January 19, 2026 marks a major turning point in the precious metals markets. Gold smashes through the symbolic $4,660 per ounce barrier, establishing a new all-time high since the beginning of the year. This spectacular performance contrasts sharply with Bitcoin, which is struggling to regain its December 2024 highs and oscillating in a consolidation zone between $90,000 and $95,000.

Gold’s Meteoric Rise in 2026

The year 2026 has started at full throttle for the yellow metal. In just 13 days, gold has set three consecutive all-time highs: $4,597 on January 12, $4,627 on January 13, and $4,663 on January 19. This 6% progression since January 1st is part of an upward trend that began in mid-2025 and shows no signs of slowing down.

Gold has progressed from $2,630 to $4,663 between January 2025 and January 2026, representing a 77% increase over 13 months.

For European investors, the performance remains impressive despite the euro’s appreciation against the dollar. Gold now trades around €4,018 per ounce, extending a dynamic that saw the precious metal gain 45% in euros during 2025.

2025: A Historic Year for Precious Metals

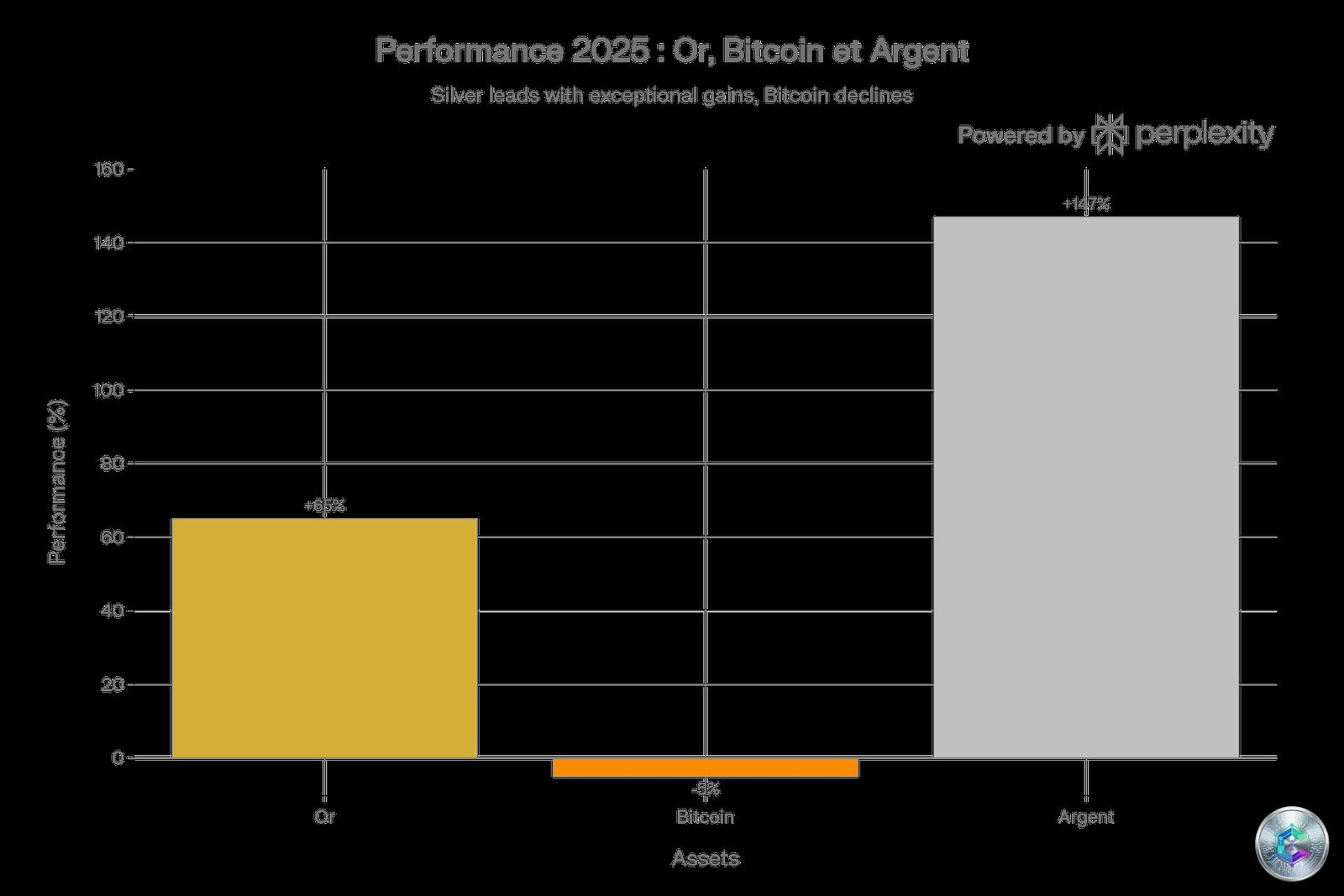

The year 2025 will be remembered as one of the best for gold since 1979. With a 65% increase in dollars, the yellow metal outperformed virtually all traditional asset classes.

Even more surprising, silver literally exploded with a 147% increase over the year, reaching all-time highs beyond $85 per ounce in January 2026. Platinum also experienced a spectacular awakening with a 127% progression. These exceptional performances confirm that the entire precious metals sector is undergoing a structural revaluation phase.

Fundamental Drivers of the Rally

Central Banks: Unprecedented Structural Support

The main catalyst for gold’s rise lies in the insatiable appetite of global central banks for the yellow metal. According to a World Gold Council survey, 95% of central banks surveyed believe global gold reserves will continue to grow over the next 12 months. Even more significant, 43% of them plan to increase their own reserves — a historical record that demonstrates a paradigm shift in foreign exchange reserve management.

China remains at the forefront of this movement with 14 consecutive months of gold purchases through December 2025, bringing its reserves to 74.15 million troy ounces. Poland, India, Kazakhstan, and Turkey are also among the most active buyers.

