In a striking demonstration of its institutional accumulation strategy, Tether has reached a historic milestone by becoming the fifth-largest Bitcoin holder worldwide. The USDT stablecoin issuer acquired an additional 8,888.88 BTC in the fourth quarter of 2025, bringing its total reserves to 96,185 bitcoins, valued at approximately $8.42 billion. This systematic accumulation redefines reserve management standards for stablecoins and positions Tether as a major institutional player in the crypto ecosystem.

An Unprecedented Methodical Accumulation Strategy

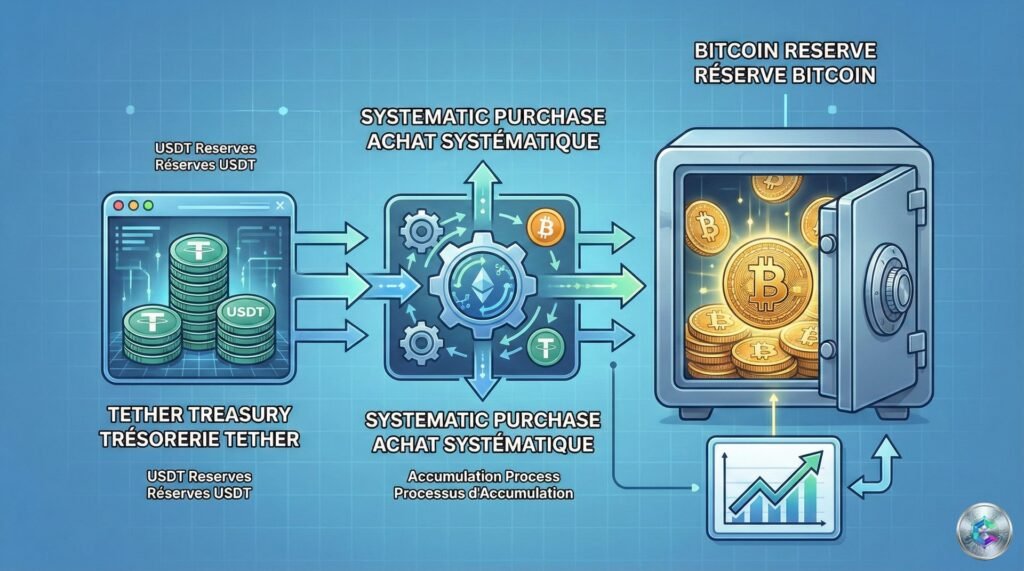

Announced on December 31, 2025, by CEO Paolo Ardoino, this acquisition is part of a rigorous institutional framework established in May 2023. Tether has committed to systematically allocating up to 15% of its quarterly operating profits to Bitcoin purchases. This approach creates constant buying pressure, completely independent of market cycles and price volatility.

The precise amount of 8,888.88 BTC is not coincidental. This number sequence, repeated three times in 2025, illustrates a quasi-systematic discipline that contrasts radically with market unpredictability. In the first quarter of 2025, Tether had already acquired 8,888 BTC for an estimated value of $735 million, at an average price of approximately $82,700 per bitcoin. The Q4 2025 purchase, executed at an average price of $87,800, represents an investment of approximately $780 million.

A Unique Funding Model in the Industry

Tether’s accumulation capacity is based on a particularly robust revenue structure. The company’s profits come primarily from liquid assets backing USDT, with over 50% consisting of short-term U.S. Treasury bonds and repo operations. With $97.6 billion invested in these instruments, elevated interest rates generate substantial revenues that mechanically fuel Bitcoin purchases.

This dynamic paradoxically transforms the U.S. Federal Reserve’s restrictive monetary policy into an indirect catalyst for Tether’s Bitcoin exposure. The higher rates remain, the more revenue Treasury bonds generate, and the more capital Tether has available to acquire BTC. A model where stablecoin profitability directly feeds the accumulation of the ultimate digital asset.

Top 5 Worldwide: A Major Strategic Position

With its 96,185 BTC, Tether now occupies the fifth worldwide position among Bitcoin holders, according to data from Arkham Intelligence and on-chain analyst Ember. This position places it just behind major centralized exchanges like Binance, Robinhood, and Bitfinex, but ahead of most public companies.

