The year 2025 marked a decisive turning point in Bitcoin’s evolution, revealing unprecedented correlation patterns that challenge established narratives. Between historic synchronization with the Nasdaq and dramatic compression of the ratio against gold, the world’s leading crypto-asset experienced a year of profound structural transformations.

Bitcoin-Nasdaq Correlation: A Rollercoaster Ride

First Half: Record Synchronization

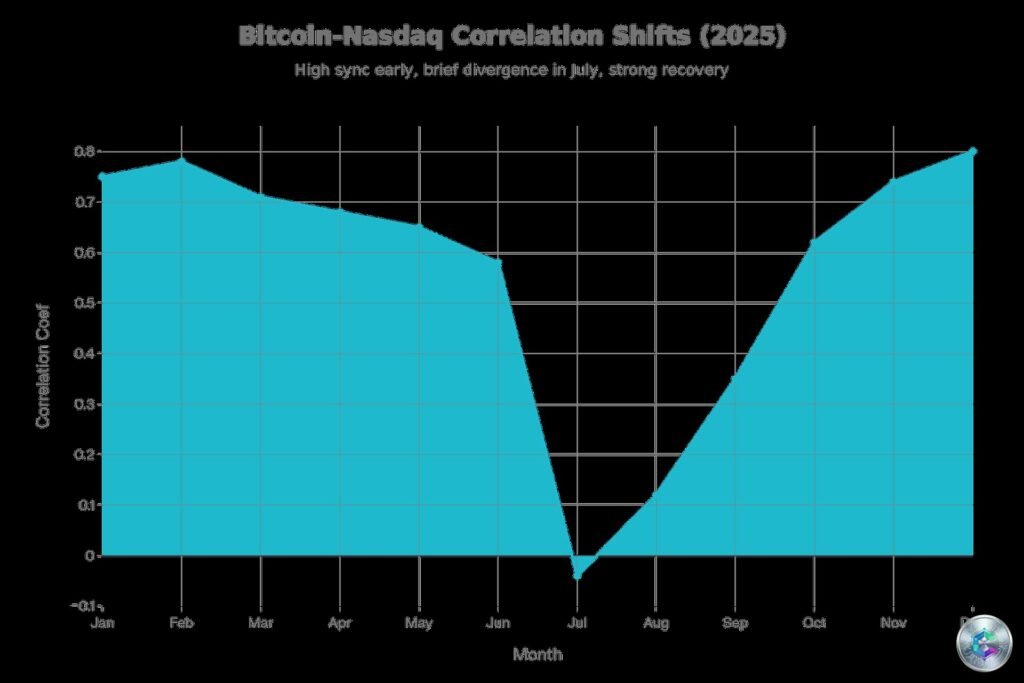

The beginning of 2025 was characterized by an exceptional correlation between Bitcoin and the Nasdaq 100. Wintermute data revealed a 30-day correlation coefficient peaking at 0.8, while other analyses confirmed a monthly correlation of 71%. This synchronization was explained by several converging factors.

Increased institutional integration via spot Bitcoin ETFs facilitated access for traditional investors, treating BTC as a high-beta technology asset rather than an autonomous store of value. Meanwhile, a massive sector rotation saw capital traditionally invested in the crypto ecosystem shift toward Nasdaq technology stocks.