This institutional demand is not motivated by simple portfolio diversification. It reflects a deliberate strategy of de-dollarization and protection against growing geopolitical risks.

A Geopolitical Context Favorable to Safe-Haven Assets

The geopolitical environment of early 2026 provides fertile ground for gold demand. Trade tensions initiated by the Trump administration have intensified with the announcement of 10% tariffs on eight European nations from February 1st, in retaliation for their refusal to facilitate the acquisition of Greenland by the United States.

Investors are also concerned about the Federal Reserve’s independence after its chairman Jerome Powell revealed he was threatened with criminal prosecution by the Trump administration. This politicization of the American central bank erodes confidence in the dollar and fuels demand for traditional safe-haven assets like gold.

Accommodative Monetary Policy and Dollar Weakness

Expectations of interest rate cuts by the Federal Reserve constitute a crucial technical factor supporting the gold price. The CME FedWatch Tool indicates a high probability of additional rate cuts of 50 to 75 basis points during 2026, with a terminal rate expected around 3.50-3.75%.

The US dollar has been under significant downward pressure since the beginning of the year, losing more than 10% against a basket of currencies since January 2026. This depreciation mechanically favors gold appreciation, as its price is denominated in dollars.

Bitcoin: A Puzzling Consolidation

A Disappointing Performance in 2025

While gold shone brightly in 2025, Bitcoin had a significantly more difficult year. The main cryptocurrency ended 2025 down 5 to 6%, after reaching an all-time high around $126,000 in December 2024.

Benjamin Cowen, a reputable crypto analyst, believes Bitcoin likely completed its post-halving cycle in the fourth quarter of 2025, unlike the euphoric peaks of 2017 and 2021. He describes the current situation as a « post-cycle digestion phase » rather than the beginning of a new bullish rally.

Consolidation Between $90,000 and $95,000

In early January 2026, Bitcoin is trading in a narrow range between $90,000 and $95,000, struggling to break through the key technical resistance level around $93,940. This consolidation reflects a market in transition, searching for direction after the brutal late-2025 correction that saw over $1.2 trillion in crypto market capitalization evaporate in six weeks.

