Solana has achieved the unthinkable in 2025. With $1.3 billion in annual revenue, the ultra-fast blockchain now surpasses Ethereum and all of the world’s top ten blockchains combined, according to CryptoRank data. This performance marks a decisive turning point in cryptocurrency history and redefines the success criteria for a blockchain.

Unprecedented Financial Dominance

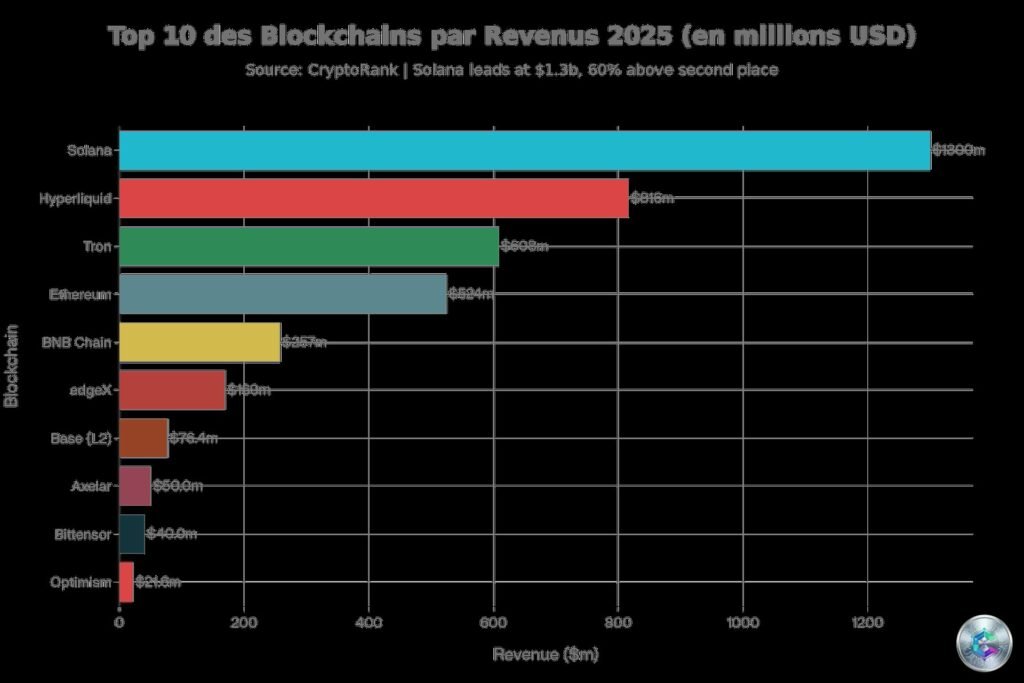

In 2025, Solana establishes itself as the absolute leader in blockchain revenue, far surpassing its competitors with $1.3 billion compared to just $524 million for Ethereum. This performance represents 2.5 times Ethereum’s revenue, despite a Total Value Locked (TVL) that is ten times lower.

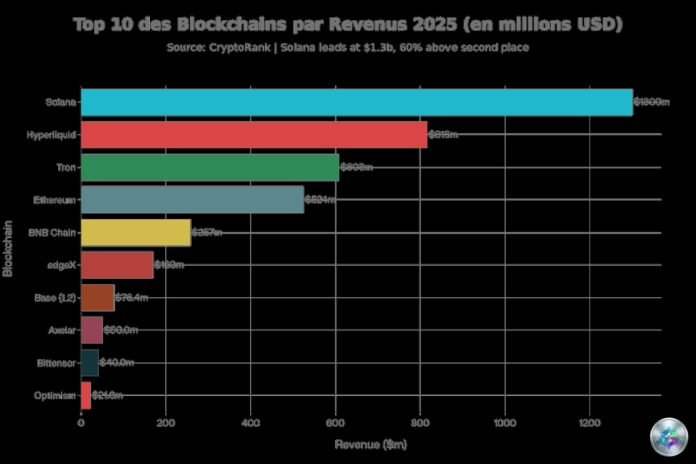

The 2025 ranking reveals a radically transformed hierarchy:

