. These measures will take effect on February 1, 2026, with an explicit threat to raise them to 25% by June 1 if no agreement is reached regarding the acquisition of Greenland.

The originality and severity of this announcement lie in its stated objective. Unlike previous Trumpian trade wars targeting China or commercial rebalancing, Trump explicitly links these economic sanctions to a territorial claim concerning Greenland, an autonomous Danish territory. In a message published on Truth Social, the US president accused these allied countries of playing « a very dangerous game » by sending military forces to Greenland.

Liquidation Cascade: $1 Billion Evaporated in Hours

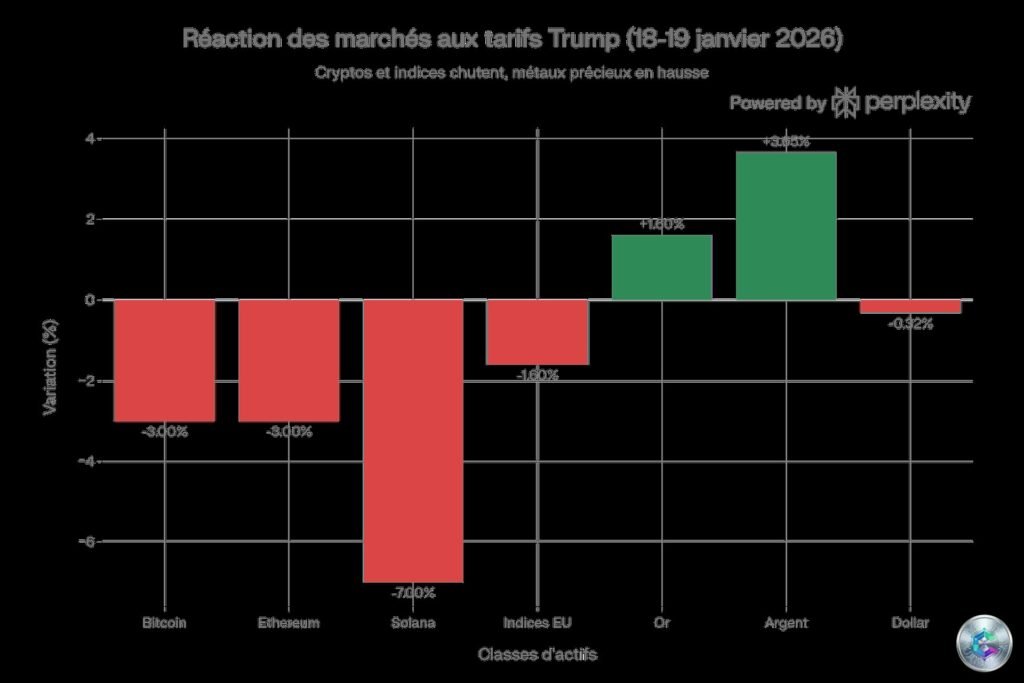

The crypto market’s reaction was immediate and brutal. At the start of Monday morning’s Asian session, Bitcoin suffered a sharp drop from nearly $95,000 to a floor of $91,000 before stabilizing around $92,500-$92,600. This 2.5% to 3% decline in 24 hours may seem modest, but it triggered a cascade of devastating liquidations.

According to data from Coinglass and other analytics platforms, between $770 million and $1 billion in positions were liquidated within a few hours. The Blockhead platform reports that $525 million was wiped out in just 60 minutes during the peak volatility. Approximately 90% of these liquidations concerned long positions, demonstrating that the market was massively positioned for a continuation of the bullish trend.

The largest individual liquidation occurred on Hyperliquid, with a Bitcoin position worth over $25 million automatically closed. In total, more than 1.4 million traders were reportedly affected by these forced liquidations.

Altcoins Deep in the Red

Altcoins were not spared from this panic movement. Ethereum shed 2.96% to settle around $3,200. Solana suffered an even more severe correction of 7%, while BNB, XRP, Cardano, and other major cryptocurrencies all lost more than 7% in 24 hours.

The total crypto market capitalization melted by 3% in 24 hours, falling below the $3.13 trillion mark. Since the previous Thursday, the market has lost over $110 billion in valuation.

A Market Fueled by Leverage Rather Than Real Demand

The post-mortem analysis of this crash reveals a worrying structural fragility. Bitcoin’s lightning-fast surge toward the $96,000-$97,000 zone the previous week was not driven by solid spot demand but mainly by mechanical flows in derivatives products.

On-chain data shows that the recent rally was essentially fueled by short liquidations and increasingly concentrated leverage among speculative traders. This excessive dependence on leverage explains why Bitcoin reacted so violently to a relatively modest price decline.

Riya Sehgal, analyst at Delta Exchange, emphasized that « the decline followed the escalation of tensions between the US and EU after new tariff threats that revived fears of a trade conflict, adding to an already cautious environment marked by delays in the US crypto market structure bill. »

Gold and Silver Soar: The Real Safe Haven

While Bitcoin and cryptocurrencies plunged, traditional safe-haven assets experienced a spectacular surge, highlighting the contrast between Bitcoin’s perception as « digital gold » and its actual market behavior.

Gold reached a new all-time high at $4,689 per ounce on Monday, January 19, up 1.6% for the day. The yellow metal gained $74 to settle at $4,668 per ounce. Since the beginning of the month, gold has risen by more than 5% and shows a dizzying 72% increase over one year.

Silver delivered an even more impressive performance, jumping 3.65% to $93.22 per ounce, also establishing a new absolute record. Over one year, silver has exploded by more than 204%.

