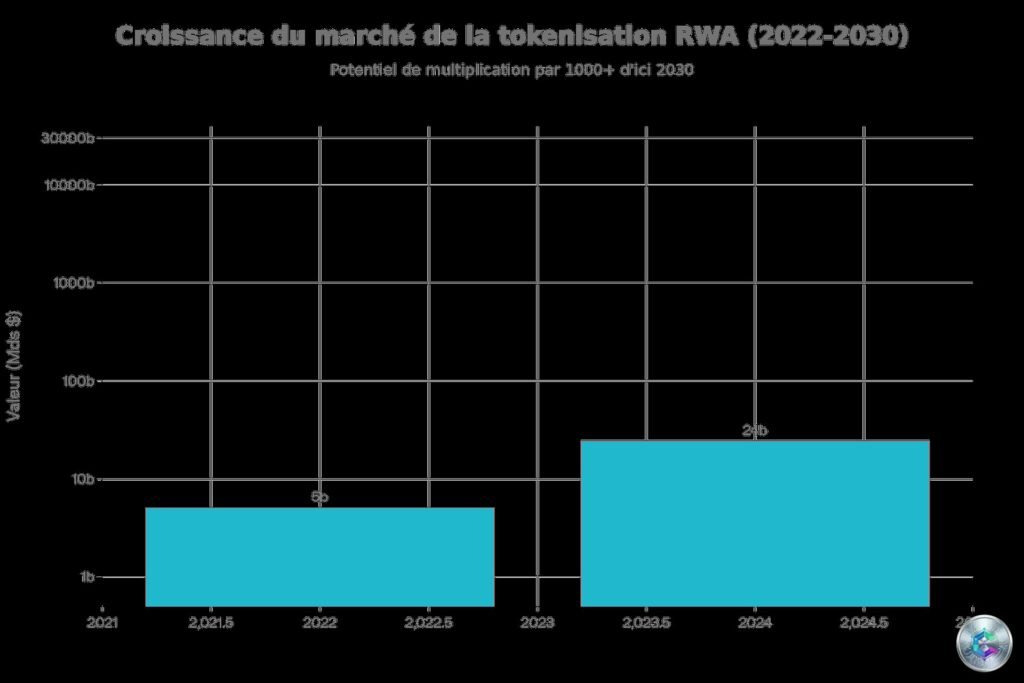

Asset tokenization is emerging as one of the major financial revolutions of this decade. With a market growing from $5 billion in 2022 to over $50 billion in December 2024, this technology is radically transforming how we invest in real assets. BlackRock, Ondo Finance, and other financial giants are massively investing in this innovation that could reach $30 trillion by 2030.

What is Asset Tokenization?

Tokenization involves transforming ownership rights over real assets into digital tokens recorded on a blockchain. These assets can be tangible like real estate, gold, or artwork, or intangible like stocks, bonds, or intellectual property rights.

In practical terms, a token represents a fraction of ownership in an asset. For example, a building valued at €10 million can be divided into 100,000 tokens at €100 each. This fragmentation allows investors with limited capital to access assets traditionally reserved for high-net-worth individuals.

The Technological Pillars of Tokenization

The process relies on three essential components:

- Blockchain: A decentralized and immutable digital ledger that records all transactions with total transparency and enhanced security against fraud

- Smart contracts: Autonomous programs that execute automatically when certain conditions are met, automating transactions and revenue distributions while eliminating intermediaries

- Tokens: Fractional ownership units guaranteed immutable and unforgeable thanks to the decentralized nature of blockchain

An Exploding Market: +380% in Three Years

The figures demonstrate remarkable growth. In December 2024, the market crossed the $50 billion mark in tokenized assets (excluding stablecoins), marking a 67% increase from the beginning of the year and 380% growth since 2022.

Future projections are even more impressive. According to analyses by major financial institutions, the market could reach between $16 trillion and $30 trillion by 2030. Boston Consulting Group (BCG) and Ripple anticipate growth from $0.6 trillion in 2025 to $18.9 trillion by 2033, representing a compound annual growth rate of 53%.