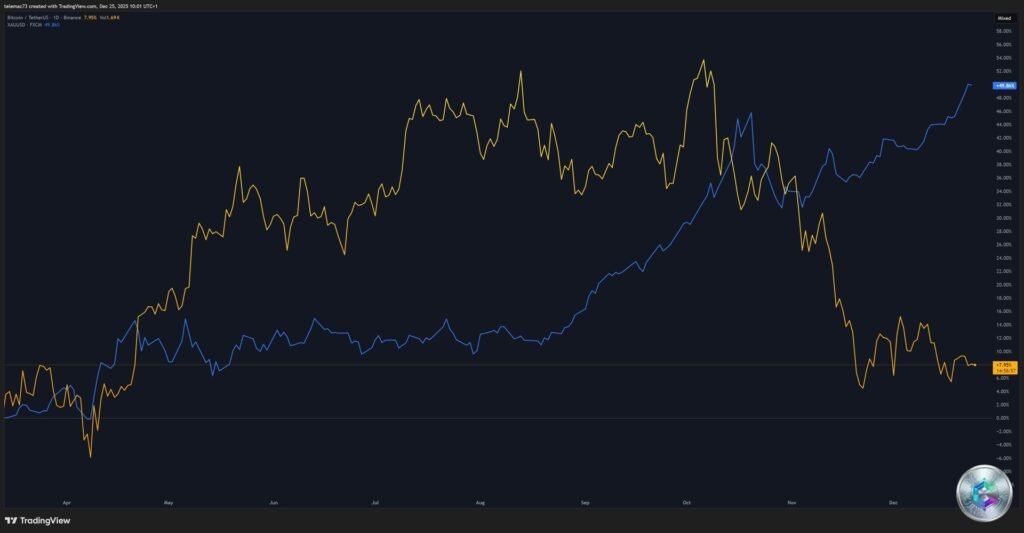

This period saw Bitcoin reach peaks close to $110,000-$115,000, closely following the performance of technology indices. Both assets reacted simultaneously to Fed monetary policy expectations and inflation reports, creating a synchronized dance in financial markets.

July: The Spectacular Break

Mid-year marked a critical inflection point. In July 2025, the 30-day correlation coefficient dropped to -4.3%, signaling a major disconnect. This decorrelation was accompanied by a significant discount of Bitcoin relative to its « implied » value based on the Nasdaq, with a gap reaching 31%.

While the Nasdaq fell from 22,000 to 16,000-18,000 points, Bitcoin showed relative resilience, stabilizing around $90,000 after an initial correction. The narrative shift was palpable: Bitcoin began to be perceived as a temporary refuge rather than a pure speculative asset.

Year-End: Asymmetric Return

Paradoxically, the end of the year saw a return to high correlation, with the coefficient rising back to 0.80 in November. However, this re-correlation comes with a worrying asymmetry: Bitcoin continues to outperform during Nasdaq declines while underperforming during bullish phases. Wintermute identifies this phenomenon as a consequence of capital concentration in large-cap technology stocks.