Europe Fights Back: $108 Billion in Countermeasures

The European Union does not intend to be intimidated. As early as Sunday evening, EU member state ambassadors agreed on an ambitious retaliation plan. An emergency summit of European leaders is scheduled for Thursday, January 22, in Brussels to discuss retaliatory measures.

According to reports from the Financial Times and Reuters, the EU is considering reactivating a retaliatory tariff package worth €93 billion ($107.7 billion) on US imports. This countermeasures package could automatically enter into force as early as February 6 if negotiations fail.

Beyond simple reciprocal tariffs, the EU is also studying the deployment of its « Anti-Coercion Instrument » (ACI), a powerful legal tool that could limit US companies’ access to the European market.

The Trump Paradox: « Pro-Crypto » President but Destabilizing Policy

The irony of the situation is not lost on anyone in the crypto ecosystem. Donald Trump positioned himself as the « crypto president, » having promised during his campaign to make the United States the « world capital of Bitcoin. » However, his protectionist and unpredictable economic policy creates exactly the type of instability that drives capital away from risky assets like cryptocurrencies.

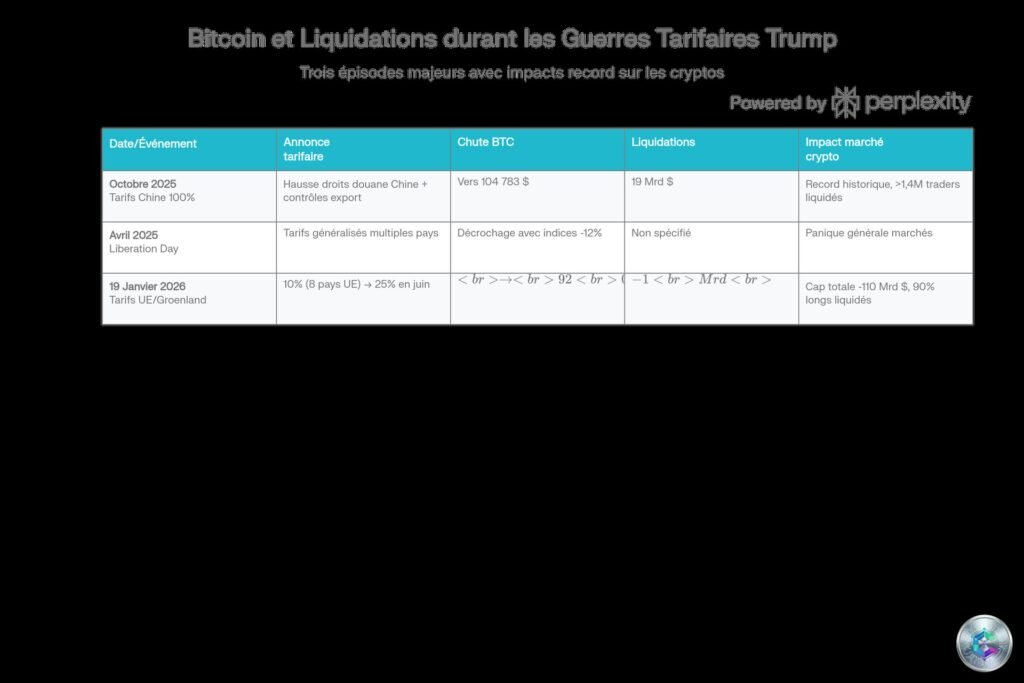

In April 2025, during the famous « Liberation Day, » Bitcoin also fell following Trump’s tariff announcements. Even more traumatic, on October 10, 2025, when Trump threatened to impose 100% tariffs on Chinese imports, the crypto market experienced its worst liquidation episode: over $19 billion in positions wiped out in 24 hours.

Technical Analysis: Bitcoin Stuck in a Tight Range

From a technical perspective, Bitcoin remains locked in a consolidation phase. Since December 3, 2025, Bitcoin has been rejected six times on the same resistance zone located around $94,000-$95,000.

The current range oscillates between a major low zone of $80,000-$82,000 and a high zone of $94,000-$95,000. The $87,000-$90,000 zone constitutes the current immediate support. On the upside, sustainably breaking through $94,000 with volume and conviction would open the space toward $100,000-$102,000.

Outlook: Between Consolidation and Bullish Potential

Despite the current turbulence, analysts generally maintain bullish prospects for Bitcoin on the 2026 horizon. Consensus forecasts place Bitcoin’s price between $120,000 and $200,000 by year-end, with a median around $150,000-$200,000.

These projections rest on several catalysts: continued institutional adoption via ETFs, progressive clarification of the US regulatory framework, and the post-halving effect that typically plays out over a 12-18 month cycle.

Vikram Subburaj, CEO of Giottus, advises investors: « Avoid overexposing your positions with leverage, favor liquid majors like BTC and ETH, and scale your entries rather than chasing short-term movements. »

Conclusion: A Market at a Crossroads

Bitcoin’s plunge below $92,000 constitutes a brutal reminder: despite growing institutionalization, cryptocurrencies remain inherently risky assets, strongly correlated with stock markets and vulnerable to geopolitical shocks.

The $770 million to $1 billion in liquidations reveal a worrying structural fragility, fueled by excessive dependence on leverage. The simultaneous surge of gold and silver to new all-time highs reminds us that during real crises, investors turn to millennial safe-haven values.

For crypto investors, the lesson is clear: in an environment where Trump can trigger a trade crisis for unpredictable geopolitical reasons, risk management and discipline become paramount. The Trump-EU tariff war is probably just beginning, with a crucial European summit on January 22 that will determine the scale of the response.