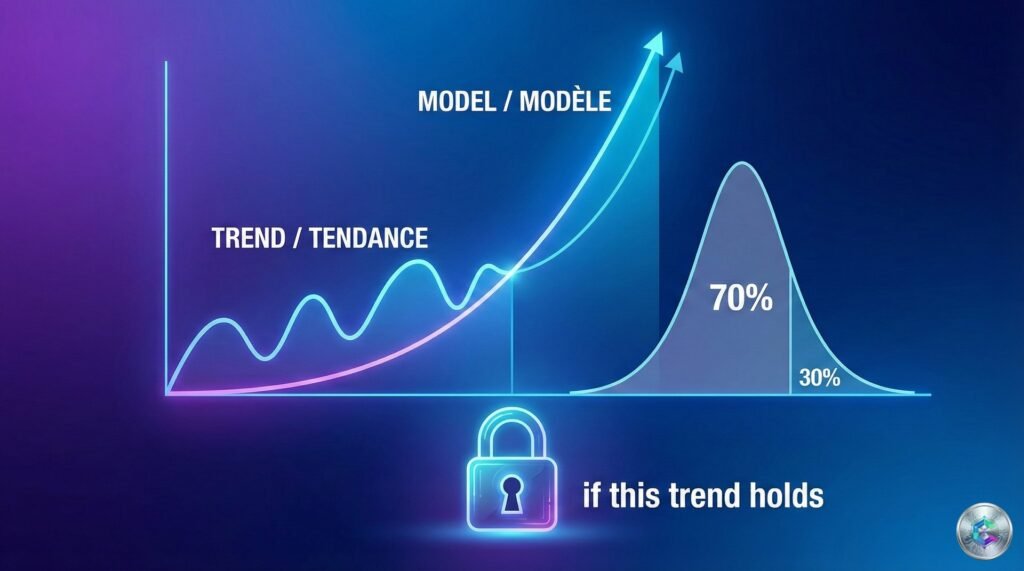

While Bitcoin is trading around $89,000 at the end of December 2025, 30% below its all-time high of $126,000 reached in October, analysts and quantitative models converge on a surprising scenario for 2026: a 70% probability of reaching a new all-time high.

A Tumultuous Year 2025

Bitcoin experienced a year marked by extreme volatility in 2025. After setting a record at $126,000 in early October, the cryptocurrency suffered a brutal correction, losing more than $18,000 in November – its largest monthly decline since mid-2021.

This drop was fueled by several converging factors: rising U.S. real yields that reached 1.6-2.1% in 2025, record outflows of $3.5 billion from spot Bitcoin ETFs in November, and a maintained high correlation with U.S. stock markets.

The 70% Probabilistic Model: Rigorous Methodology

The estimate of a 70% probability for a new all-time high in 2026 is based on a stochastic model applying quantitative finance principles to Bitcoin’s unique characteristics. This model integrates several key parameters:

- Current price and barrier: Starting from a level of $89,000, Bitcoin must break through the $126,000 barrier, representing a 42% appreciation

- Annualized volatility: The model uses approximately 41% volatility based on the BVX (Bitcoin Volatility Index)

- Positive drift: The model assumes an upward trend consistent with institutional forecasts, notably Citigroup’s target of $143,000 for the end of 2026

Convergence of Institutional Forecasts

Major financial institutions have adjusted their Bitcoin forecasts for 2026, showing recalibration after the euphoria of 2025, while maintaining predominantly bullish outlooks:

- Citigroup: Base case scenario at $143,000, bullish case at $189,000, bearish case at $78,500

- Standard Chartered and Bernstein: $150,000 for the end of 2026

- JP Morgan: Target close to $170,000 for 2026

- Fidelity: More conservative position with support between $65,000 and $75,000

This concentration of most estimates in the $120,000-$170,000 range suggests an institutional consensus on significant appreciation.

The Impact of the 2024 Halving and Supply Tightening

Bitcoin’s halving on April 19, 2024, reduced the mining reward from 6.25 to 3.125 BTC per block. With approximately 450 new bitcoins created daily, the daily issuance represents about $40 million at a price of $89,000.

Currently, 94.42% of Bitcoin’s total supply has already been mined, with 19.825 million BTC in circulation. Projections indicate that the symbolic milestone of 20 million BTC will be reached on March 12, 2026, at block 940,217.

Institutional Adoption: The Crucial Role of ETFs

The approval of spot Bitcoin ETFs in the United States in January 2024 marked a historic turning point. U.S. spot Bitcoin ETFs attracted approximately $85 billion in assets under management by the end of 2025.