Technical levels to watch in case of a bearish resumption include support zones at $85,000, $75,000, and potentially $58,000.

Volatile but Encouraging ETF Flows

Flows in spot Bitcoin ETFs show contradictory signals. While the week of January 13 recorded record net inflows of $1.42 billion — the highest weekly total since October 2025 — December 2025 saw net outflows of 13,211 BTC.

BlackRock’s IBIT ETF dominated inflows with $1.03 billion during this period. This volatility in institutional flows demonstrates investor hesitation in the face of macroeconomic uncertainties.

Gold vs Bitcoin: A Multidimensional Comparison

Inflation Protection: Advantage Gold

Gold has a millennial history as a store of value and has demonstrated its ability to preserve purchasing power over the very long term. Bitcoin, on the other hand, presents a more ambiguous profile. Several studies have shown that Bitcoin’s price increases after positive inflation shocks, but unlike gold, it does not behave as a safe-haven asset during periods of financial stress.

Volatility and Risk-Return Profile

Volatility constitutes the main point of divergence between these two assets. Gold displays moderate volatility, typical of a mature asset class. Bitcoin remains characterized by extreme volatility, with 20% monthly movements considered normal.

Over a 10-year horizon (2016-2025), a programmed investment of $50 per month in Bitcoin would have generated approximately $37,000, compared to $15,000 for the same investment in gold. This superior Bitcoin performance, however, comes with considerably higher emotional stress.

2026 Outlook: Heading for $5,000 Gold

The consensus of major financial institutions for gold prices in 2026 ranges from $4,500 to $5,000 per ounce. Wells Fargo forecasts a range of $4,500 to $4,700, while UBS is more optimistic with a target of $4,700 as early as the first quarter of 2026.

JP Morgan adopts the most bullish view with a target of $5,055 for the fourth quarter of 2026, followed by a progression toward $5,400 at the end of 2027.

Bitcoin: The $100,000 Threshold in Sight

For Bitcoin, the consensus ranges from $100,000 to $150,000 by the end of 2026. Standard Chartered and Motley Fool converge toward $150,000, while 21Shares’ base scenario targets $130,000.

Sustainably crossing the $100,000 threshold constitutes Bitcoin’s major psychological test in 2026. Potential catalysts include the effective creation of a Bitcoin Strategic Reserve in the United States and accelerating flows toward ETFs.

Allocation Strategies: Complementarity Rather Than Exclusivity

The optimal approach for investors is not to choose between gold and Bitcoin, but to understand their complementarity within a diversified portfolio. A typical allocation for a balanced investor might include:

- 8 to 12% gold for stability and protection against systemic risks

- 2 to 5% Bitcoin for growth potential and exposure to technological innovation

For conservative investors prioritizing capital preservation, allocation should lean heavily toward gold (10-15%) with minimal Bitcoin exposure (0-2%). More aggressive profiles can consider a more balanced allocation (8% gold, 5-8% Bitcoin).

Conclusion

The year 2026 perfectly illustrates the dichotomy between gold and Bitcoin as investment assets. Gold, strong in its millennial safe-haven status, benefits from an ideal environment combining central bank support, geopolitical tensions, accommodative monetary policy, and dollar weakness.

Bitcoin, despite a frustrating consolidation for its supporters, retains significant valuation potential linked to its growing adoption and programmed scarcity. The question is therefore not which of these assets is « better, » but understanding their complementary roles.

In early 2026, both assets appear destined for positive performances, each driven by distinct but converging catalysts: growing distrust of fiat currencies, geopolitical fragmentation, and the quest for scarce assets in the face of continuing monetary expansion.

⚠️ Disclaimer: This article is published for educational and informational purposes only. It does not constitute financial investment advice in any way. Cryptocurrency and precious metals markets are volatile and carry significant risks. Always consult a qualified financial advisor before making investment decisions.