- Solana: $1.3 billion

- Hyperliquid: $816 million

- Tron: $608 million

- Ethereum: $524 million

- BNB Chain: $257 million

Explosive Quarterly Growth

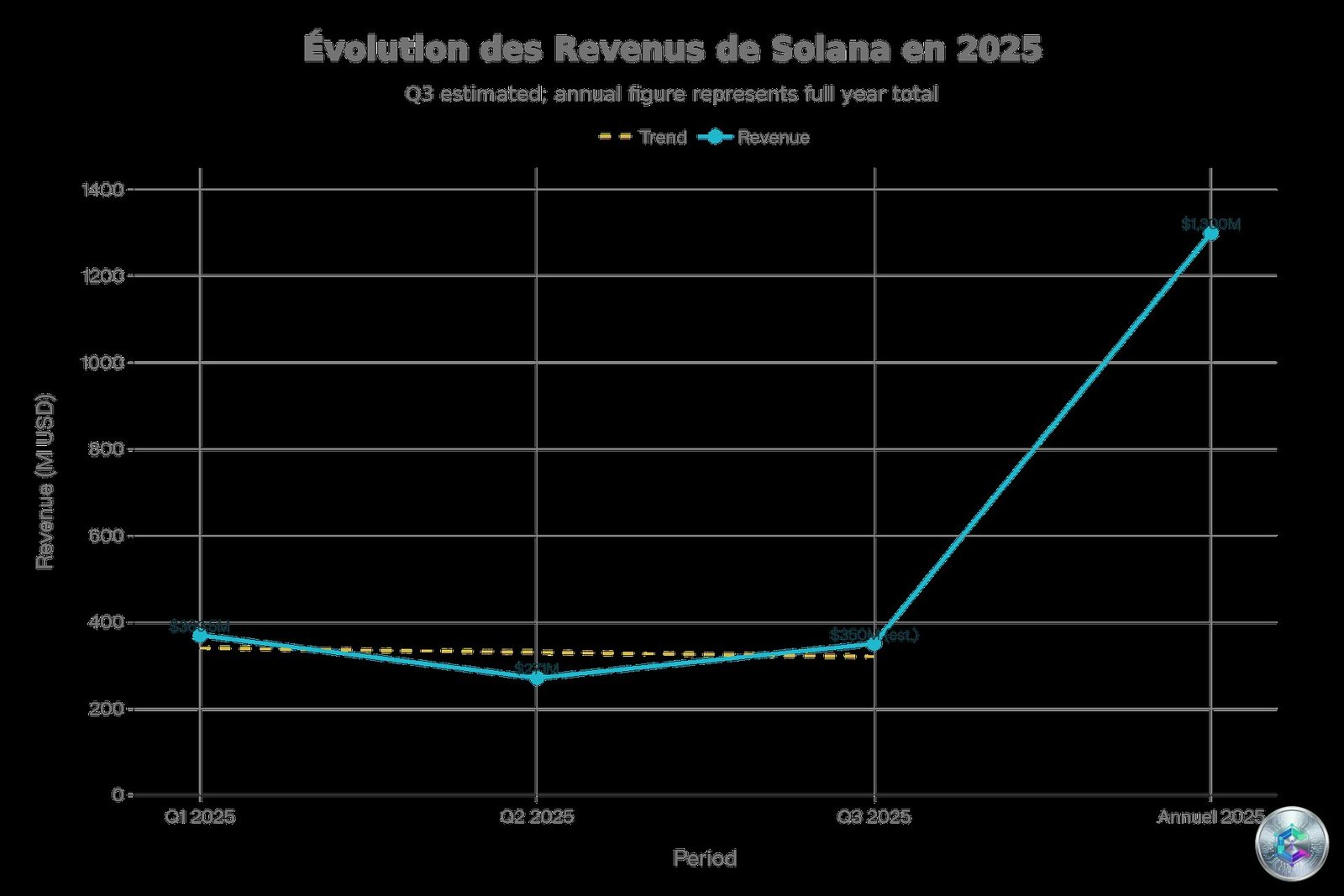

Quarterly analysis demonstrates sustained growth throughout the year. The first quarter of 2025 recorded a peak of activity with $369.5 million, already half of the entire 2024 annual total. The second quarter maintained solid performance with $271 million, marking the third consecutive quarter of leadership.

This performance far exceeds initial projections and confirms the network’s ability to maintain high revenue generation even during periods of market volatility. Anatoly Yakovenko, Solana’s founder, shared this data to emphasize the importance of revenue distribution as a key metric in blockchain evaluation.

Performance Drivers

Record Trading Volume

Solana’s financial success rests on massive transaction volume. In 2025, the network’s decentralized exchanges processed over $1.4 trillion in volume, with a monthly peak of $408 billion in January and up to $37 billion in a single day.

Jupiter, Solana’s leading DEX aggregator, played a central role with $716 billion in token volumes processed in 2025. The platform currently controls 93.6% of the Solana aggregator market, with a weekly volume of $49.1 billion in December 2025.

The Memecoin Explosion

Pump.fun, the leading memecoin launch platform, generated over $800 million in cumulative revenue in 2025, with daily peaks exceeding $3 million. The platform launched more than 11.9 million tokens and represents 91% of all new tokens created daily on Solana.

In January 2025, Pump.fun was responsible for 70% of all new tokens launched and approximately 56% of trading activity on Solana exchanges. This model, based on a 1% commission on swap transactions, generates recurring revenue flow for the ecosystem.