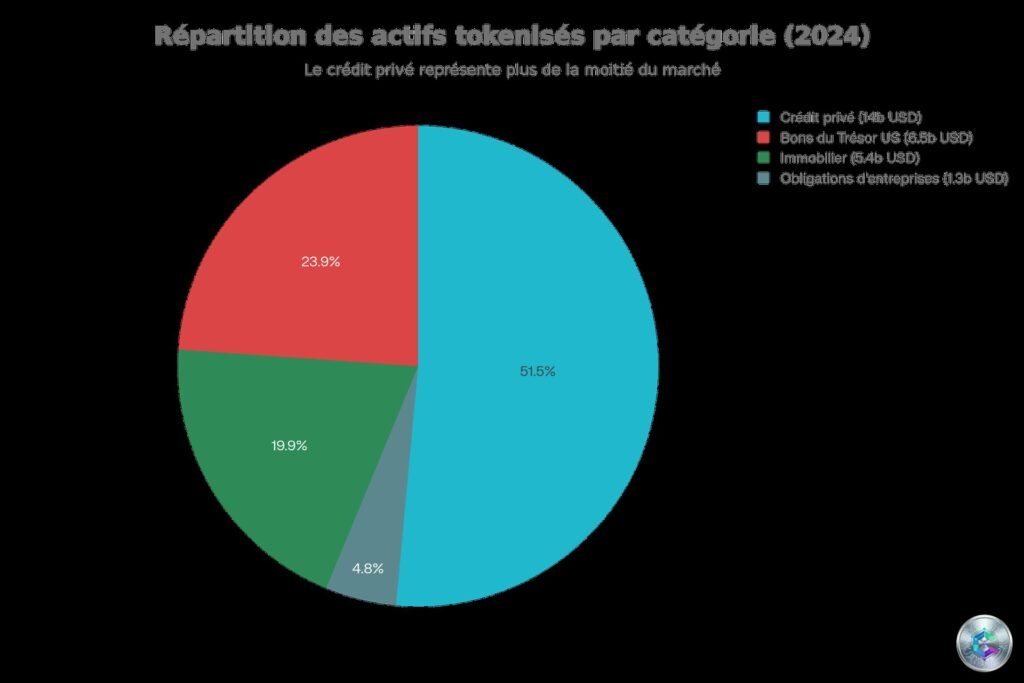

Distribution by Asset Type

The tokenized assets market is currently distributed as follows:

- Private Credit ($14 billion USD): Represents more than half the market, particularly attracting institutional investors seeking stable returns

- US Treasury Bonds ($6.5 billion USD): BlackRock launched its BUIDL fund which quickly reached $2.9 billion in assets under management

- Real Estate ($5.4 billion USD): Democratizes access to a sector historically reserved for large portfolios, with projections reaching $24 billion in coming years

- Corporate Bonds ($1.3 billion USD): Offers a new pathway to bond markets

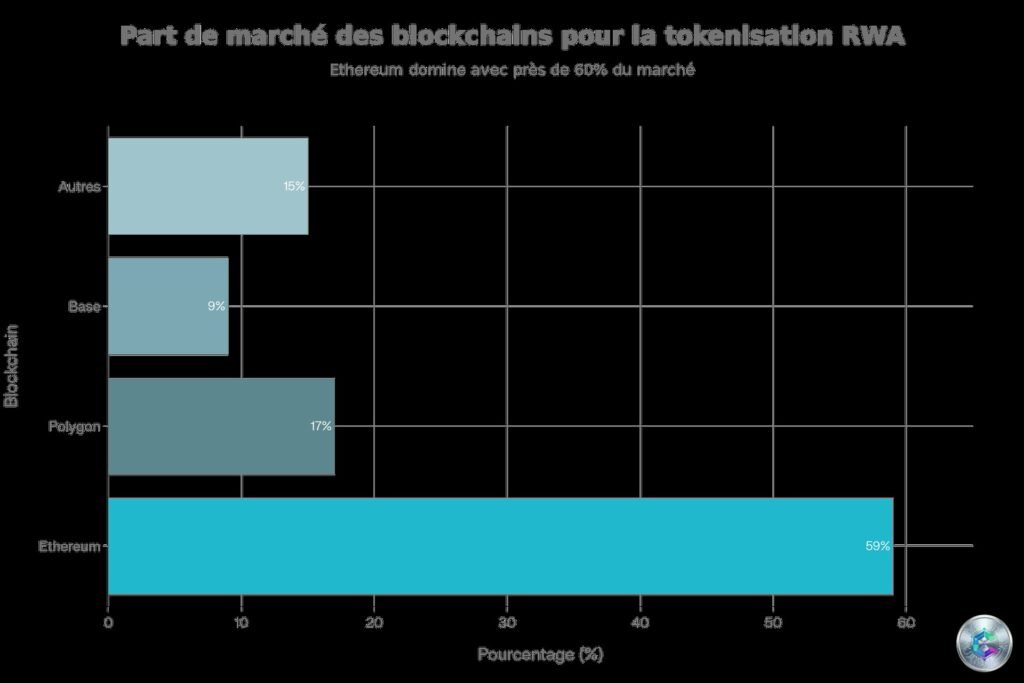

Leading Blockchains for Tokenization

Ethereum remains the platform of choice with 59% of total tokenized value. Its technological maturity, developed ecosystem, and proven security make it the natural choice for financial institutions tokenizing high-value assets.

