The first day of 2026 brought crypto markets far more than a simple hangover. At 3 AM Beijing time, while most traders were still sleeping, a spectacular anomaly occurred on Binance involving the BROCCOLI714 token. What followed constitutes one of the most instructive trading operations of the year, demonstrating how technological vigilance and deep market understanding can transform a security incident into massive profits.

The Anatomy of a $26 Million Anomaly

The incident began not with a sensational headline, but with a simple price gap. Vida, founder of Equation News and experienced algorithmic trader, was operating a complex funding arbitrage strategy involving a $500,000 short position in BROCCOLI714 perpetual contracts on Binance, hedged by an equivalent long position on the spot market.

This strategy, commonly used by sophisticated traders, typically generates stable returns by capturing funding fees paid by leveraged speculators. The funding rate represents a fundamental mechanism of perpetual contracts: unlike traditional futures with expiration dates, perpetuals use periodic payments (every 8 hours) between long and short traders to maintain price alignment.

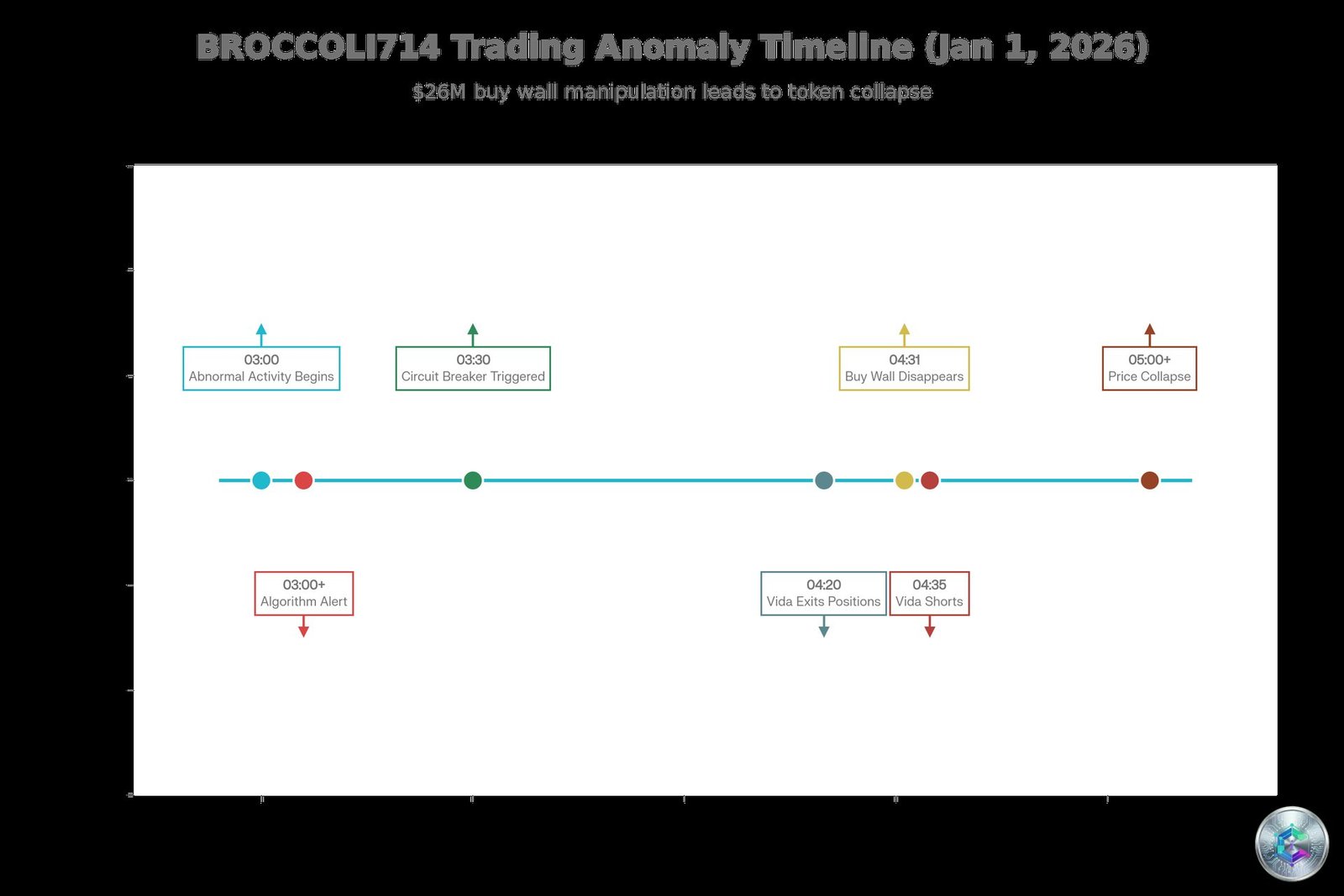

However, Vida’s model broke at 3 AM on New Year’s Day. His automated alert systems triggered frantically, signaling a price surge of over 30% in 30 minutes and a growing gap between spot and futures prices. His initial hedge position had transformed into chaotic imbalance: the spot position had swollen to $800,000 while the futures leg remained significantly behind.