Solana vs Ethereum: A New Paradigm

The comparison between Solana and Ethereum reveals a fascinating paradox. Solana generates 2.5 times more revenue than Ethereum despite a TVL ten times lower ($11.5 billion versus $114.9 billion). This superior efficiency is explained by three structural factors:

- Capital Velocity: Assets circulate more rapidly on Solana, generating more fees per locked dollar

- High-Frequency Activity: Memecoin trading, DeFi, and consumer applications create massive transaction volume

- Value Concentration: Unlike Ethereum where Layer 2s disperse revenue, Solana captures all fees on its main chain

With an average of 162 million daily transactions and capabilities reaching 65,000 transactions per second, Solana processes 140 times more volume than Ethereum (1.13 million daily transactions).

DeFi Ecosystem: A Growth Pillar

Solana’s Total Value Locked reached historic highs in 2025, peaking at $12.27 billion in September. Major protocols consolidated their position with Kamino Finance representing 24.1% of total TVL, Jupiter reaching $2.6 billion with the launch of Jupiter Lend, and liquid staking platforms Jito and Marinade accumulating approximately 16.82 million locked SOL.

Liquid staking represents a major ecosystem innovation, with Marinade Finance (7.058 million SOL, 6.543% yield) and Jito (6.38 million SOL, 6.892% yield with additional MEV revenue distribution) dominating the sector.

Institutional Adoption and Tokenization

Institutional adoption reached a decisive milestone in 2025. Public companies now hold 5.9 million SOL (1% of circulating supply), with major players like DeFi Development Corp (1.18 million SOL valued at $199 million) and Sharps Technology (private placement of $400 million).

Real World Assets (RWA) tokenization on Solana experienced explosive growth of 372%, compared to 198% on Ethereum. Strategic collaborations with R3 aim to tokenize $10 billion in RWA, including BlackRock’s BUIDL fund, on-chain Treasury bonds, and over 400 tokenized US stocks via Robinhood and Backed Finance.

DePIN: The Silent Revolution

The DePIN (Decentralized Physical Infrastructure Networks) sector represents a promising innovation with over $3 million in revenue generated and 17.6% growth in FDV. In April 2025, DePIN projects counted 238,165 registered on-chain nodes.

Major projects include Helium (decentralized wireless network), Render Network (GPU compute power marketplace migrated to Solana), Hivemapper (decentralized mapping), and IO.net (distributed compute infrastructure with over 120,000 workers collectively earning more than $500,000).

Developers and Innovation: The Strategic Advantage

Solana displays explosive developer growth with 17,708 active developers in September 2025, an 83% year-over-year increase. This growth is ten times higher than Ethereum’s (5.8%). Between January and September 2025, Solana attracted 11,534 new developers with a retention rate exceeding 70%.

This performance is explained by strategic investments from the Solana Foundation in regular hackathons (Riptide, Hyperdrive, Breakout with over 900 submitted projects), advanced development tools (Anchor framework, Solana Mobile Stack, ZK compression), educational programs (Solana Educate, regional bootcamps), and grant programs for promising projects.

2026 Outlook: Consolidation of Dominance

Several growth catalysts are identified for 2026: the Firedancer upgrade (potential throughput increase to 1 million TPS), likely approval of Solana ETFs (estimated at 90% by analysts, potentially unlocking institutional flows similar to Bitcoin ETF’s $65 billion), continued DePIN expansion, DeFi maturation with growing institutional adoption, and the emergence of autonomous AI agents as a new application class.

Anthony Scaramucci, founder of SkyBridge Capital, stated that Solana could eventually surpass Ethereum in market capitalization, citing its architecture and performance capabilities as decisive advantages.

Challenges to Monitor

Despite these impressive performances, Solana faces significant challenges. SOL’s price dropped 58% from its January peak of $294, with Q4 2025 down 39.1%, marking the year’s worst quarter. Network activity declined 97% in Q4.

Identified risks include holdings concentration (5.9 million SOL held by public companies presenting liquidity risk), memecoin dependency (80% of activity related to speculative trading), and security losses (over $250 million stolen in H1 2025).

Diversification toward more sustainable use cases like payments, RWA, DePIN, and enterprise applications will be essential to maintain long-term growth. Early signs are encouraging with growing institutional adoption and stablecoin expansion reaching $17 billion in supply on Solana.

Conclusion: A Historic Turning Point

Solana’s revenue dominance in 2025 marks a historic turning point in the blockchain industry. This performance demonstrates that superior technical execution and capital efficiency can surpass traditional metrics like TVL.

For investors, developers, and users, Solana now represents the reference blockchain for high-frequency execution, consumer applications, and DeFi innovation. Its revenue leadership is not an accident but the result of a deliberate strategy favoring performance, accessibility, and continuous innovation.

The question is no longer whether Solana can compete with Ethereum, but rather how these two complementary ecosystems will coexist in an increasingly specialized multi-chain blockchain future.