The undisputed leader is BlackRock’s iShares Bitcoin Trust (IBIT), holding $70.12 billion, followed by the Fidelity Wise Origin Bitcoin Fund (FBTC) with over $20 billion.

However, flows were marked by extreme volatility at the end of 2025. November recorded record outflows of $3.5 billion, reflecting widespread risk aversion.

Macroeconomic Environment: The Determining Factor

The macro environment is perhaps the most determining variable for Bitcoin’s trajectory in 2026. U.S. real yields oscillated between 1.6% and 2.1% in 2025, a level that penalizes non-yielding assets like Bitcoin.

The Federal Reserve executed three rate cuts in 2025, bringing the federal funds rate to 3.50-3.75%. However, markets now anticipate only one additional 25 basis point cut in 2026.

Global M2 money supply reached $108.4 trillion in early 2025. Historically, Bitcoin has demonstrated a 0.94 correlation with M2 growth. A similar M2 expansion in 2026 could propel Bitcoin toward institutional projections of $145,000 to $175,000.

On-Chain Signals: Accumulation and Tightening

Bitcoin reserves held on centralized exchanges fell to 2.76 million BTC in December 2025, among the lowest levels ever recorded. This decline accelerated during the November-December price correction.

Bitcoin whales (wallets holding between 10 and 10,000 BTC) reversed their behavior in December 2025, accumulating a net 47,584 BTC after unloading 113,070 BTC between October and November.

The crypto Fear & Greed index stands at 23 in December 2025, firmly anchored in the « extreme fear » zone. Paradoxically, extreme fear levels are often considered contrarian indicators by savvy investors.

Regulatory Clarity: A Major Catalyst

The year 2025 marked a turning point in cryptocurrency regulation globally. The European Markets in Crypto-Assets (MiCA) regulation was fully implemented, creating a unified framework across the EU’s 27 member countries.

In the United States, the GENIUS Act on stablecoins is progressing in Congress, and the Clarity Act aims to define the regulatory framework for cryptocurrencies more broadly. The Trump administration has also signaled support for crypto development.

Necessary Conditions for a New High in 2026

Five interdependent conditions emerge as necessary for Bitcoin to reach a new all-time high in 2026:

- Sustained flow regime via ETFs: Citigroup’s hypothesis of $15 billion in ETF inflows in 2026 provides an essential benchmark

- Favorable macro environment: Declining real yields and accommodative Fed policy

- Continued access expansion: Integration into mainstream brokerage platforms

- Persistent regulatory clarity: Adoption of the GENIUS Act and Clarity Act in the United States

- Narrative catalysts: Crossing the 20 million BTC mined threshold in March 2026

The Debate on Breaking the Four-Year Cycle

Bitcoin’s « four-year cycle, » based on the halving, has long structured market expectations. The year 2026 is crucial as it tests this model. If Bitcoin establishes a new high in 2026, it would suggest a break from the traditional cycle.

Several factors suggest the cycle could indeed break: market maturation, decreasing marginal impact of halvings (with 94% of supply already mined), modified market structure through ETFs, and high macro correlation.

Scenarios for 2026-2028

Scenario 1: Model Validation (50-60% probability)

Bitcoin establishes a new all-time high between $130,000 and $180,000, confirming a break from the traditional cycle.

Scenario 2: Extended Consolidation (25-35% probability)

Bitcoin maintains support in the $75,000-$95,000 range, avoiding a complete collapse but failing to establish a new high.

Scenario 3: Return to Bear Market (10-20% probability)

Bitcoin falls back to the $50,000-$65,000 range, validating the traditional cycle and triggering an extended bear market.

Conclusion: A Historic Crossroads

The year 2026 represents a critical crossroads for Bitcoin. Probabilistic models suggest a 70% probability of establishing a new all-time high, but this projection depends on a favorable alignment of multiple variables.

Institutional forecasts largely converge on the $120,000-$170,000 range. This convergence demonstrates institutional conviction that Bitcoin, despite its volatility, retains significant appreciation potential.

For investors, 2026 requires a nuanced approach. Key technical levels to monitor include support at $82,800-$85,000 and resistance at $93,000-$95,000. A clear breakout above $95,000 would open the path to targets of $120,000-$143,000.

The interaction between macroeconomic liquidity, institutional adoption, and market psychology will determine whether the 70% model materializes. One thing is certain: 2026 will say a lot about Bitcoin’s market maturity and its ability to transcend speculative cycles to truly become a global store of value asset.