The Impossible Order Book

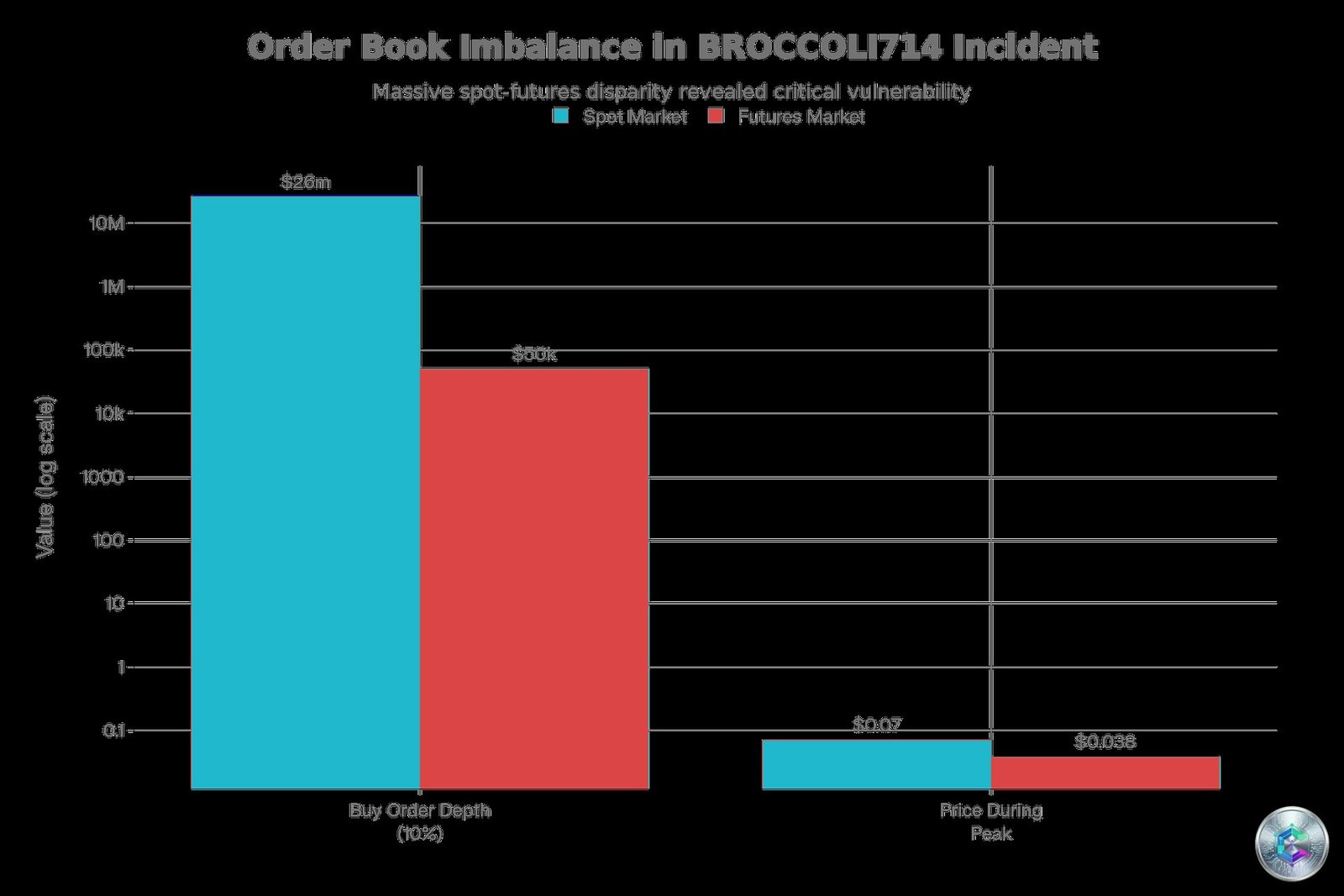

A quick analysis of the order book revealed the source of this distortion. On Binance’s spot market, a single entity had placed buy orders worth nearly $26 million within a 10% range of the current price. In comparison, the futures market displayed only a superficial depth of just $50,000.

For a token with a circulating market cap of only $40 million, a $26 million buy wall represents a statistical impossibility for any rational actor. Institutional investors don’t execute their entries by displaying their entire capital on the buy side – they act discreetly, using sophisticated algorithms to mask their intentions.

As Vida explained: « I understood that this had to be either a hacked account or a bug in a market-making program. No whale is stupid enough to give charity like that. »

Exploiting the Circuit Breaker

Vida immediately understood the implications: the « attacker » was attempting to pump the spot price to increase the value of their positions before exiting. As long as the $26 million buy wall remained in place, the price had only one possible direction: up.

The trader therefore pivoted from a neutral arbitrage strategy to a directional long position. However, the sheer speed of the rise triggered Binance’s automated circuit breakers – protection mechanisms that freeze price limits to prevent liquidation cascades.

As the spot price ripped through the $0.07 barrier, Binance’s futures engine capped contracts at $0.038. This created a massive disparity between the two markets. On Bybit, contracts traded freely at $0.055, confirming that the suppression remained local to Binance’s risk engine.

Vida deployed a high-frequency sniper strategy, hammering the execution terminal every 5 to 10 seconds to open long positions. He bet that the circuit breaker would momentarily lift when the price stabilized.

« As soon as the order succeeded, it meant the circuit breaker time had passed. I managed to wait for this opportunity, » he explained.

