As the generational divide deepens in the financial world, a new reality is emerging: for those under 40, Bitcoin is no longer a speculative bet, but an economic necessity in the face of a system deemed « broken. » The latest « State of Crypto Q4 2025 » report from Coinbase confirms this major structural shift in wealth building.

An Unprecedented Generational Divide: 45% vs 18%

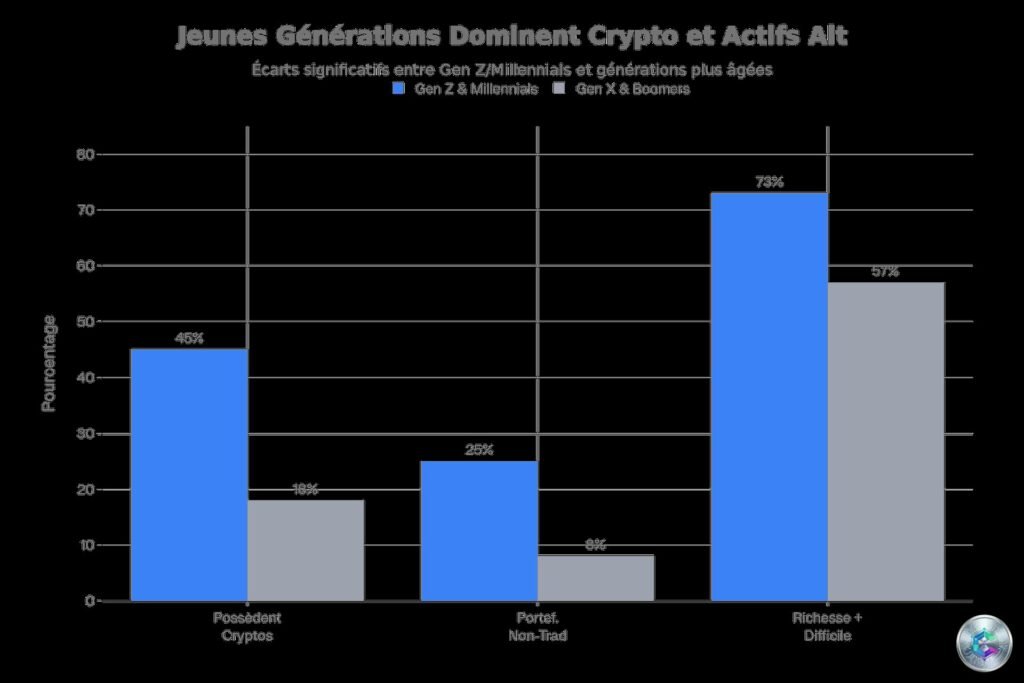

The figures revealed by the Coinbase/Ipsos study are striking. In the United States, 45% of young investors (Gen Z and Millennials) now own cryptocurrencies, compared to just 18% among older generations (Gen X and Boomers). This disparity extends beyond mere ownership to the very composition of investment portfolios.

Even more striking, young investors allocate nearly 25% of their total portfolio to non-traditional assets (crypto, DeFi, NFTs), three times more than their elders who cap at 8%. This difference reveals a fundamental paradigm shift in investment approach.

« Financial Nihilism »: When Youth Loses Faith in Wall Street

To understand this massive migration to digital assets, we must analyze the macroeconomic context. Analysts from Fast Company and Fortune identify a phenomenon they call « financial nihilism. » Unlike Baby Boomers who benefited from a growing economy and affordable housing, younger generations face a triple wall:

- Prohibitive housing costs: Homeownership has become mathematically out of reach for a large portion of the emerging middle class

- Student debt and wage stagnation: The report highlights that 73% of young people believe it’s harder for them to build wealth than for previous generations

- Traditional asset inflation: Classic savings (savings accounts, bonds) no longer compensate for the real inflation in cost of living

In this context, Bitcoin and DeFi are not perceived as « additional risks, » but as the only remaining escape routes. As Gareth Kay of Coinbase notes: « Young investors feel that the traditional playbook no longer works… so they decided to build a new one. »

The Death of the Traditional Financial Advisor

This paradigm shift is also disrupting the advisory industry. The Q4 2025 report highlights a crisis of trust in traditional intermediaries: only 33% of young investors use traditional financial advisors, compared to 51% for older generations.

The preferred source of information has become decentralized. Young investors now turn to YouTube, social networks, and peer circles for their investment decisions. This autonomy comes with increased risk tolerance: they are three times more likely to trade weekly and use tools like leverage to maximize returns in short timeframes.

A Paradoxical Institutionalization

Ironically, this financial « rebellion » is gradually becoming institutionalized. The massive arrival of Bitcoin and Ethereum ETFs has created a bridge between the two worlds. PwC’s report on wealth management for 2025 confirms that crypto has become a « key consideration » for wealth managers, with the global market exceeding $3.6 trillion.

A fundamental trend is also emerging: wealth transfer. According to Henley & Partners, we are entering the era of the « borderless crypto-entrepreneur, » where digital wealth becomes a tool for international mobility, escaping the geographical constraints that limited previous generations. We’re even seeing an increase in « crypto gifting » during the holiday season, a sign that the asset is becoming normalized within families.

The Coming Great Wealth Transfer

For savvy investors, this report is a major wake-up call. Ignoring cryptocurrency means ignoring the dominant economic strategy of the next 30 years. Gen Z and Millennials aren’t « playing » with crypto; they are redefining their generation’s reserve currency, just as their parents did with real estate and gold.

The coming « Great Wealth Transfer, » where Boomers will bequeath their capital to their children, threatens to trigger a tidal wave of liquidity leaving traditional markets to pour into the blockchain. This migration could completely reshape the global financial landscape in the coming decades.

Conclusion: A New Financial Era

The data from the « State of Crypto Q4 2025 » report leaves no doubt: we are witnessing a structural transformation of finance. Younger generations aren’t adopting Bitcoin out of opportunism, but out of economic necessity. Faced with a traditional system perceived as « broken, » they are building their own path to financial independence.

This silent revolution is redefining not only how wealth is built, but also the very nature of value and trust in our economic system. For market observers, one thing is certain: the future of finance will be digital, decentralized, and driven by a generation that refuses to accept the status quo.