DeFi giant Aave is going through the most serious existential crisis in its history. In less than three weeks, the conflict between Aave Labs and its DAO has caused the AAVE token to plummet 18%, wiping out more than $500 million in market capitalization. This battle is not about a technical flaw or cyber attack, but raises a fundamental question: who really owns a decentralized protocol?

Anatomy of an Open War

Aave, flagship protocol of decentralized finance with over $34 billion in total value locked (TVL), has been plunged into an unprecedented governance crisis since early December 2025. At the heart of the conflict: a major ideological fracture between Aave Labs, the development entity founded by Stani Kulechov, and the DAO supposed to represent token holders.

The stakes go far beyond revenue allocation. They call into question the very foundations of the DAO model: who holds the real ownership of a DeFi protocol? The code deployed on the blockchain? The interface used by 90% of users? Or the brand, which concentrates economic value and symbolic power?

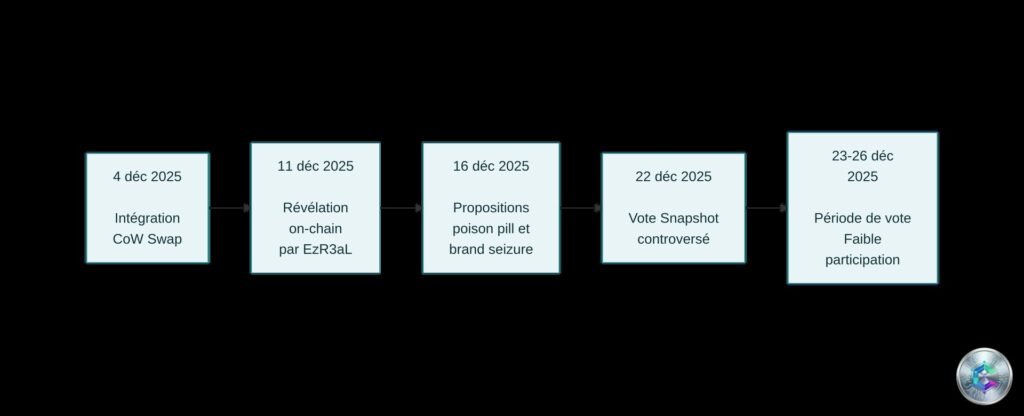

Timeline of an Announced Disaster

December 4, 2025: Aave Labs announces the integration of CoW Swap on the Aave interface, promising improved exchange prices and protection against miner extractable value (MEV). A seemingly innocuous technical announcement that will trigger a storm.

December 11: Pseudonymous delegate EzR3aL publishes an explosive on-chain analysis revealing that fees generated by this integration do not join the DAO treasury, but a private wallet controlled by Aave Labs. Estimated loss: $10 million annually for the DAO.

December 16: Ernesto Boado, former CTO of Aave Labs, publishes two radical proposals. The first, nicknamed « poison pill », demands the seizure of all Aave intellectual property and the transformation of Aave Labs into a subsidiary owned by the DAO. The second, called « brand seizure », calls for the immediate transfer of trademarks, domain names, social networks and GitHub repositories.

December 22: Aave Labs triggers a Snapshot vote taking up these proposals, in the name of Ernesto Boado. The latter immediately denounces a « forcing through », claiming he never validated this vote. The timing during the Christmas period is seen as an attempt to minimize participation.

The Opposing Camps

Aave Labs: Defending the Hybrid Model

Stani Kulechov vigorously defends the position that Aave Labs owns the brand and infrastructure, while the protocol belongs to the DAO. According to him, revenues previously returned to the DAO were « voluntary contributions » and not an acquired right.

Kulechov emphasizes that fees generated by the former ParaSwap provider (approximately $1.1 million in 2025) had been paid to the DAO solely because of regulatory uncertainties. Aave Labs also spent $12.6 million to buy back 84,033 AAVE tokens at an average price of $176, consolidating its voting power.

The DAO: Accusing Stealth Privatization

Marc Zeller, central figure in governance and founder of the Aave Chan Initiative, calls the situation « stealth privatization ». For him, the DAO has lost up to $10 million in annual revenue without a vote or formal validation.

Delegate EzR3aL demonstrated that the CoW Swap integration generates at least ten million dollars annually, a multiple of previous revenues. For DAO defenders, if it finances development and marketing, it must own the corresponding intangible assets.

Devastating Market Impact

The crisis caused a brutal collapse of the AAVE token, dropping from nearly $200 to less than $160 in a few days. On December 22, a large holder sold 230,000 AAVE tokens (about $35 million), triggering an intraday drop of nearly 10%.

Trading volumes exploded to $834 million, representing more than a third of the circulating market cap. Polymarket bets indicate a vote validation probability around 25%, down 26 percentage points since the beginning of the week.

Paradoxically, despite the turmoil, the protocol’s TVL has increased by $1.42 billion since December 18, reaching over $34 billion and consolidating Aave’s dominance of 60% of the DeFi lending market.

A Turning Point for All DeFi

This crisis goes far beyond Aave and raises a question that all DeFi has avoided for years: who really owns a decentralized protocol? The hybrid model, where a centralized entity develops and maintains the interface while a DAO governs smart contracts, reveals its limits when interests diverge.

As Louis, a venture capital partner involved in governance, warned: « The biggest risk for any DAO is an independent competing equity vehicle. » This crisis is testing in real conditions the limits of the DAO model against centralized entities essential to its operation.

Three Possible Scenarios

Scenario 1 – Proposal Failure: Aave Labs retains control of the brand and revenue streams. AAVE could rebound 10-15% in the short term, but community trust would be permanently damaged.

Scenario 2 – Proposal Adoption: Aave Labs becomes a subsidiary of the DAO, all its Aave-related revenues are redirected to the treasury. Implementation would involve complex legal processes over several months.

Scenario 3 – Extended Stalemate: AAVE risks becoming the 2025 warning about what happens when founders and DAOs go to war. Billions in value can disappear overnight.

Conclusion: A Historic Precedent

Whatever the outcome of the vote, one thing is certain: DeFi can no longer ignore the question of real protocol ownership. Aave is testing in real time the limits of the DAO model against essential centralized entities.

The precedent that emerges from this crisis will be historic in decentralized finance. For investors and users, it underscores the importance of understanding not only the underlying technology, but also governance structures and incentives of different stakeholders.

In an ecosystem where trust is based on code and transparency, the breaking of that trust can have dramatic and lasting financial consequences.