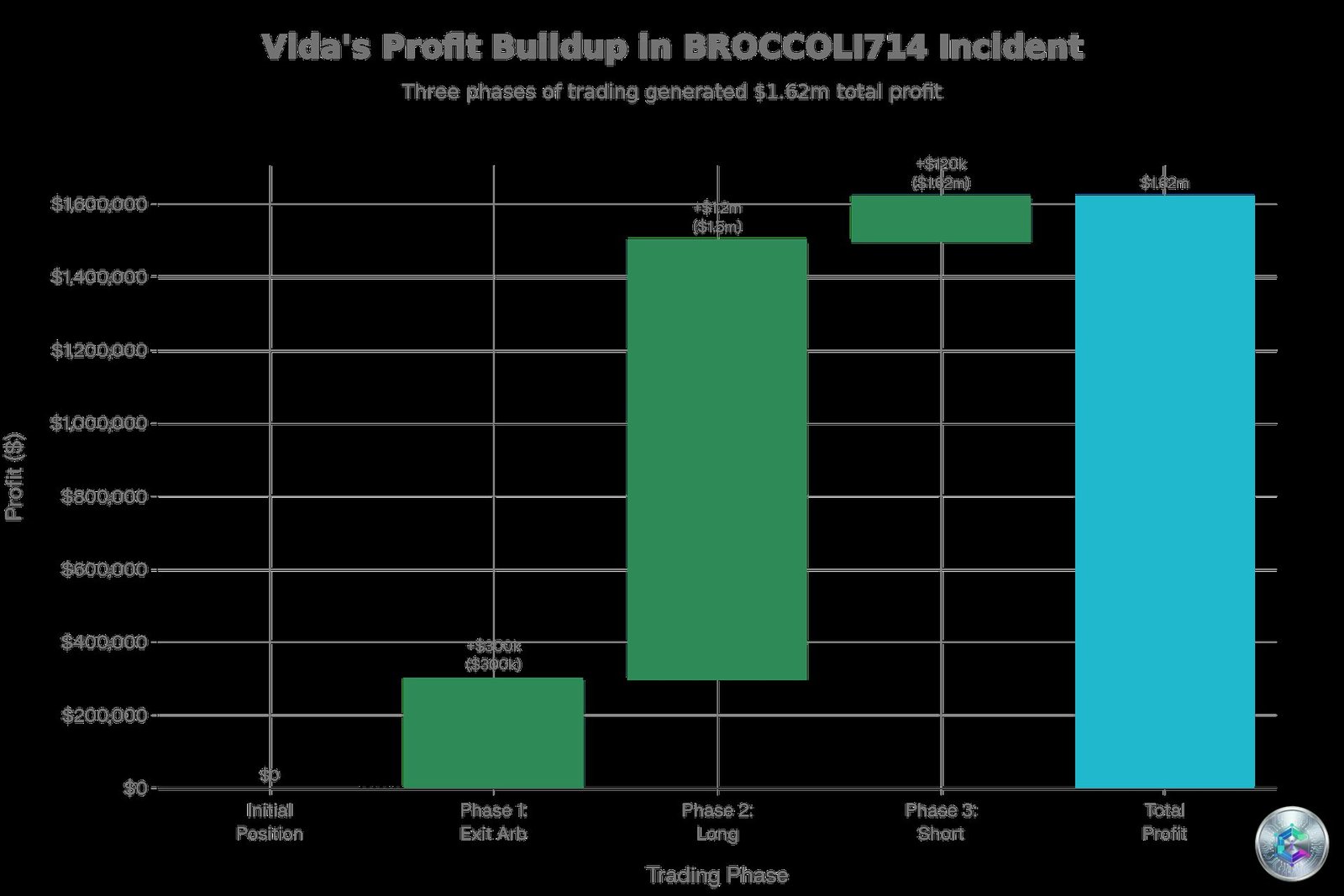

This strategy worked. Vida accumulated $200,000 in long positions at an entry cost of approximately $0.046, effectively front-running the mysterious $26 million buyer.

The Race Against Risk Control

The trade now depended on a game of chicken with Binance’s risk control department. A $26 million buy order on an illiquid coin necessarily triggers internal red flags. If Binance flagged the account as compromised, they would freeze the funds and withdraw the orders.

Vida monitored the order book on a dedicated monitor. At one point, the massive buy wall wavered and disappeared, only to reappear a minute later, pushing the price to $0.15. This erratic behavior showed that the end was approaching.

As Vida emphasized: « I knew the final outcome would definitely be a total loss. Once the account is controlled by risk and orders are withdrawn, Broccoli collapses. »

At 4:20 AM, Vida executed a complete exit. This frenzied sell liquidated approximately $1.5 million from the market, securing a massive profit from an initial capital of around $400,000.

Ten minutes later, the prophecy came true. At 4:31 AM, the $26 million buy wall disappeared definitively. The support evaporated.