Bitcoin-Gold Ratio: A Historic Compression

Gold’s Triumph

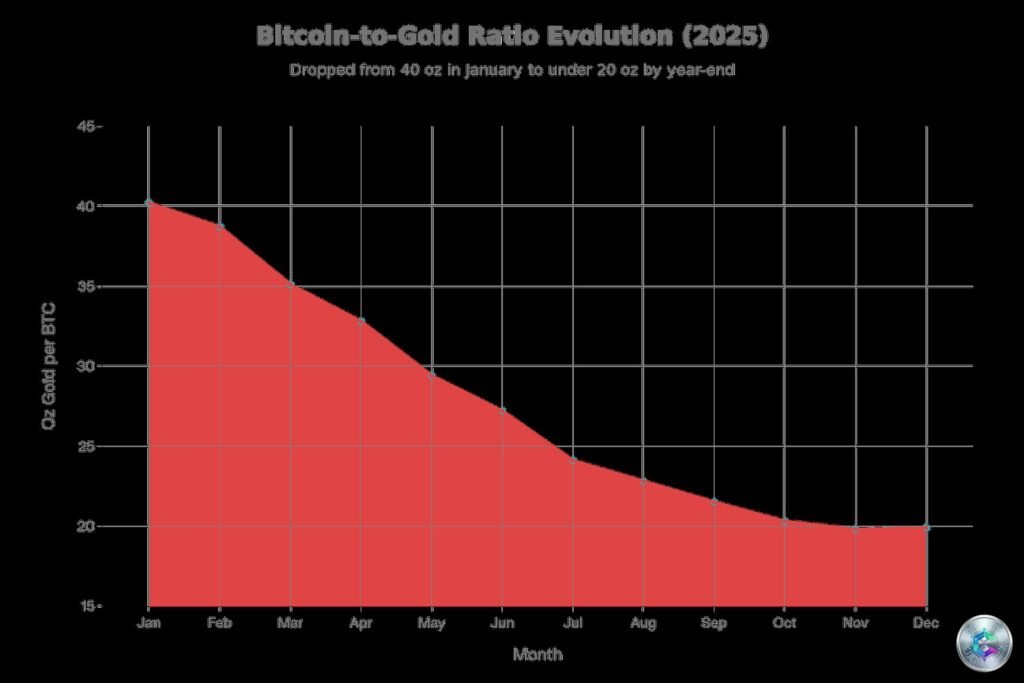

2025 was particularly favorable for gold, which recorded an exceptional performance of 55% to 63% depending on sources, reaching historic highs above $4,000 per ounce. This performance translated into a dramatic compression of the Bitcoin-gold ratio, dropping from 40 ounces per BTC in December 2024 to around 20 ounces by year-end.

Several factors explain gold’s dominance. Central banks purchased 254 tons through October, with Poland’s National Bank leading (83 tons). Gold ETFs saw record inflows of 397 tons in the first half, bringing total assets to 3,932 tons in November. The geopolitical risk index jumped 34% year-over-year, reinforcing gold’s appeal as portfolio insurance.

Bitcoin Struggles

Unlike gold, Bitcoin showed signs of fatigue in 2025. After reaching a peak of $126,200 in October, BTC fell more than 30% to trade below $90,000 by late November. Key indicators reveal weakened demand: ETF holdings dropped from $152 billion in July to $112 billion in December.

Long-term holders sold more than 500,000 BTC, including 300,000 BTC in October alone, representing the most aggressive distribution phase since December 2024. The Bitcoin-gold ratio thus reached its lowest level since November 2022, with a 14-day RSI of 22.20, suggesting extreme oversold conditions for Bitcoin relative to gold.

Explanatory Factors and Strategic Implications

Macroeconomic Environment

The 2025 environment was characterized by restrictive interest rates maintained by the Fed until September, creating an unfavorable context for non-productive assets. However, gold demonstrated an unprecedented disconnect from its traditional relationship with real yields, climbing 23% in the second quarter despite average real yields of 1.8% in developed markets.

Investor Perception

Institutional investors showed a growing preference for gold as a reserve asset, while Bitcoin was perceived as a high-risk technology asset. This dichotomy was reinforced by the maturity of gold infrastructure (physical tangibility, established infrastructure, use in cross-border transactions) versus the perceived immaturity of Bitcoin (persistent volatility, regulatory uncertainty, absence of official reserve status).

Opportunities for 2026

Historical analysis suggests that periods of strong negative decorrelation between Bitcoin and the Nasdaq have preceded rapid BTC rebounds. The 31% discount relative to implied Nasdaq value could represent an entry opportunity for investors anticipating normalization.

For the Bitcoin-gold ratio, the technical oversold level (RSI at 22.20) indicates that Bitcoin could be undervalued relative to gold. JPMorgan has suggested a $165,000 target for Bitcoin, based on volatility-adjusted valuation relative to gold.

Conclusion: A Maturing Asset

The year 2025 redefined Bitcoin’s correlation relationships, revealing a volatility in links with traditional assets that exceeds simple market cycles. The temporary decorrelation with the Nasdaq and structural compression of the ratio with gold do not signal the end of Bitcoin’s narrative, but rather a complex maturation of its role in the global financial ecosystem.

For investors and analysts, these developments imply a nuanced approach: Bitcoin is neither a simple speculative asset nor an immature digital gold, but a hybrid asset whose correlations vary according to macroeconomic regimes. The ability to navigate these correlation transitions could become a key determinant of crypto portfolio performance in 2026.

Year-end data suggests Bitcoin could be at a turning point, with technical indicators pointing to a possible recovery relative to gold and historical patterns of decorrelation with the Nasdaq preceding bullish phases. The key question for 2026 will not be so much absolute correlation, but Bitcoin’s ability to establish more predictable and less asymmetric behavioral patterns in a constantly evolving financial environment.