As 2025 draws to a close, renowned economist and notorious Bitcoin critic Peter Schiff has issued a fresh apocalyptic warning. In a series of statements made just after Christmas, Schiff predicts not only the end of the US dollar’s hegemony but also a dark period ahead for cryptocurrency holders. But beyond his usual pessimism, do the economic data from late 2025 actually support his claims? A comprehensive analysis.

Schiff’s Alert: « King Dollar Is Dead »

On December 26, 2025, Peter Schiff didn’t mince words. On platform X, he declared that the reign of the American dollar was coming to an end and that we should prepare for a « historic economic collapse. » His argument rests on three pillars he now considers unsustainable.

US Debt Reaches Dizzying Heights

With national debt now exceeding $36.7 trillion and a debt-to-GDP ratio above 100%, Schiff believes the United States is on the brink of technical insolvency. This alarming situation raises legitimate questions about the long-term sustainability of the American economy.

Inflation Remains « Sticky »

Despite repeated attempts by the Federal Reserve, inflation remains persistent, gradually eroding the purchasing power of American households. This economic reality reinforces Schiff’s argument that the dollar is losing its intrinsic value.

The Flight to Gold Accelerates

Central banks worldwide are accumulating gold at record pace, progressively abandoning US Treasury bonds. For Schiff, the conclusion is unequivocal: « Gold will reclaim its throne. The dollar will collapse against other fiat currencies, and America’s ‘free ride’ on the back of the global economy will end. »

2025: The Year of Gold vs Bitcoin?

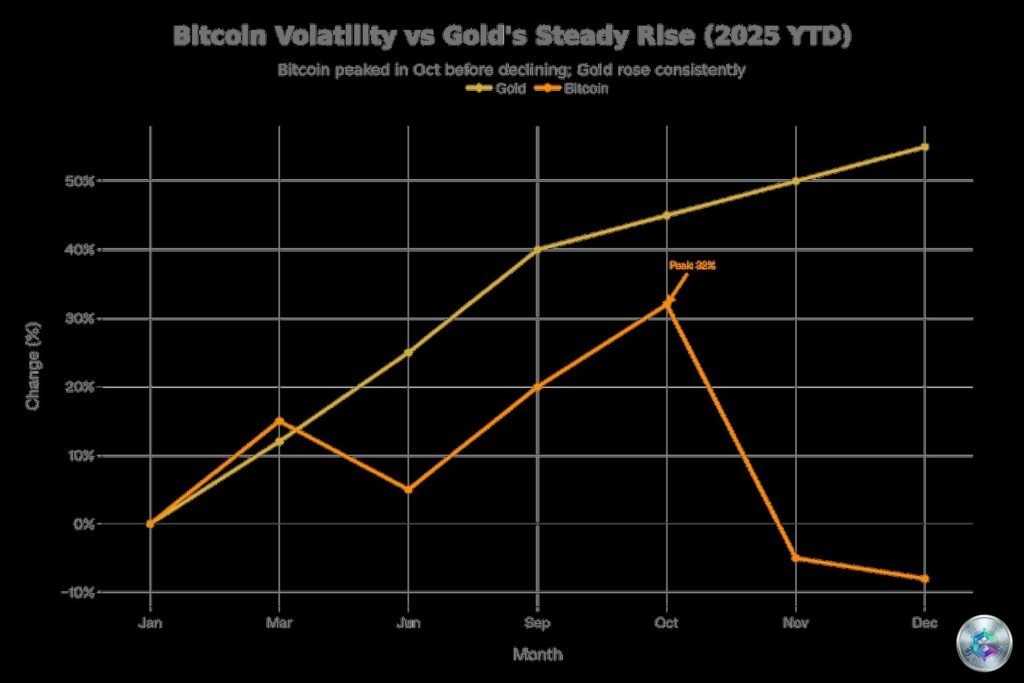

What makes Schiff’s statement particularly relevant this year is that 2025’s numbers seem, for once, to validate his « Gold > Bitcoin » thesis. While Bitcoin reached an all-time high around $126,000 in October 2025, it suffered a brutal correction at year’s end, falling back to the $87,000-$88,000 range by late December.

Conversely, gold had an exceptional year, climbing approximately 55% to reach highs near $4,500 per ounce. Schiff doesn’t hesitate to highlight this divergence, claiming that « gold is eating Bitcoin’s lunch » and that the digital gold narrative is crumbling.

While Bitcoin offered massive profit opportunities with its October peak, its volatility brought it back into negative territory compared to the year’s start, while gold maintained a stable and steady ascent.

Other Sources: Should We Panic?

To avoid relying solely on Schiff’s apocalyptic vision, it’s essential to analyze other institutional sources for 2026. The consensus is far from being as grim.

The Bearish View: Bloomberg Intelligence

Mike McGlone, strategist at Bloomberg, partially agrees with Schiff. He recently labeled Bitcoin as « dead money » for now, emphasizing that the asset struggles to maintain its gains amid an environment of elevated interest rates and recession risks. If the American economy enters a hard recession in 2026, risk assets like BTC could indeed suffer more than gold.

The Bullish View: Fundstrat and JPMorgan

On the opposite side, Tom Lee from Fundstrat maintains a very bullish outlook. He predicts Bitcoin could reach $200,000 to $250,000 by the end of 2026. His argument? Institutional demand via ETFs is only beginning to materialize long-term, and Bitcoin’s post-halving supply remains historically low.

Similarly, JPMorgan has mentioned a potential target of $170,000, considering that current volatility is just a normal consolidation phase within a larger bull cycle.

Historical Reality

It’s crucial to remember that Peter Schiff has been predicting Bitcoin’s demise since it was worth just a few dollars. In 2018, he advised against buying at $3,800. In 2019, he swore Bitcoin would never reach $100,000. The fact that Bitcoin now trades at $88,000 (more than 20 times its 2018 price) stands as tangible proof of the asset’s long-term resilience, despite 2025’s underperformance against gold.

Conclusion: A Disguised Opportunity?

Schiff’s warning about the American economy is credible: US debt represents a major problem that could indeed weaken the dollar. However, his conclusion that this will destroy Bitcoin is historically questionable.

If the dollar truly collapses, investors will inevitably seek safe haven assets. While 2025 was gold’s year, history shows that Bitcoin tends to massively outperform gold in the years following its major corrections.

Our advice: Take macroeconomic warnings seriously, but keep in mind that Schiff has been selling gold for decades. Bitcoin’s current correction could well be the entry point that many investors will regret missing in 2026.

Sources: Finbold, Bloomberg via CoinTribune, Fundstrat Reports 2025, TwelveData Market Data, Yahoo Finance, KuCoin News, Reuters