Sensing the shift, Vida flipped to a short position and opened a $400,000 short at $0.065. Without the artificial buying pressure, gravity took over. The token collapsed, eventually finding a floor near $0.02. The trader covered the short, capturing the entire pump-and-dump cycle.

The Risks of Low-Liquidity Tokens

The BROCCOLI714 incident exposes the systemic vulnerabilities of low-liquidity tokens. From 2023 to 2025, major platforms experienced increased manipulation, with losses exceeding $2.7 billion.

Low-liquidity tokens are particularly susceptible to manipulation due to their thin order books. Common characteristics:

- Insufficient order book depth (less than $100,000 within 2% of price)

- Low daily volume (less than $1 million)

- High bid-ask spreads (exceeding 0.15%)

- Bot activity suggesting wash trading

- Concentrated ownership (top wallets holding +30% of supply)

The BROCCOLI714 case illustrates how these factors converge. With a market cap of only $40 million and minimal liquidity, the token provided ideal conditions for manipulating prices with relatively limited capital.

BROCCOLI: CZ’s Dog Memecoin

To understand why BROCCOLI714 existed, we must go back to February 2025, when Changpeng « CZ » Zhao, Binance’s former CEO, revealed his dog’s name: Broccoli, a Belgian Malinois. CZ deliberately shared this information as a social experiment, knowing the crypto community would inevitably create memecoins around the name.

Within hours, dozens of BROCCOLI tokens emerged on BNB Chain and Solana. The most popular token, $BROCCOLI, attracted a market cap of $140 million within 24 hours. However, without a clear winner, many collapsed as quickly as they rose.

The BROCCOLI714 token involved in the incident represented one of these many derivatives, built on BNB Chain with minimal liquidity and limited speculative interest.

Binance’s Response

Binance issued an official statement on January 1st, acknowledging the price movements and launching a comprehensive internal investigation. According to the platform, initial checks revealed that risk management mechanisms were functioning normally.

« Based on examination of internal data, no clear signs of hacking attacks have been found. The platform has received no feedback related to stolen accounts, » Binance stated.

This denial eliminates the most convenient narrative – a hack – and leaves a more complex story: incompetence or software malfunction. If no theft occurred, then a market maker deliberately or accidentally burned tens of millions to pump a memecoin.

Implications and Lessons

The BROCCOLI714 incident offers several critical lessons for the crypto ecosystem. First, even on major platforms like Binance, control mechanisms may be insufficient to quickly prevent abnormal activities on low-liquidity tokens.

Second, the incident highlights the growing role of automation in trading. Vida’s ability to identify and capitalize on the opportunity relied entirely on his automated alert systems and understanding of market microstructure.

Third, it emphasizes the importance of market maker account security. If the incident resulted from a compromised account, it suggests that even professional entities may have vulnerabilities.

Finally, the incident illustrates the double-edged nature of memecoins and low-liquidity tokens. While they can create opportunities for massive gains, they also expose investors to extreme manipulation risks.

Conclusion

The BROCCOLI714 incident of January 1st, 2026 represents far more than a spectacular trading anecdote. It constitutes a revealing case study of the systemic vulnerabilities, regulatory gaps, and increasing technical sophistication that define modern crypto markets.

For Vida, the event demonstrated the value of algorithmic preparation and disciplined execution. His $1.5 million profit was not the result of luck, but of carefully constructed systems and rapid pattern recognition.

For the crypto ecosystem, BROCCOLI714 serves as a brutal reminder that low-liquidity tokens remain hunting grounds for manipulation. As regulators intensify their oversight and detection systems become more sophisticated, the balance of power will evolve.

Nevertheless, one thing remains clear: in the crypto world, there’s never a dull day, and for those who are prepared, extraordinary opportunities continue to emerge in the most unlikely corners of the market.

Important Note: This incident illustrates the extreme risks of leveraged trading and low-liquidity tokens. The use of leverage carries a very high probability of losing all your assets. This article is for informational purposes only and does not constitute investment advice.