Polygon occupies second position with 17% market share, attracting projects through its reduced transaction fees and Ethereum compatibility.

Base, Coinbase’s blockchain, captures 9% of the market, benefiting from its creator’s regulated infrastructure.

Other blockchains are experiencing spectacular growth: Solana recorded a 1,200% increase since 2022, Aptos 4,800%, and Avalanche 1,500%.

Transformative Advantages of Tokenization

1. Accessibility and Democratization

Fractional ownership represents the most transformative advantage. Investing in a commercial building or valuable artwork traditionally required hundreds of thousands of euros. With tokenization, minimum investment can drop to $50, allowing a much wider audience to access previously inaccessible asset classes.

2. Enhanced Liquidity

Traditionally illiquid assets like real estate or private fund shares become tradable 24/7 on blockchain markets. This permanent liquidity allows investors to exit their positions more easily than traditional mechanisms that can take weeks.

3. Cost Reduction

Eliminating intermediaries (brokers, notaries, banks) through smart contracts significantly reduces fees. Automated processes also reduce settlement times from several days (T+2 or T+3) to near-instant settlement (T+0).

4. Transparency and Security

Every transaction recorded on the blockchain is visible, traceable, and immutable. This transparency drastically reduces fraud risks and offers investors and regulators complete visibility into an asset’s history.

Real-World Examples: Market Leaders

BlackRock and the BUIDL Fund

Asset management giant BlackRock, managing over $10 trillion, launched its first tokenized fund in March 2024: the BlackRock USD Institutional Digital Liquidity Fund (BUIDL). This money market fund invests in US Treasury bonds and offers daily interest payments. Within months, it surpassed $2.9 billion, capturing 28% of the Treasury bond tokenization market.

Ondo Finance: Tokenized Stocks and ETFs

Ondo Finance positions itself as one of the leaders in traditional financial asset tokenization. In November 2025, Ondo obtained authorization from Liechtenstein regulators to offer tokenized stocks and ETFs throughout Europe, reaching over 500 million potential investors in 30 countries.

RealT: Real Estate Accessible from $50

RealT is revolutionizing real estate investment by enabling the purchase of tokens representing property shares in the United States with entry tickets as low as $50. Investors receive weekly rental income in the form of stablecoins, offering a regular source of passive income.

Regulatory Framework: MiCA in Europe

The European Markets in Crypto-Assets (MiCA) regulation represents a major advance in tokenization oversight. Progressively implemented since June 2024 and fully applicable since December 2024, MiCA creates a uniform legal framework for all 27 EU member states.

The regulation imposes strict authorization requirements for token issuers and crypto-asset service providers (CASPs), aiming to protect investors while promoting innovation within a secure framework.

Challenges to Overcome

Despite its numerous advantages, tokenization presents significant challenges:

- Regulatory uncertainties: The legal framework remains unclear in many jurisdictions regarding property rights, taxation, and dispute resolution

- Security risks: Private key management and potential smart contract vulnerabilities require robust protection measures

- Volatility: Token prices can fluctuate due to various economic and technological factors

- Adoption and education: Lack of understanding of blockchain technology hinders mass adoption by the general public

The Future: Toward a Tokenized Financial World

Tokenization is no longer a technological experiment but a structural transformation of the global financial system. The largest financial institutions are massively investing in this technology. Larry Fink, CEO of BlackRock, calls it the « next generation of markets » and the « largest capital migration in financial history. »

Beyond real estate and traditional financial assets, new categories are emerging: tokenized carbon credits ($400 million in 2024), fractionalized intellectual property, and commodities accessible without physical storage constraints.

Conclusion

Asset tokenization represents a silent but profound revolution redefining the foundations of ownership and investment. By transforming illiquid assets into 24/7 tradable digital tokens, this technology democratizes access to asset classes previously reserved for the wealthy.

With a market potentially multiplied by 600 by 2030, tokenization establishes itself as an unavoidable structural transformation. For investors, it offers unprecedented opportunities for diversification and access to new markets. For issuers, it enables faster capital raising and reduced operational costs.

The financial world of tomorrow will be tokenized, transparent, and accessible to all. This revolution is just beginning.