The ranking of major institutional holders reveals the scale of this accumulation. Strategy (formerly MicroStrategy) dominates largely with 672,000 BTC valued at $59.5 billion. Tether ranks second among public and private companies, ahead of MARA Holdings, Twenty One Capital (43,514 BTC, a company in which Tether holds a majority stake), and Metaplanet (35,102 BTC).

A Fundamental Strategic Differentiation

Tether’s approach differs radically from other institutional players. While companies like Strategy or Metaplanet issue shares or take on debt to finance their Bitcoin purchases, Tether exclusively uses its surplus profits. This strategy avoids any shareholder dilution and in no way compromises USDT’s stability.

This distinction is crucial: the core of USDT’s backing remains composed of very low-risk financial instruments, while Bitcoin constitutes a secondary strategic reserve that does not weaken the liquidity of primary reserves. CFO Simon McWilliams actively oversees the certification process by a Big Four firm, addressing persistent criticism about transparency.

Counter-Cyclical Accumulation During Uncertain Times

The fourth quarter of 2025 was characterized by reduced liquidity and uneven risk appetite in crypto markets. Bitcoin oscillated around $89,000 in early January 2026, down 22% from its previous peaks, struggling to establish a clear direction. In this context, Tether’s silent but methodical accumulation acts as an institutional counterpoint.

On-chain analyst Ember identified two major transactions illustrating this strategy: a withdrawal of 961 BTC from Bitfinex on November 7, 2025, for $97.18 million, followed by a massive transfer of 8,888.8 BTC to the reserve address on January 1, 2026, representing $778 million. This systematic approach, completely independent of short-term fluctuations, underscores a strong conviction: for systemic actors, Bitcoin remains a long-term strategic asset.

Diversification: Bitcoin, Gold, and Strategic Stakes

Tether’s strategy is not limited to Bitcoin. In the third quarter of 2025, the company acquired an additional 26 tons of gold, bringing its total reserves to 116 metric tons, valued at approximately $7.5 billion. This accumulation places Tether among the world’s 30 largest gold holders, consolidating its position in traditional safe-haven assets.

Furthermore, Tether holds a majority stake in Twenty One Capital, a company listed on the NYSE under ticker XXI since December 2025. This subsidiary owns 43,514 BTC, making it the third-largest public Bitcoin holder behind MARA Holdings and Strategy. This structure allows Tether to expand its Bitcoin exposure indirectly, creating an integrated and diversified investment ecosystem.

Transparency, Rating, and Regulatory Challenges

In December 2025, S&P Global downgraded USDT’s rating from « constrained » to « weak » (5 on a 5-point scale), citing concerns related to transparency and risk concentration. Tether responded by accelerating its audit efforts and clarifying the nature of its Bitcoin movements, notably explaining that apparent Q3 2025 fluctuations resulted from transfers to Twenty One Capital, not sales.

With 183 billion USDT in circulation in early 2026 and a market capitalization of $140 billion, Tether’s treasury decisions directly influence Bitcoin’s supply dynamics. Each quarterly allocation of 15% of profits creates predictable institutional buying pressure, closely monitored by the entire market.

2026 Outlook: A Benchmark Institutional Buyer

Tether’s systematic approach positions the company as a benchmark institutional buyer whose movements are scrutinized throughout the crypto ecosystem. The fixed 15% profit policy guarantees continuous and predictable accumulation, while diversification into gold and strategic stakes creates a robust multi-asset investment model.

The acquisition of 8,888.88 BTC in Q4 2025 is therefore not a simple opportunistic market operation, but the manifestation of a deeply structured institutional strategy that redefines stablecoin reserve management. By systematically converting profits generated by Treasury bonds into Bitcoin, Tether creates a unique precedent where USDT stablecoin dominance directly fuels the accumulation of the asset considered the ultimate digital store of value.

With 96,185 BTC and a position as the fifth-largest holder worldwide, Tether demonstrates that a systemic actor can massively strengthen its Bitcoin exposure without compromising the stability of its financial liabilities. In a market hesitating between correction and consolidation, this methodical accumulation sends a powerful institutional signal: conviction in Bitcoin as a long-term store of value does not waver, and is even becoming irreversibly institutionalized.